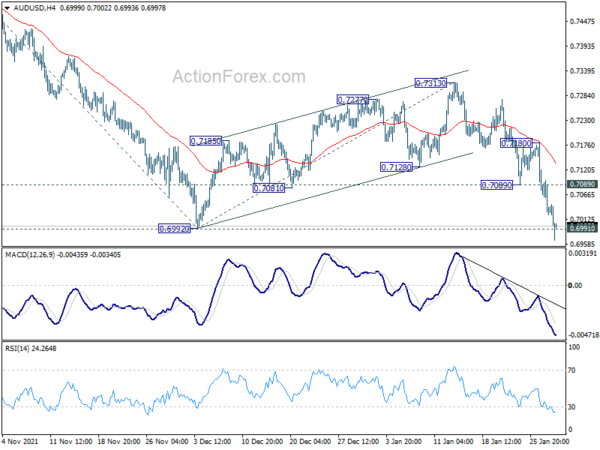

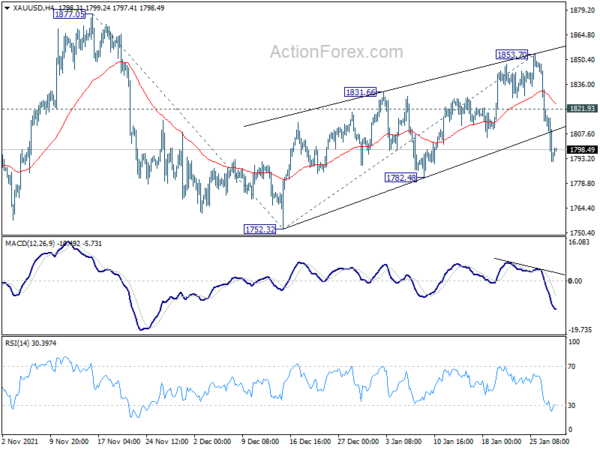

Dollar Digests Gains after PCE Inflation Data, Aussie Broadly Lower

Dollar retreats mildly today after PCE inflation data posted no surprises. While there is some profit taking, the greenback remains the strongest one for the week by some distance. Selling focus has turned from Euro to commodity currencies today, as...

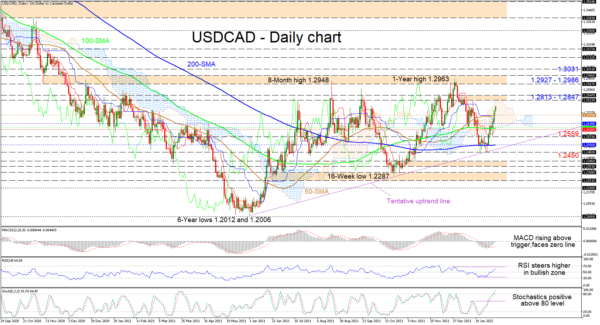

USDCAD Rockets Off 200-MA, Fuelling Upward Trajectory

USDCAD remains positively energized aiming for the Ichimoku cloud’s upper band around the 1.2813 high, after taking flight from the 200-day simple moving average (SMA) around the 1.2500 mark. The longer-term SMAs are suggesting an overall neutral trend in the...

EUR/USD and NZD/USD Elliott Wave Analysis: Be Aware of More Weakness

While USD is extending its rally, we can see EURUSD even lower, but still trading in the middle of wave 3, so be aware of more downside pressure in upcoming days, just watch out for a intraday pullback. EUR/USD 4h...

GBPJPY Chases Soft Gains; Short-Term Outlook Somewhat Gloomy

GBPJPY found strong footing around its longer-term 50- and 200-day simple moving averages (SMAs) this week, but the price could only gradually strengthen to 154.80 since then, unable to recoup January’s losses. While the 50- and 200-day SMAs have escaped...

US 30 Index Remains Negative in Short-Term; SMAs Post Bearish Cross

The US 30 (Cash) index rebounded off the seven-month low of 33,145, gaining some momentum, but the short-term simple moving averages (SMAs) posted a bearish crossover. The RSI indicator is flattening near the oversold zone, while the MACD oscillator is...

SPX 500 Struggles for Support

Upcoming US rate hike still weighs on equity markets. A tentative break below last October’s low (4300) has put the S&P 500 on the defense. A bearish MA cross on the daily chart shows that sentiment could be deteriorating as...

US Oil Breaks to New High

Oil climbed amid fears of disruption as tensions between Russia and the West grew. After a short-lived pause, WTI crude saw bids near a previous low at 82.00 which lies on the 20-day moving average. A break above the January...

Stock futures rise as market set to wrap up a wild week, Apple shares pop

Stock futures rose early Friday, boosted by a jump in Apple shares, as Wall Street looks to wrap up a roller-coaster week on a high note. Futures on the Dow Jones Industrial Average gained about 162 points, or 0.48%. S&P...

Dollar Staying Strong, Sterling Trying to Catch Up

Dollar remains overwhelmingly the strongest one for the week, as boosted by intensified Fed hike expectations. Sterling is trying to catch and trading as the next stronger, with special help from buying against Euro. Australian and New Zealand Dollar are...

GDP grew at a 6.9% pace to close out 2021, stronger than expected despite omicron spread

The U.S. economy grew at a much better-than-expected pace to end 2021 from sizeable boosts in inventories and consumer spending, and despite signs that the acceleration likely tailed off toward the end of the year. Gross domestic product, the sum...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals