The Fed Is Bringing Markets Back To Life

Last night, the Dollar lost about 0.4%, reaching 1.1909, around which it is quietly trading on Tuesday morning. The Dollar index dropped 0.5% yesterday and has so far remained around 91.935 in anticipation of further drivers. They won’t take long...

Stocks Bounce Back, Bullard and Kaplan, Chicago Fed, Oil Rises, Gold Steady, Bitcoin Lower

Wall Street is still feeling the impact of the Fed’s hawkish tilt. US stocks are finding some footing as the growth outlook for the rest of the year is extremely robust, with growth targeting 8-10% and around 5% in 2022....

Global Financial Markets Are Still Affected By Fed’s Forecasts

The US stock market closed in the red zone on Friday. The S&P 500 index decreased by 1.31%, the NASDAQ lost 0.94%, and the Dow Jones fell by 1.58%. Over the weekend, James Ballard, the head of St. Louis Federal...

Weekly Economic & Financial Commentary: U.S. and E.U. End Aircraft Dispute to Form United Front Against China

Summary United States: The U.S. Economy Continues to Push Through Supply-Side Headwinds During May, retail sales pulled back 1.3%, while industrial production rose 0.8%. Housing starts improved 3.6% in May, but the NAHB/Wells Fargo Housing Market Index slipped two points...

The Weekly Bottom Line: Bank of Canada Not Spooked by Inflation

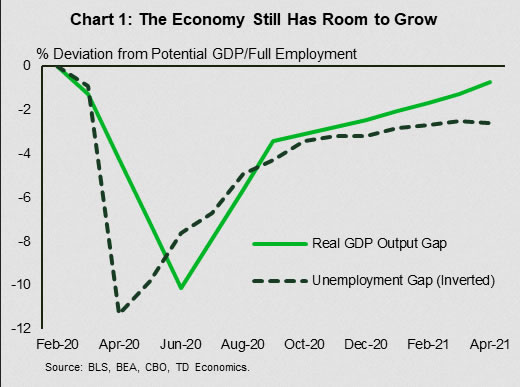

U.S. Highlights The U.S. Federal Reserve continues to upgrade its outlook. And while Chairman Powell reiterated that the recent rise in inflation was transitory, he acknowledged that there was a risk that inflation could be higher than expected. Most U.S....

Week Ahead: FOMC aftermath, BOE and PMIs

Although the FOMC statement was close to that of the last meeting, the hawkish forecasts and “dot plots” surprised markets. Some Fed members are now looking for an increase in rates by the end of 2022! Fed Chairman Powell will...

Week Ahead – Dollar Rally Accelerates on Hawkish Fed

The steepening trade is dead for now as Treasury flattening accelerates. The Fed’s super hawkish pivot is sending short-term Treasury yields and the US dollar higher. The Fed is no longer in an ultra-accommodative stance, they are now just pretty...

Weekly Focus – The Fed and Norges Bank turn more hawkish

This week’s most important event was the Fed meeting. The Fed was more hawkish than anticipated and the meeting most likely marked the first step of the Fed taking the foot off the gas. The Fed is now signalling two...

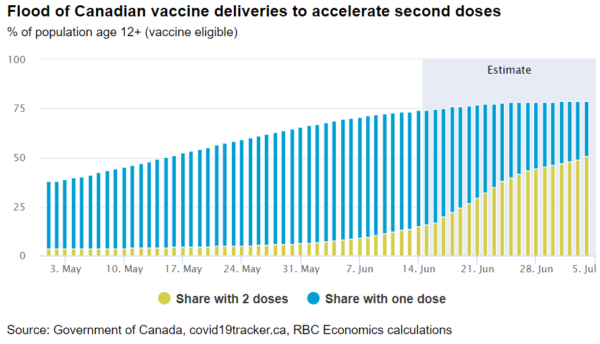

Forward Guidance: Canadian Retail Spending to Stage Summer Comeback from Third Wave Lows

Retail sales fell a sizable 5.1% in April, Statistics Canada’s preliminary estimate showed. The steep drop—which followed big gains in both February and March—came amid renewed pandemic restrictions that forced many shops to close their doors to in-person shoppers. According...

USD Stabilises After Initial Jump

The USD tended to stabilize against a number of its counterparts during today’s Asian session, after the initial gains it had displayed given the Fed’s hawkish surprise on Wednesday, which sent it to an almost two month high. It should...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals