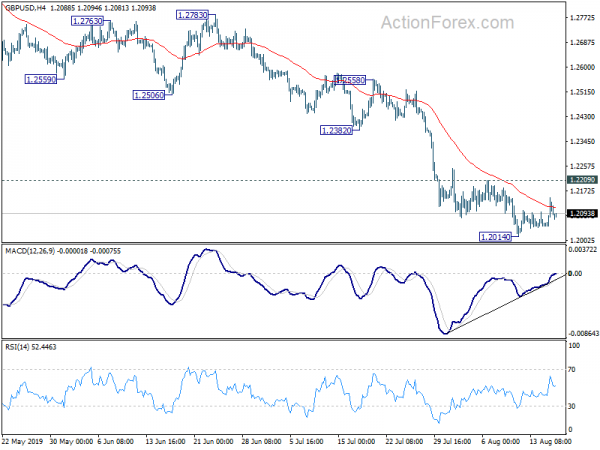

Sterling Falls after Brexit Comments from UK and EU, Yen Rises Broadly

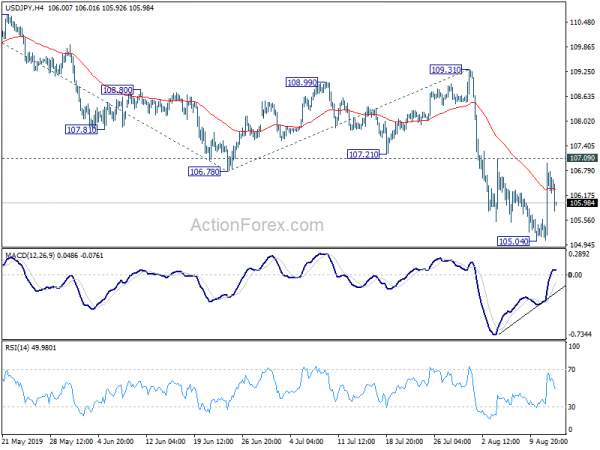

Sterling drops broadly today as comments from UK and EU suggested that there is no compromise on Brexit any time soon. Euro is also pressured as German is back pressing -0.7 handle. Yen jumps again and is trading as the...

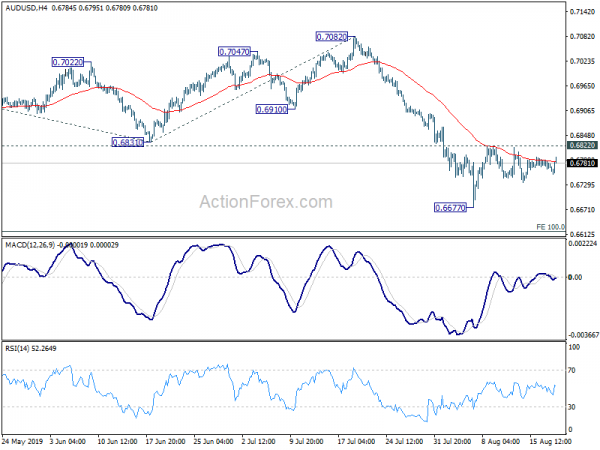

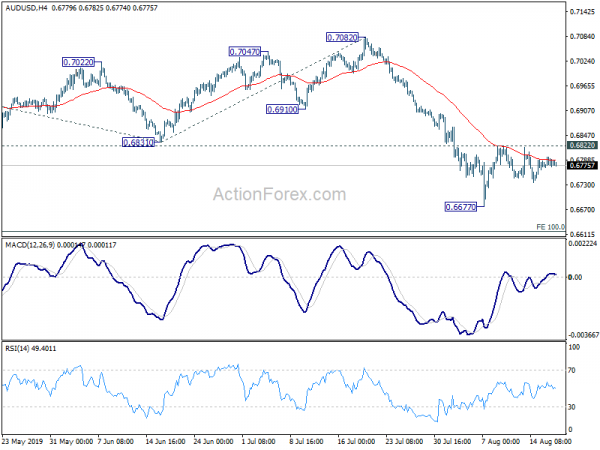

Australian Dollar Mildly Higher after RBA Minutes, But No Follow Through Buying Seen

Asian markets opened higher earlier today, following another day of strong rebound in the US overnight. But buying lost momentum entering into European session. Australian Dollar is currently the strongest one for today as RBA minutes indicates the central bank...

Risk Appetite Coming Back on Huawei Reprieve and Stimulus Talks

Global markets stage a strong rebound today with help from talk of global stimulus. China has already indicated that it will reform rate system to lower lending cost. There were also talks that Germany is considering stimulus measures. Markets response...

Risk Appetite Lifted by PBoC Reform, But Forex Markets Shrug

Risk appetite is striking a come back as another week starts, lifted by China’s measure to lower lending rates. Though, the response in the currency markets is rather muted. For the moment, major pairs and crosses are stuck inside Friday’s...

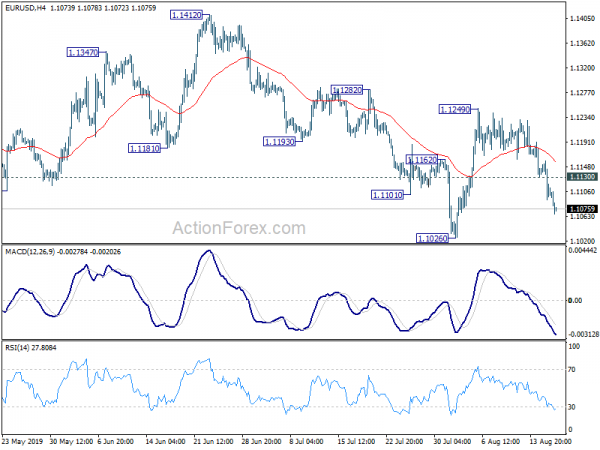

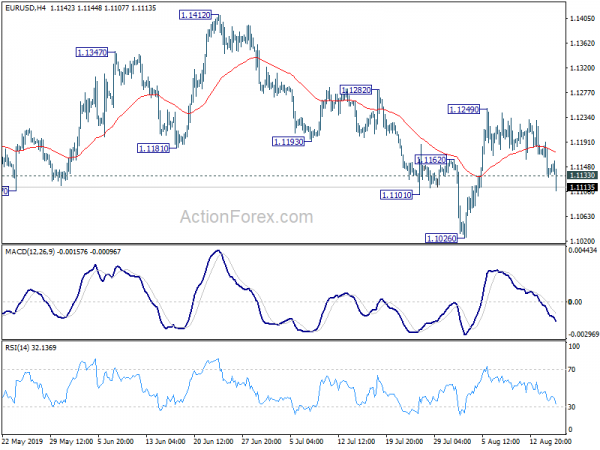

An Important Week for EUR/USD as Fed and ECB Easing Expectations Built

Euro ended last week as the weakest one as comments from a top ECB official suggested a forceful easing package to be announced in September. Additionally recession fear in Germany sent 10-year bund yield to new record low. New Zealand...

Euro Selloff Continues as German 10-Year Yield Hits Another Record Low Below -0.7%

Selloff in Euro picks up momentum again today as Germany yields dive on ECB easing expectations. Swiss Franc is also pressured as SNB could sometime be forced to intervene. Yen is the third weakest, following rebound in stocks rather than...

Dollar Mildly Higher as Sentiments Stablized, Yields Remain Pressured

Asian markets turned mixed after US stocks stabilized overnight. Treasury yields remain pressured though, as 10-year JGB yield hit the lowest level since 2016. In the currency markets, Dollar strengthens mildly today after a Fed dove dismissed an emergency rate...

Euro Dives on German Yield, Dollar and Pound Supported by Retail Sales

The global financial markets turned a bit mixed today even though risk aversion remains the underlying theme. European stocks are generally lower while US stocks recovers, turning into consolidations. Comments from China suggests that retaliation is still underway despite delay...

Risk Aversion Continues as Markets Await UK and US Retail Sales

Risk aversion stays in Asia after the -3% crash in Dow overnight. More importantly, treasury yields took another dive on recession fears. US 30-year yield even drops through 2% handle in Asia and hit as low as 1.964. In the...

Risk Aversion Back on Recession Fear, Yen Regains Control

Risk aversion quickly comes back to the market as German data suggests that the economy is on the edge of recession. Major European indices are trading in deep red and German 10-year yield also hit new record low at -0.649....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals