Japanese Yen Edges Higher, BoJ Rate Statement Next

USD/JPY has edged lower on Tuesday. In the North American session, the pair is trading at 109.43, down 0.23% on the day. On the release front, Existing Home Sales was unexpectedly weak, dropping to 4.99 million and missing the estimate...

Markets Rebound From China Slowdown On Trade Hopes

FX – Dollar not slowing down despite holiday and ongoing partial shutdown The US dollar is mixed against major pairs on Monday. The Martin Luther King holiday in the States did not slow down the dollar at the beginning of...

Brexit: May Unveils Plan B, Market Shrugs

As my colleague Fawad Razaqzada noted earlier this morning, markets were relatively dull heading into the day’s marquee event, the release of UK PM Theresa May’s “Plan B” Brexit bill. Unfortunately, the “new” proposal did little to shake things up....

No NY’s Resolutions from ECB

Reinvestment policy and forward guidance interest rates to remain unaltered No downgrade of risks to eco outlook (yet) Muted market reaction expected, but sensitivity to comments on TLTRO’s? This week, the ECB holds its first policy meeting after ending net...

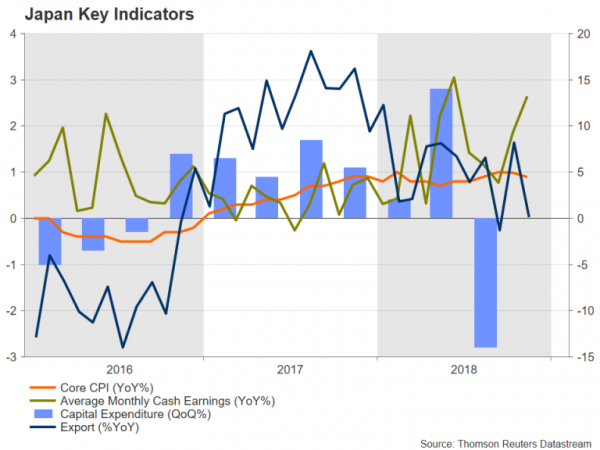

Bank of Japan Meets amid Growing Downside Risks and Stronger Yen

The Bank of Japan will hold its first monetary policy meeting of 2019 on January 22-23, and unlike this time last year when there was a real prospect of a QE exit, policymakers will probably be discussing if or how...

ECB Preview: We Assign 60% Chance of ECB Hike in December 2019

Most interesting to us at next week’s meeting will be the growth risk assessment and more hints on liquidity operations. We expect growth risk to be on the downside and no formal announcement of liquidity operations. We expect Mario Draghi...

China Weekly Letter – More Signs a Trade Deal is Coming

Weak data confirms slowdown – but markets are calm US-China high-level trade negotiations confirmed for 30-31 January Wall Street Journal story adds to signs that a trade deal is coming China announced further opening up for inbound financial investments More...

Weekly Economic and Financial Commentary: Hanging in There

U.S. Review Available Data Show U.S. Economy Is Hanging in There Industrial production rose 0.3% in December, driven by a 1.1% jump in manufacturing output. Details of the Empire and Philly Fed manufacturing surveys, however, suggest that the factory sector...

The Weekly Bottom Line: Dysfunctional Governments on Parade

U.S. Highlights The government shutdown extended to its 28th day, making it the longest on record with no clear end in sight. The White House upped its estimate of the impact of the government shutdown to a 0.5ppt drag on...

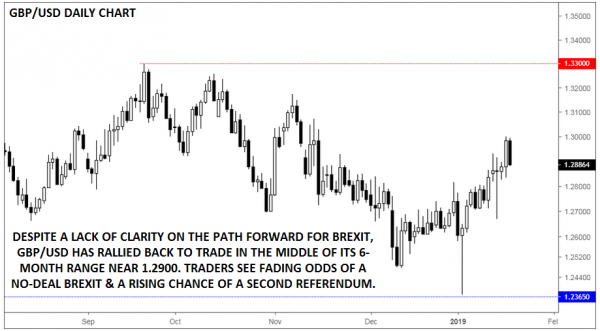

Brexit: Betting Markets See Near Coin-Flip Odds of a Second Referendum, “Plan B” on Tap

Much like a rollercoaster ride, this week’s Brexit developments have been full of twists and turns…but have ultimately taken us right back to where we started the week. PM May’s Brexit deal was roundly rejected on Tuesday, but the Prime...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals