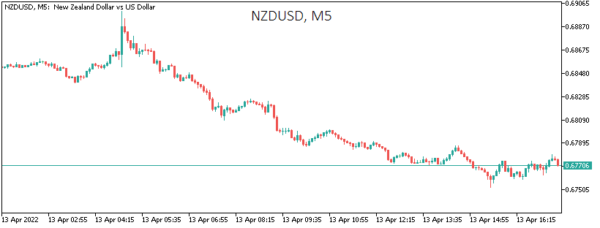

A 50-Point Rate Hike Has Not Saved NZD, CAD from a Sell-off

Today the central banks of Canada and New Zealand raised their key rates by 50 points at once. New Zealand was not expected to rise sharply, but that did not save the NZD from the ensuing sell-off. A heavy downturn...

RBNZ Come Out Swinging with Their Most Aggressive Hike in 22 Years

In true RBNZ style, the central bank came out swinging with a punchy 50 bps hike to tame inflation (and inflation expectations). Summary of today’s RBNZ statement: Increased the Official Cash Rate (OCR) to 1.50 percent Appropriate to continue to...

Inflation is All that Matters

All eyes are on US inflation data today. Investors feel the heat before today’s inflation print. All three major indices extended losses yesterday, as the S&P500 dropped 1.70% and slipped again below its 50-DMA, while Nasdaq, which is the most...

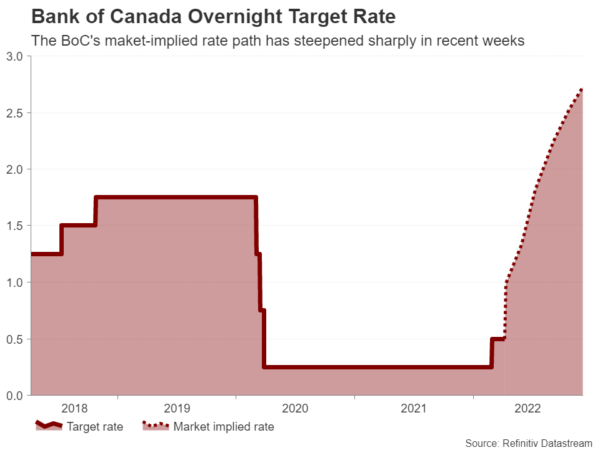

Will the Bank of Canada Opt for a 50-bps Rate Hike at its April Meeting?

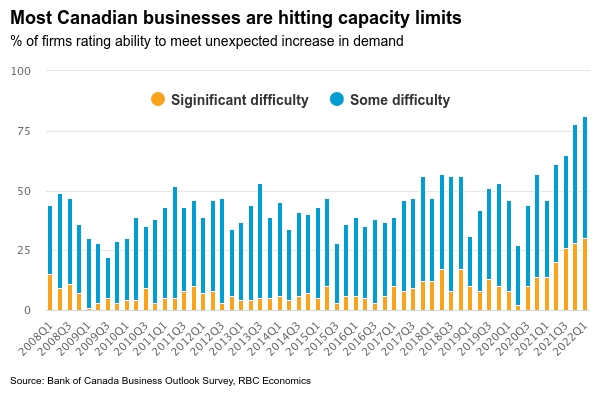

The Bank of Canada announces its next monetary policy decision on Wednesday (14:00 GMT) and the odds of a double rate hike are very high. The Canadian economy has been going from strength-to-strength after emerging from the first lockdown in...

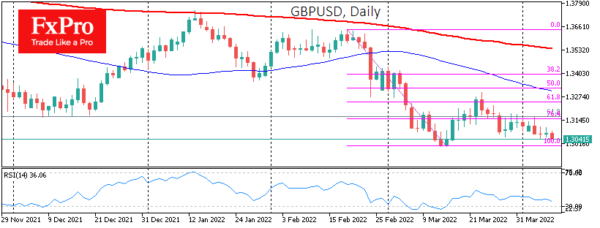

Pound Tests 1.3000 Again, Risks Falling to 1.2600

The British pound returned to the $1.3000 area, a significant circular level from which the British currency bounced in the middle of last month. The bulls continue to hold for the second consecutive trading session. The intraday charts clearly show...

Weekly Economic & Financial Commentary: Minutes Put All Eyes on the Fed, but Economic Activity Remains Strong

Summary United States: Minutes Put All Eyes on the Fed, but Economic Activity Remains Strong In an otherwise calm week of data, Wednesday’s release of the FOMC minutes stirred things up as they showed committee members agreeing that elevated inflation...

Week Ahead: Central Banks, Inflation Data, and Earnings to Highlight the Week

After a somewhat quiet week due to the lack of economic highlights last week, things kick into high gear this week as central banks and inflation data take center stage. The RBNZ, BOC, and ECB all meet this week to...

Bank of Canada to Hike Rates for Second Straight Meeting

We expect the Bank of Canada to hike interest rates by 50 basis points next week. The move will follow up on the 25 bp rate hike in March and come alongside the widely-expected start of ‘quantitative tightening’ as the...

Week Ahead – Rapid Tightening on the Way

Central banks playing catchup There has been incredible resilience in equity markets in recent weeks as central banks have ramped up interest rate expectations, particularly at the Fed, and bond markets have at times priced in a recession. While there...

Pound Retreats ahead of Dollar; Could Fall to 1.2500

The US dollar works its way up against European currencies, including the British Pound. After a corrective bounce from March 15th to the 23rd, GBPUSD has returned to the downside. Most worryingly, this decline is coming very evenly. It is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals