GBPJPY Rallies Towards New 44-Month High, Next Stop At 160.00

GBPJPY posted six straight green days and today is continuing the bullish rally towards a fresh 44-month high around 156.57. The pair jumped well above the medium-term descending trend line and any closing candle beyond the previous high of 156.50...

US 100 Attempts A Bullish Reversal

The Nasdaq 100 rose as investors anticipate strong profit growth in the third quarter. The break above 14930 has prompted sellers to cover their positions, alleviating the bearish pressure in the process. The tech index has then secured support around...

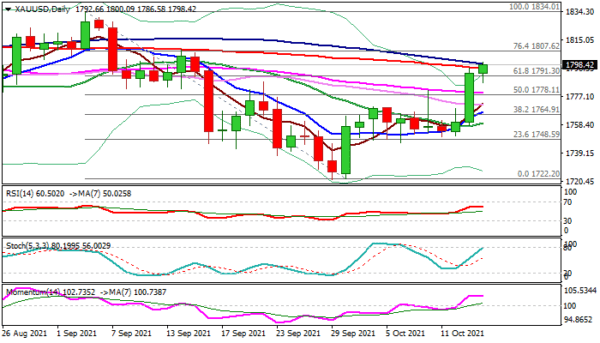

XAU/USD Outlook: Weaker Dollar And Rising Inflation Lift Gold

Spot gold rose sharply on Wednesday (up 1.82% for the day, the second biggest daily advance in 2021) lifted by weaker dollar on further rise in US inflation and unclear situation regarding the start of tapering stimulus, which markets widely...

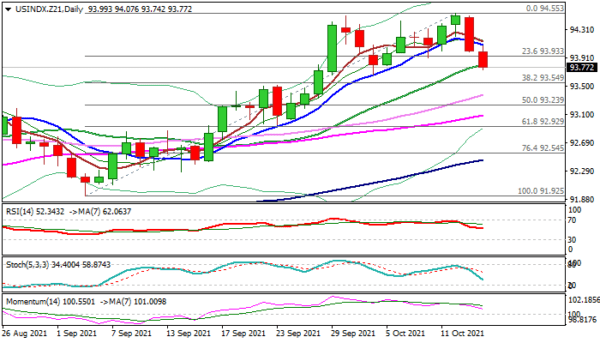

US Dollar Index Outlook: Extended Pullback From One-Year High Warns Of Deeper Correction

The dollar extends lower on Thursday, following Wednesday’s 0.52% drop, with Wednesday’s close below 10DMA (94.14) and today’s drop through Fibo 23.6% of 91.92/94.55 upleg, generating initial reversal signal. After minor negative impact from downbeat US jobs data, which were...

AUDUSD Paves Way For Further Progress, Bullish Bias Fragile

AUDUSD is targeting the 0.7400 level again after successfully piercing the descending trendline drawn from May’s peak of 0.7890 on Wednesday. The bullish bias is still in place according to the momentum indicators as the MACD continues to grow within...

EUR/CAD: Lopsided Short Positioning May Hint at a Bullish Reversal

As my colleague Joe Perry noted in his Currency Pair of the Week article, the loonie has been on absolute tear of late, with the ongoing rally in the price of oil, Canada’s most important export, and more recently, Friday’s...

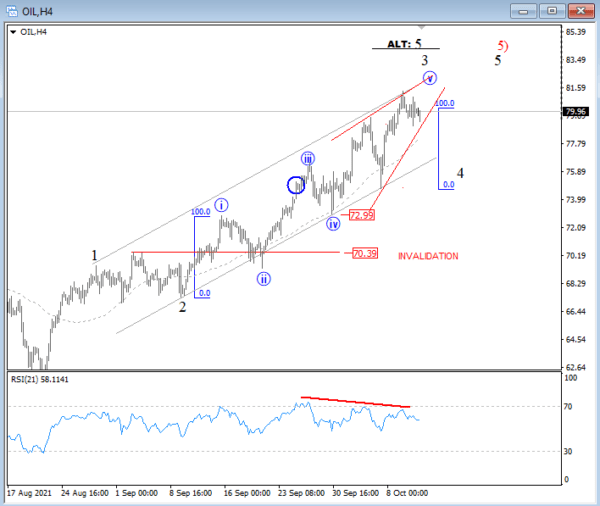

Elliott Wave Analysis: Oil May Slow Down at 80-82 Area

After yesterday’s intraday shake out, Crude oil looks corrective on the intraday basis, which means that it can retest the highs and 82-83 area, ideally as part of final leg of an ending diagonal pattern before it finds the resistance....

Elliott Wave View: S&P 500 Should Extend Lower

Short Term view in S&P 500 (SPX) suggests the decline from Sept 23, 2021 peak is unfolding as a double three Elliott Wave structure. Down from Sept 23 peak, wave W ended at 4278.94 as a zigzag structure. Wave ((a))...

GBP/USD Technical Bearish Trend Continuation

GBP/USD is in downtrend. The pattern is a bearish continuation sign. Q L3 should be the target. Bearish Zig-zag. D1 chart GBP/USD 1. Descending Trendline. 2. Bearish Order block. 3. Pinbar Bearish. 4. Q L3 and M L3 Pivot targets....

USD/TRY Outlook: USD/TRY Hits New Record High On Fears That The CBRT Would Cut Rates Again Next Week

The USDTRY rose through 9.00 barrier and hit new all-time high on Tuesday. Lira remains under pressure which increased on fears that Turkish central bank would make another rate cut in the policy meeting, scheduled next week, after the CBRT...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals