ECB Preview – ECB to Convince Market Low Interest Rate Still Necessary Despite Rising Inflation

The surge in electricity price has haunted the Eurozone since the last ECB meeting. Meanwhile, heightened inflation expectations have moved forward market pricing of the first post-pandemic rate hike to end-2022, significantly ahead of the central bank’s estimate. We expect...

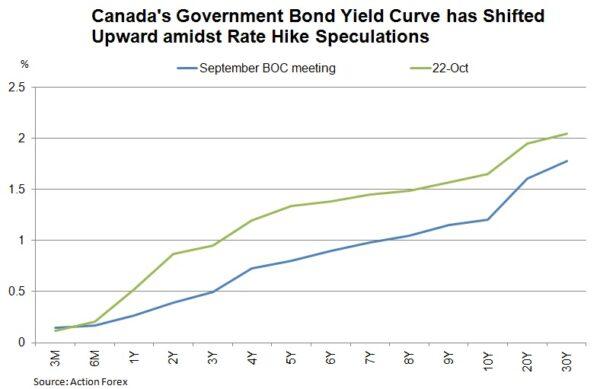

BOC Preview – Further QE Tapering

As further QE tapering to CAD 1B/week has been fully priced in, the focus of this week’s BOC meeting is the forward guidance on rate hike. The market has priced in 3 rate hikes in 2022. We expect the central...

FOMC Minutes: QE Tapering can Come in As Soon As Mid-November

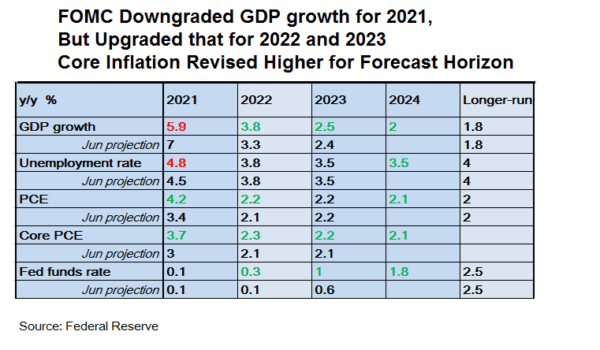

At the FOMC minutes for the September meeting, the members sent more hints about QE tapering. It is highly likely a formal announcement will be made in November, barring abrupt deterioration of pandemic condition and power shortage problems. On economic...

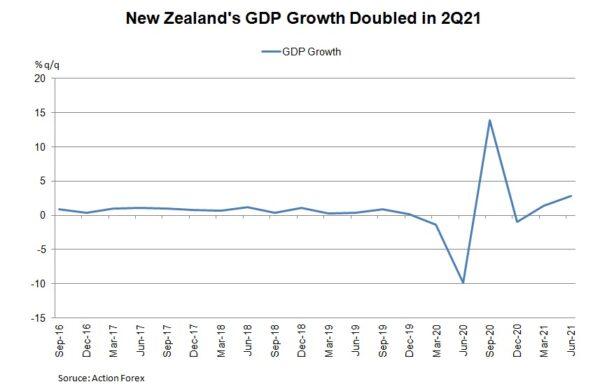

RBNZ Hiked Policy Rate for First Time in 7 Years

For the first time in 7 years, the RBNZ increased the OCR by +25 bps to 0.5% in October. Policymakers pledged to tighten further in coming months as inflation pressure continues to exceed target. Policymakers remained hopeful about the economic...

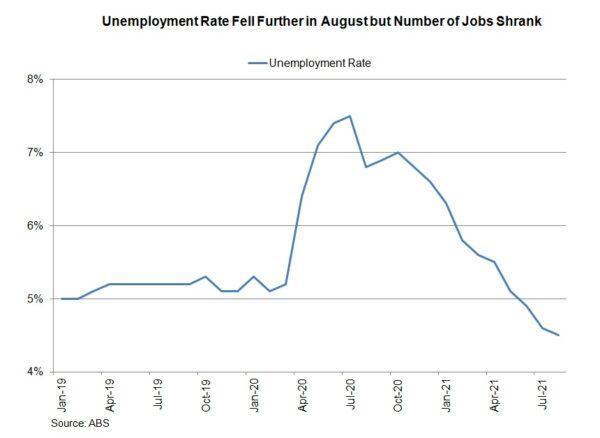

RBA Affirmed No Rate Hike Until 2024, Widening Policy Divergence with Counterparts

The RBA left the cash rate unchanged at 0.1%, and asset purchases at AUD 4B/month, in October. Despite sharp rise in housing prices, policymakers chose to stick with ultra-easy monetary policy in order to achieve the inflation target and full...

RBA Preview – To Maintain Rate at Historical as Counterparts Begin Tightening

The RBA will maintain all monetary policy measures unchanged at next week’s meeting. That is, the cash rate, as well as the yield target on the April 2024 bond, will stay at 0.1%. Asset purchases will also be kept at...

RBNZ Preview – Rate Hike Cycle Begins

The RBNZ is almost certain to raise the OCR by +25 bps to 0.5% next week. The Funding-For-Lending program (FLP) will stay unchanged at NZ$28B. This should not be affected by the slowdown in economic activities in the third quarter....

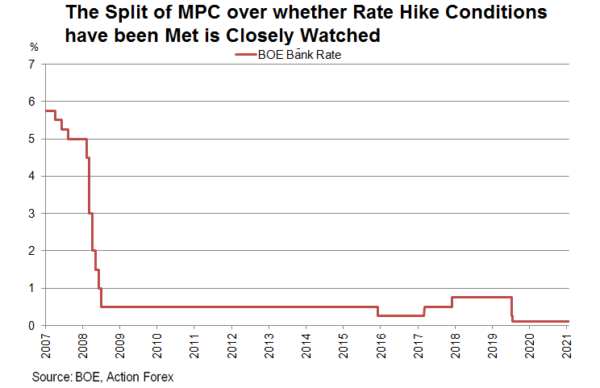

BOE Downgraded Short-Term Growth, but Turned Slightly More Hawkish about Tightening

The BOE voted 9-0 to leave the Bank rate at 0.1% at the September meeting. The members voted 7-2 to keep the QE program at 895B pound. Deputy governor Dave Ramsden and external member Michael Saunders favored lowering the amount...

FOMC Review: Tapering will Start “Soon” while First Rate Hike may Come in as Soon as 2022

The Fed turned more hawkish in September, with the first rate hike pushed forward to 2022. Fed Chair Jerome Powell indicated that QE tapering will come “soon”. The staff downgraded the GDP growth forecast for this year, but revised higher...

BOE Preview – How will New Members Shift the Views of Rate Hike Conditions?

Economic developments since the last meeting have raised concerns of “stagflation” in the UK, i.e. slow growth with strong inflation. As the main constraint to growth is supply chain, we do not expect this to derail BOC’s monetary policy stance....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals