Elliott Wave View: Oil (CL) Looking For 3 Waves Rally

Short-term Elliott wave view in Oil (CL) suggests the decline from Oct 25, 2021 peak is unfolding as a zigzag Elliott Wave structure. Down from Oct 25, wave ((i)) ended at 80.58 and bounce in wave ((ii)) ended at 84.88....

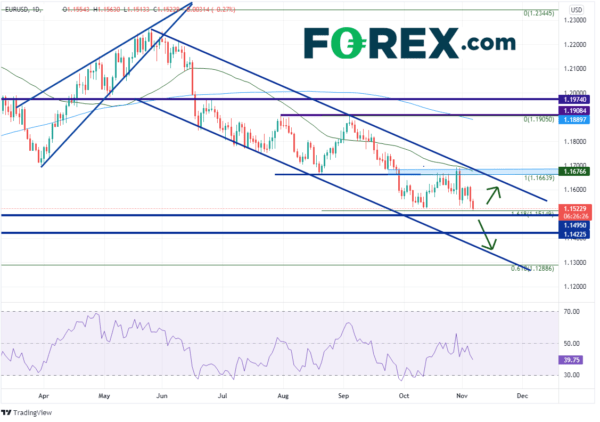

EUR/USD Resigned to Pressure

At the beginning of the second week of November, euro/dollar is trading at 1.1560. The market keeps supporting the USD, and there are reasons for it. According to statistics, the unemployment rate in October dropped to 4.6%, which is quite...

Elliott Wave Analysis: EUR/USD Finds Bottom

EURUSD came to a new low on Friday, but then it quickly stabilized so we have to be aware of a higher degree shape; an ending diagonal that can come to an end soon. Further impulsive rise from here would...

EUR/USD Approaches Key Breakout, NFP Impresses

Key Highlights EUR/USD is struggling to stay above the 1.1520 support. It is facing a major hurdle near the 1.1620 zone on the 4-hours chart. GBP/USD declined heavily below 1.3600 and 1.3500. The US Nonfarm Payrolls increased 531K in Oct...

NZDUSD May Find its Feet ahead of 50.0% Fibonacci

NZDUSD has surrendered just about 50.0% of its latest rally from 0.6910 until 0.7217 but the negative drive seems to have somewhat softened. The falling 50-period simple moving average (SMA) appears to be heading for a bearish crossover of the...

NFP: Strong Beat! But Does It Matter?

The US added 531,000 non-farm jobs to the economy in October, stronger than the +455,000 that was forecasted. The September print was revised higher from +194,000 to +312,000, which makes the headline print more like +649,000! In addition, the Unemployment...

GBP/USD Near Year-to-Date Lows Amidst Worst Week Since August

Looking at GBP/USD in particular, the pair is falling nearly 200 pips from Monday’s open, which would mark its worst week since August. More importantly, cable is approaching its year-to-date low at 1.3412; the last time the pair traded below...

US 30 Index Breaches 176.4% Fibo on Upbeat NFP Payroll

The US 30 stock index (Cash) has pushed past the 36,200 level, that being the 176.4% Fibonacci extension of the down leg of 35,893 until 35,495, which had capped recent advances, keeping the all-time high at 36,189. The index has...

GBPUSD Rocked As BoE Alters Decision To Hike Rate

GBPUSD plummeted to a one-month low of 1.3470 yesterday, after the Bank of England’s Monetary Policy Committee (MPC) voted to continue with its existing programme of UK government bond purchases, and to keep the bank rate unchanged at 0.1%. The...

Two Trades To Watch: Gold, EUR/USD

Gold eyes 1800 ahead of NFP After a slew of less hawkish than expected central bank meetings this week. Gold is charging higher. Gold rallied over $30 yesterday after the Fed pushed back on an interest rate hike and the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals