Currency Pair of the Week: XAU/USD

It may be an opportunity for gold bugs to enter the market if investors decide to jump back into the inflation-hedge precious metal! Gold (XAU/USD) is considered to be a hedge to inflation. Having said that, traders may be wondering...

Gold Gains Struggle above 1,800 Mark

Gold’s recent positive traction off the mid-Bollinger band after a price bounce within the 1,750-1,763 support region is having trouble soaring past the 1,809-1,815 resistance belt. The converged simple moving averages (SMAs) are currently not endorsing any clear trend in...

Brent is Consolidating

Early in the final week of December, the Brent price is looking quite stable; the asset is trading at $76 and it can be assumed that the situation won’t dramatically change until the end of the year. However, in January...

EUR/USD Continues To Struggle Near 1.1350

Key Highlights EUR/USD is facing a major resistance near 1.1350 and 1.1380. A key bullish trend line is forming with support at 1.1250 on the 4-hours chart. GBP/USD gained pace for a move above the 1.3300 resistance zone. Gold price...

EUR/USD Pair Started a Steady Recovery from 1.1260 Support

The Euro found support near the 1.1260 level against the US Dollar. The EUR/USD pair started a steady recovery wave above the 1.1280 and 1.1300 levels. It is now moving higher above 1.1320 and the 50 hourly simple moving average....

WTI Oil Futures Meet December’s Bar; Bullish Bias Still in Play

WTI oil futures (February delivery) paused their two-day advance near December’s resistance zone of 73.10. Although some consolidation is likely around that ceiling, the bulls could soon recharge their batteries according to the momentum indicators. The RSI has breached its previous...

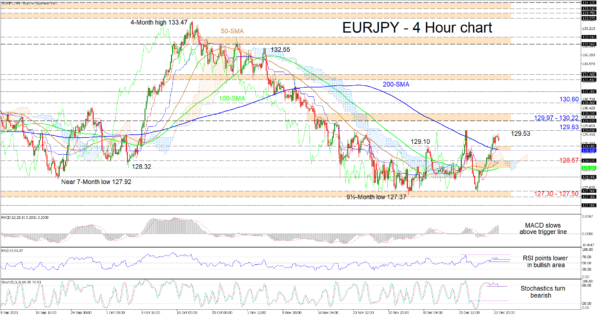

EURJPY’s Ascent Slows, and Neutral Tone Strengthens

EURJPY is struggling to extend its latest rally, which began around 127.50, beyond the December 16 high of 129.63. The converging simple moving averages (SMAs) are hinting that a more neutral price development may evolve confined now between a lower...

USD/CAD Plummets Due To Fundamentals

During Wednesday’s afternoon, US Final GDP, Consumer Confidence and Building Starts data showed contradicting information, which was represented by a wide hourly candle. The rate bounced between the borders of the minor scale channel down pattern until the pattern’s support...

GBP/JPY Books New High

By the middle of Thursday’s trading, the GBP/JPY had reached above the 153.20 level. During its surge, the rate was slowed down by the 151.50 level, the weekly R1 simple pivot point at 152.23 and the previous December high level...

AUD/USD Breaks December High Level

On Thursday morning, the Australian Dollar succeeded against the US Dollar in its second attempt to book a new December high level. Previously, the 0.7222 level held and caused a retracement down to the 0.7200 level and the weekly R1...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals