Positive Tone on Wall Street ahead of a Busy Week

Market participants are feeling optimistic at the start of the week, with major indices in Europe rising and US stocks poised to open moderately higher and near record high territory US index futures Dow futures +0.0% at 35,891 S&P futures...

Weekly Economic & Financial Commentary: Restoring Balance in the Post-Pandemic Economy

Summary United States: Consumer Prices Continue to Climb, Little Reprieve to Supply Issues In Sight This week’s data continued to demonstrate severe supply problems. The number of unemployed workers per job opening reached a fresh record low of 0.67 in...

The Weekly Bottom Line: All About Inflation

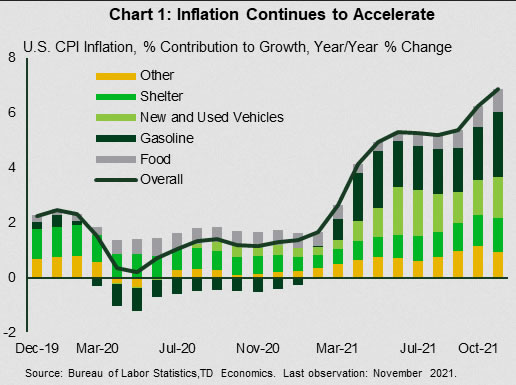

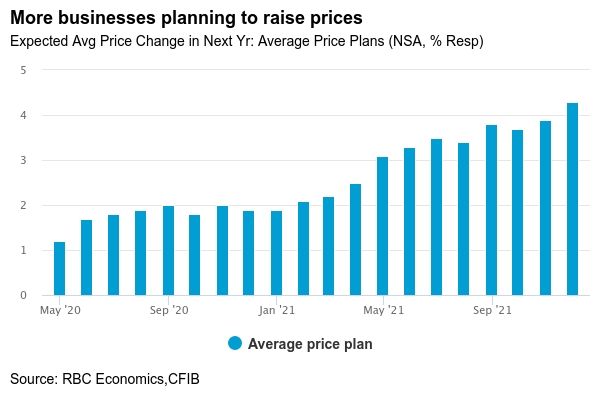

U.S. Highlights Consumer prices continued to accelerate in November. On year-on-year basis, headline CPI was up 6.8% (from 6.2% previously), the highest in nearly forty years. Core inflation (ex. food and energy) also accelerated, hitting 4.9% (from 4.6% in October)....

Forward Guidance: Canada’s November Inflation Data in Focus in Week Ahead

Last month’s year-over-year growth rate in Canadian CPI likely ticked down to 4.5% from 4.7% in October, when it hit a two-decade high. Gas prices have eased from October, but were still up more than 40% from a year ago...

Week Ahead: Nine Major Rate Decisions with Developed Markets Moving Slow

A huge week of central bank rate decisions will tell a diverging story over how developed markets can afford to hold off on rate hiking cycles while emerging markets continue to tighten monetary policy. The main event on Wall Street...

Week Ahead – Fed Kicks Off Central Bank Extravaganza

Global markets will enter the holiday season with a bang, as the upcoming week features five central bank decisions and a heavy barrage of data releases. The Fed will get the show rolling. It will decide whether to accelerate the...

Weekly Focus – Team Dovish or Hawkish to Prevail?

The concern about omicron abated over the past week as vaccines were deemed effective against the variant with a booster shock. Preliminary analysis from the European health agency suggests the symptoms are milder than with previous variants. Furthermore, a new...

New Zealand Dollar Extends Losses

The New Zealand dollar is in negative territory for a second straight day. In the European session, NZD/USD is trading at 0.6778, down 0.23% on the day. Soft manufacturing data weighs on NZD This week’s New Zealand manufacturing data pointed...

The euro has reversed directions…

The euro has reversed directions on Thursday and has posted losses. In the North American session, EUR/USD is trading at 1.1291, down 0.43% on the day. What to do with APP? This week’s calendar in Europe is thin, which has...

Stocks Give Up Ground Amid Covid Curbs; Pound Remains Muted Near 2021 Lows

Equities take a breather European stock indices returned to negative territory as infections remained elevated in the region and governments reintroduced new mild measures to counter the spread of the omicron variant despite drug makers defending the efficacy of their...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals