Crude Oil Already Considered Negative News

On Monday 4 April, the Brent price is “in the black”; the asset is trading at $105.40. This sharp decline in oil prices was caused by US President Joe Biden’s decision to “unleash” the country’s reserve oil tanks and sell...

Gold Consolidates Around 50% Fibonacci Level

Gold has stabilized around the 1,925 level, which is the 50.0% Fibonacci retracement of the near six-week rally from 1,780 until the 19-month high of 2,070. The rising simple moving averages (SMAs) continue to endorse the bullish trend in the...

EUR/USD Pair Started a Fresh Decline from $1.1180

The Euro started a fresh decline from the 1.1180 resistance zone against the US Dollar. The EUR/USD pair declined below the 1.1120 level to move into a short-term bearish zone. The price even traded below the 1.1100 level and the...

GBPJPY is Back to Gains; Broader Outlook is Bullish

GBPJPY is gaining some ground again after three consecutive red days with the technical indicators endorsing this view. The RSI is heading up in the positive region and the MACD is looking highly elevated above its trigger and zero lines. However, the...

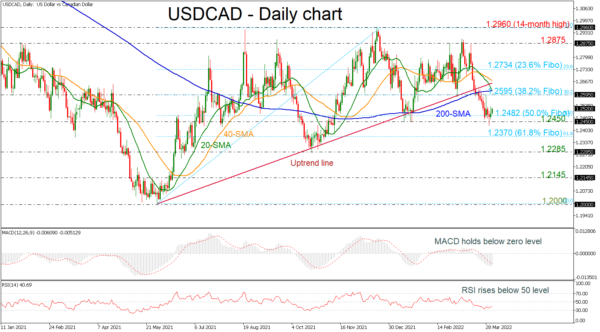

USDCAD Rebounds Off 1.2450 But Remains Below Uptrend Line

USDCAD has been heading south over the last two weeks, reaching the 50.0% Fibonacci retracement level of the up leg from 1.2000 to 1.2960 at 1.2482. The price also declined beneath the long-term uptrend line and the 200-day simple moving...

US 30 Keeps High Ground

The Dow Jones 30 retreats on profit-taking as the first quarter draws to an end. A bullish MA cross on the daily chart suggests that the rebound is picking up steam. The index hit resistance around 35400 and went horizontal,...

USD/JPY Approaches Key Support Ahead of US NFP

Key Highlights USD/JPY started a fresh decline from the 125.00 resistance zone. It traded below a major bullish trend line with support near 122.30 on the 4-hours chart. Crude oil price is struggling to gain pace above $108 and $110....

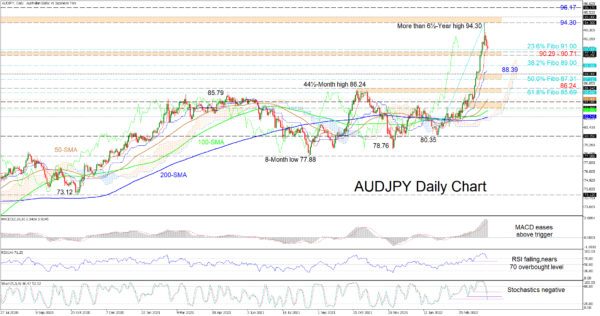

AUDJPY Retreats from 6½-Year High; Upside Risks Linger

AUDJPY’s latest pullback from the fresh multi-year peak is resting on the red Tenkan-sen line around the 91.00 price level, which is the 23.6% Fibonacci retracement of the up leg from 80.35 until the more than 6½-year high of 94.30....

NZDCAD Wave Analysis

NZDCAD reversed from support level 0.8615 Likely to rise to resistance level 0.8775 NZDCAD recently reversed up with the daily Piercing Line from the key support level 0.8615 (which has been reversing the price from the start of March). The...

Gold Price Struggle Ahead of US GDP Release

Key Highlights Gold price started a fresh decline from the $1,965 zone. A key bearish trend line is forming with resistance near $1,920 on the 4-hours chart. EUR/USD attempted a recovery wave from 1.0950, and GBP/USD is still above 1.3050....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals