Week Ahead – Another Brexit Deadline Looms; Bank of Japan Meets

A vote in the British parliament could determine whether the Brexit deadline will be extended, while a Bank of Japan policy meeting will be another highlight for traders in the coming week. Economic indicators will also be watched closely amid...

Weekly Focus – Another Central Bank Turns Very Dovish

This publication has been prepared by Danske Markets for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents...

Dollar Drops as US Hiring Plummets, But NFP May Not be as Bad as it First Looks

20K jobs created vs. 180k expected Unemployment -0.2% to 3.8% vs. 3.9% expected Wages 3.4% yoy vs. 3.3% expected Dec. revised higher from 220k to 227k Jan. revised higher from 304k to 306k The dollar sold off in a knee...

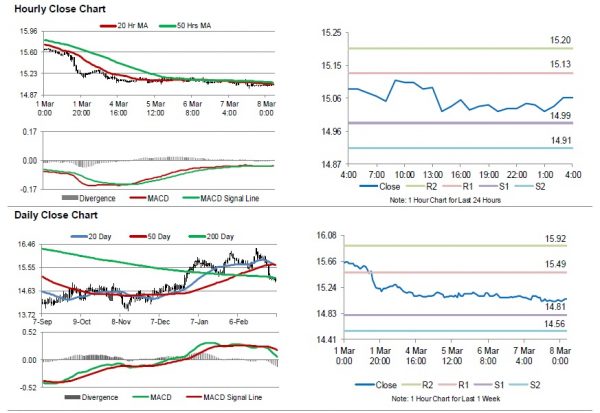

Silver: White Metal Reverses Its Losses In The Morning Session

For the 24 hours to 23:00 GMT, Silver declined 0.33% against the USD and closed at USD15.05 per ounce, tracking losses in gold prices. In the Asian session, at GMT0400, the pair is trading at 15.06, with silver trading 0.10%...

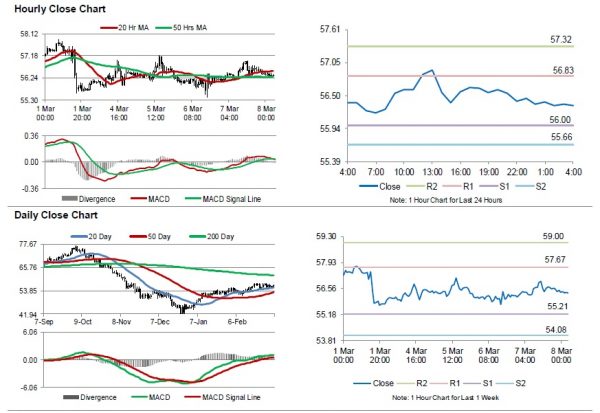

Crude Oil: Oil Trading Lower, Ahead Of Baker Hughes Weekly Rig Count Data

For the 24 hours to 23:00 GMT, Crude Oil rose 0.48% against the USD and closed at USD56.45 per barrel, after OPEC’s output declined by 60,000 barrels a day to 30.8 million barrels a day, marking its four-year low level...

ECB Review: A Postcard from Japan

Today, the ECB surprised us by announcing a series of TLTRO3 starting in September 2019 and continuing until March 2021, each with a two-year maturity. The ECB further extended the rate forward guidance to rates remaining at present levels ‘at...

British Pound Slips on PMI, Brexit Worries

GBP/USD has posted considerable losses in the Thursday session, showing significant movement for the first time this week. In North American trade, the pair is trading at 1.3102, down 0.52% on the day. There is only one key event on...

Sunrise Market Commentary

Markets US and European yields were downwardly oriented yesterday. (European) investors took a cautious stance going into today’s ECB policy meeting. Headlines/rumours that the ECB would downgrade its growth forecasts enough to warrant a new bank funding program initially had...

ECB’s Monetary Policy Meeting Will Be The Main Highlight For Today

The U.S. dollar maintained the bullish momentum although the pace of gains was somewhat smaller. On the economic front, the data from the eurozone was relatively quiet. NY Trading Session The NY trading session saw the February private payrolls rising...

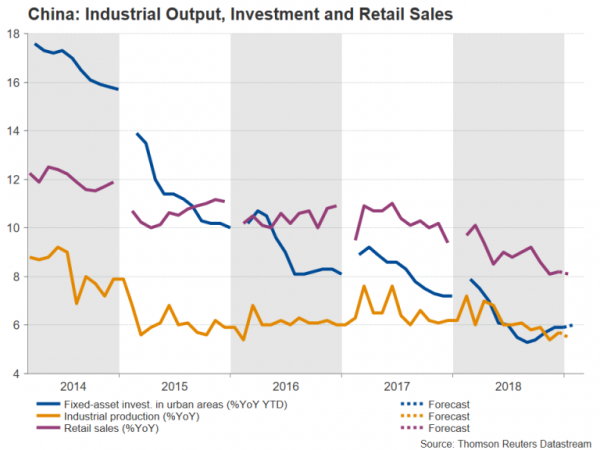

As a Trade Deal Moves Closer, is China at Risk of Overstimulating its Economy?

Growth in China decelerated to the slowest pace since 1990 last year, underlining the challenges the country faces amid sluggish global demand and a more protectionist United States. China’s leaders haven’t been sitting on their hands, however, as an abundance...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals