Strong US Data, Trade Solace, & Consistent Fed Speak Drive Strong Dollar and Risk Narrative

The US dollar rally continues to be supported by strong US data, accommodative comments from Fed officials, and a very strong US stock market. This week also saw big shifts in interest rate probabilities, the market shifted from seeing the...

Market Wrap: Markets High On Hopium

China is thinking of coperating with the US and Trump may abolish the trade tariffs, what else do you need? Stocks The S&P 500 Index jumped 0.5 percent on trade hopes as of 15:46 London time. The Stoxx Europe 600...

Australia & New Zealand Weekly

Week beginning 21 January 2019 Australia: Westpac-MI Leading Index, employment. NZ: CPI. China: GDP, retail sales, fixed asset investment, industrial production. Euro Area: ECB policy decision, IFO survey, Davos World Economic Forum. US: data delay due to shutdown. Other central...

Week Ahead – Spotlight on ECB and BoJ as Growth Jitters Persist; China GDP also Eyed

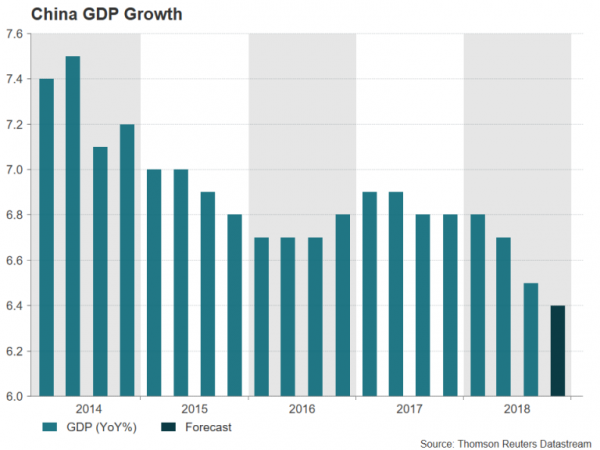

The European Central Bank and the Bank of Japan will hold their first policy meetings of 2019 next week as concerns mount about a global downturn. GDP figures out of China could underscore the worsening outlook, while flash PMIs out...

Weekly Focus – More Weakness ahead Before Relief

This publication has been prepared by Danske Markets for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents...

Canadian Inflation Surprised to the Upside in December (Airfares Again!)

Highlights: Headline CPI inflation unexpectedly jumped to 2.0% in December from 1.7% in November. Airfares rose 22% month-over-month with methodology changes to that component causing volatility over the second half of 2018. July’s 16% increase was subsequently retraced in September,...

Canada: Air Travel Drives a Modest Climb in December Inflation

Canadian consumer price inflation was 2.0% y/y in December, up a bit from November’s 1.7% pace. Markets were looking for a repeat of November’s 1.7% pace. On a seasonally-adjusted basis, prices were up 0.2% month-on-month. Much of the acceleration can...

Silver Consolidates As Investors Consider Dollar Direction

As mentioned yesterday, I am still of the view that the dollar could weaken this year and boost buck-denominated metal prices. After all, the Fed has stopped hiking interest rates. You would think this would be good news for noninterest-bearing...

Canadian Inflation Figures Due as Loonie Tracks Oil Prices

The latest inflation data out of Canada will hit the markets on Friday, at 1330 GMT. While these figures are always important for market expectations around future Bank of Canada (BoC) rate hikes, the loonie’s overall direction may depend mostly...

Two Key Ways the Dollar Drives US Stock Market Performance

In complex adaptive systems like modern financial markets, a change the price of any one market has a spillover effect into other markets. One of the best understood and most straightforward of these intermarket relationships is the impact of the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals