Week Ahead: Follow Through from FOMC and BOE; Headline Watching from Russia/Ukraine War

With a lack of an obvious catalyst this week, markets will continue to trade off the rate hikes from the FOMC and the BOE. Last week, the FOMC hiked rates by 25bps and noted in its statement that there are...

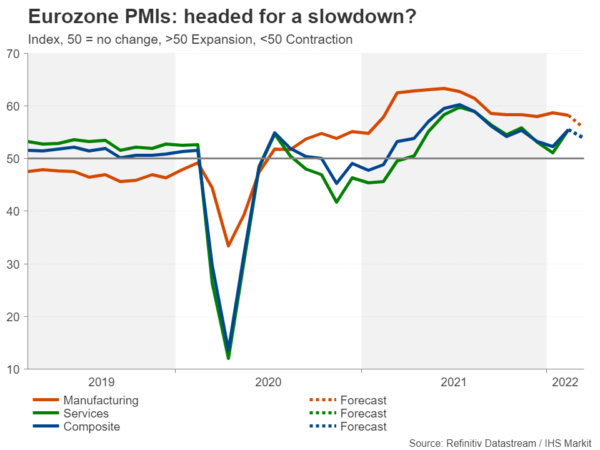

Week Ahead – Flash PMIs to Bring Recession Risks to the Forefront, SNB Meets

The upcoming week will quieten down a bit after what was a busy time for central banks and geopolitical events. But there’s still plenty of activity ahead as the latest flash PMI readings are due and the Swiss National Bank...

Dollar Retreats as Fed Hikes for the First Time Since 2018

American stocks rose on Wednesday after signs emerged that Russia and Ukraine were making progress. According to the Financial Times, the two sides have made progress on a tentative 15-point peace plan that includes an immediate ceasefire and withdrawal of...

Both Sides Express Some Optimism Over Peace Talks

Market movers today We start the week in a quiet fashion on the data front, but for markets developments in the Ukraine war and commodity prices will remain the key focus. US national security adviser Jake Sullivan and China’s top...

Weekly Economic & Financial Commentary: Let the Tightening Cycle Commence

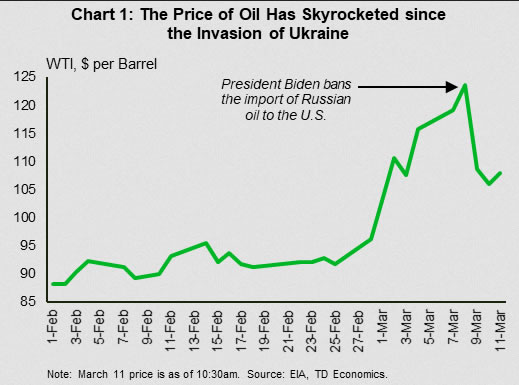

Summary United States: Intensifying War Pours Some Gas on Price Growth Russia’s invasion of Ukraine continues to loom large as the war has intensified. Most data released this week, however, do not capture the market volatility felt since the invasion...

The Weekly Bottom Line: Looking Through the Turmoil, Ready for Lift-off

U.S. Highlights It was another volatile week across global financial markets as the recent surge in commodity prices stoked fears of an inflationary spiral. Sentiment improved through the latter half of the week, allowing global equities to pare losses. Oil...

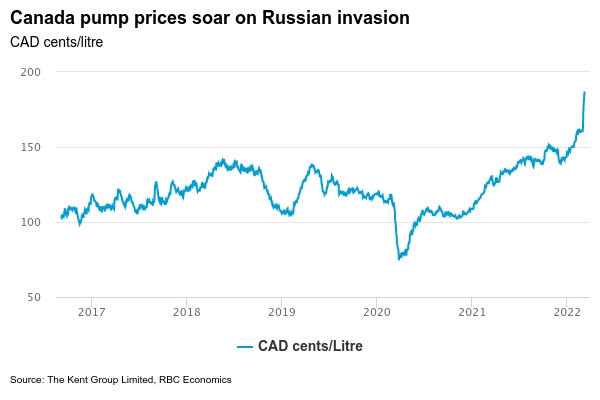

Forward Guidance: Gasoline Price Surge to Push Inflation Rates Higher

Canada’s CPI report for February is expected to show a firm 5.4% year-over-year increase. It will likely rise closer to 6% in March on the back of surging pump prices. In the first week of March alone, gas prices soared...

NZ Dollar Climbs on Sharp Maufacturing Data

The New Zealand dollar has posted strong gains on Wednesday. NZD/USD is trading at 0.6841 in the European session, up 0.55% on the day. Manufacturing Sales surge in Q4 Manufacturing Sales were outstanding in the fourth quarter, with a gain of...

How Could the Dollar React to Another Inflation Spike?

US CPI inflation readings for February will be out on Thursday at 12:30 GMT, likely generating more anxiety for Fed policymakers amid the Ukrainian geopolitical nightmare as price pressures are expected to have intensified further. The US dollar is trading in secure territory...

ECB meeting: No right choices for the euro

The European Central Bank faces a tough dilemma when it concludes its meeting at 11:45 GMT on Thursday. With the crippling sanctions imposed on Russia, European growth will slow down but inflation will heat up as energy prices soar. Will...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals