Euro Effectively Recovering

Early in a week, the major currency pair is growing; the asset is trading at 1.1585 and may gain even more weight. The “greenback” dropped a bit after the USA reported on its labour market for September. For example, the...

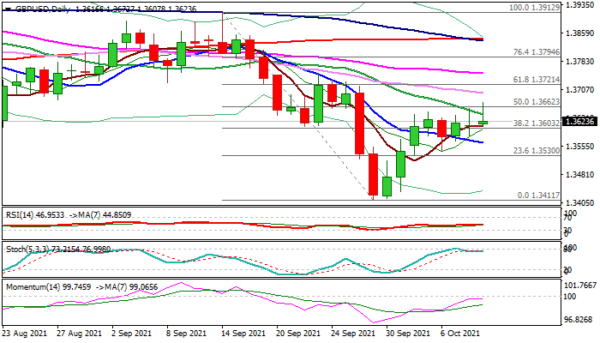

GBP/USD Outlook: Hawkish Comments On Rate Expectations Lift Pound But Bulls Need More Momentum

Cable jumped to the new two-week high (1.3673) in early Monday’s trading, lifted by hawkish comments from UK policymakers regarding earlier than expected rate hike, but gains were so far short-lived. Fresh attempts to break above recent congestion and clear...

Dollar Index (DXY) Has Reached Inflection Area

Since bottoming earlier this year, US Dollar has steadily caught a bid. One of the primary reasons for the USD strength is because of the expectation that the Fed will start tapering later this year. The Fed has communicated their...

Market Morning Briefing: USDCNY Broke Below 6.44

STOCKS Dow trades at an important juncture and needs to either sustain above 34750-35000 in order to rise to 35250+ else a fall to 33750 will hold in the coming weeks. Dax on the other hand needs to sustain above...

NFP Recap: Big Miss; But Was It Really That Bad?

Non-Farm payrolls released earlier today showed that the US added +194,000 jobs to the economy for the month of September vs an estimate of +500,000. The Unemployment Rate for September dropped to 4.8% from 5.2% in August and Average Hourly...

Silver – Another Failed Breakout?

Or more to come? Are we about to see silver break out of the descending channel and bring an end to months of a downtrend? The charts suggest we probably aren’t. Silver has rallied over the last week or so but today it’s run into significant...

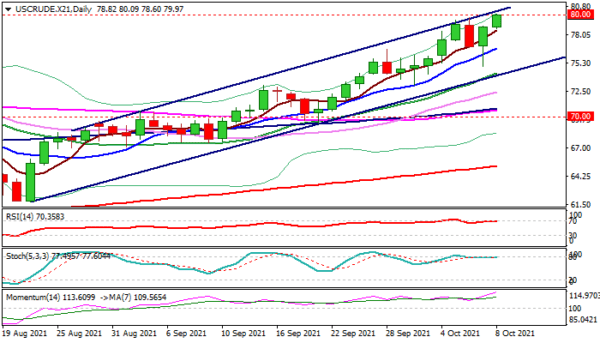

WTI Oil Outlook: WTI Price Surges to New Multi-Year Highs on Global Energy Crunch

The WTI price probed through psychological $80 barrier for the first time since November 2014 on Friday and hit new 2021 high, on track for the fifth straight weekly gains and for over 5% advance this week. Oil prices were...

EUR/JPY Trendline Resistance At 88.6 Fib

EUR/JPY looks like there could be a bounce or break soon as the market is at the confluence zone. The descending trend line is marking a possible move down as it sits at the 88.6 POC zone confluence. A rejection...

GBPJPY Reaches 100 MA After Bounce At Base Of Trading Range

GBPJPY’s current upward drive is questionable around the 100-day simple moving average (SMA) at 152.43 after the 2½-month floor of the sideways market, halted once again negative tendencies from gaining downward momentum. The converging SMAs and especially the 50- and...

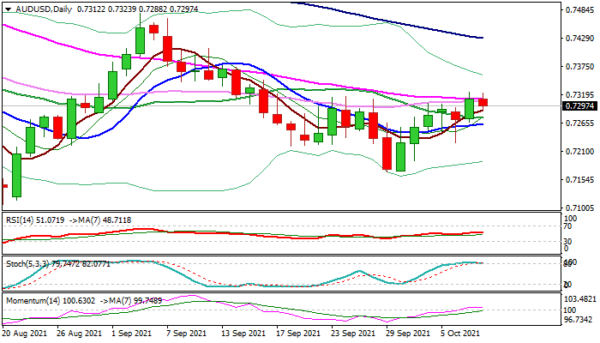

AUD/USD Outlook: Bulls Lose Traction Ahead Of US NFP Data

The Australian dollar dipped below 0.73 mark in Europe on Friday after the action was repeatedly capped by daily Kijun-sen (0.7324), pressured by higher dollar ahead of US jobs report. Daily technical studies generate initial negative signal as stochastic is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals