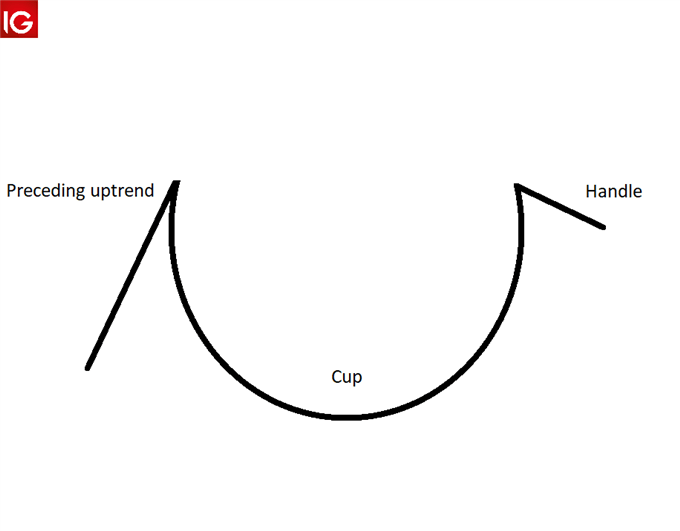

Trading with the Cup and Handle Pattern

The cup and handle pattern occurs regularly within the financial markets. Incorporating the cup and handle strategy within a trading system can enhance a trader’s market analysis technique. What is a cup and handle pattern and how does it work?...

World Trade & the Global Economy | Marc Ostwald | Podcast

What you’ll discover in this podcast with Marc Ostwald: – World trade and the global economy: is innovation good? – Why market psychology is showing a ‘deep visceral fear’ – Are CHF and JPY overvalued? In this edition of our...

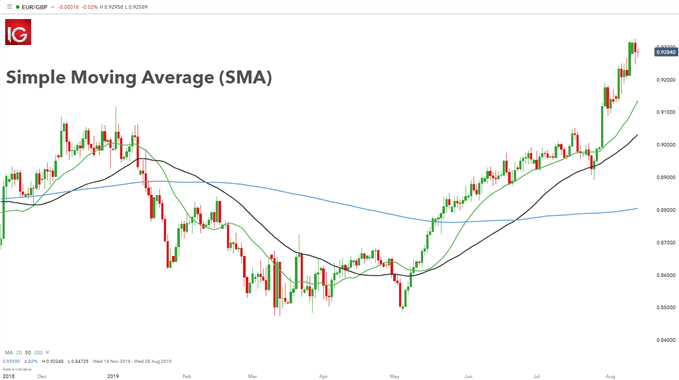

Lagging Indicators Defined and Explained

Lagging indicators are often misunderstood in their foundations however, they are a great way to analyse financial markets. This article will outline: What lagging indicators are Examples of lagging indicators Benefits of lagging indicators What is a lagging indicator? A...

Trading the Falling Wedge Pattern

The falling wedge pattern (also known as the descending wedge) is a useful pattern that signals future bullish momentum. This article provides a technical approach to trading the falling wedge, using forex and gold examples, and highlights key points to...

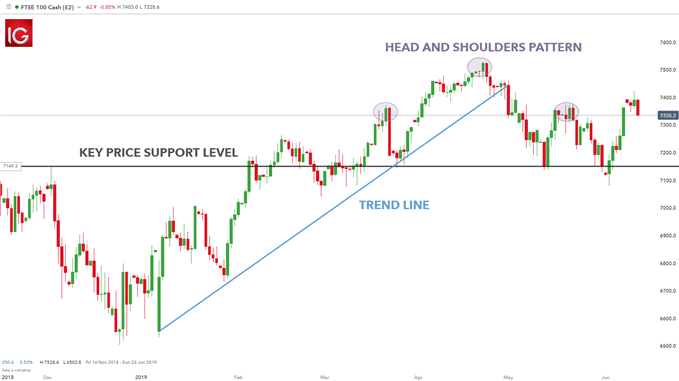

Using Price Action As Your First Indicator in Technical Analysis

What is Price Action? Price action is the study or analysis of price movement in the market. Traders use price action to form opinions and base decisions on trends, key price levels and suitable risk management. Trend identification is frequently...

Top 10 Trading Myths: Guest Commentary

Debunking top trading myths with Dr. Gary Dayton from Trading Psychology Edge Knowing the difference between common trading myths and the reality is essential to long-term success. In this article, guest editor, Dr Gary Dayton explores the top 10 trading...

What is Forex Risk Management? Learn the Basics

Effective forex risk management allows currency traders to minimize losses that occur as a result of exchange rate fluctuations. Consequently, having a proper forex risk management plan in place can make for safer, more controlled and less stressful currency trading....

Trading the News | James Stanley | Podcast

How to go about trading the news and more: Key points covered in this podcast: – Looking for breakouts when trading the news – Can economic factors co-exist with technical analysis? – When going against public sentiment works out In...

The Federal Reserve Bank: A Forex Trader’s Guide

The Federal Reserve System (the Fed) was founded in 1913 by the United States Congress. The Fed’s actions and policies have a major impact on currency value, affecting many trades involving the US Dollar. Find out about the history of...

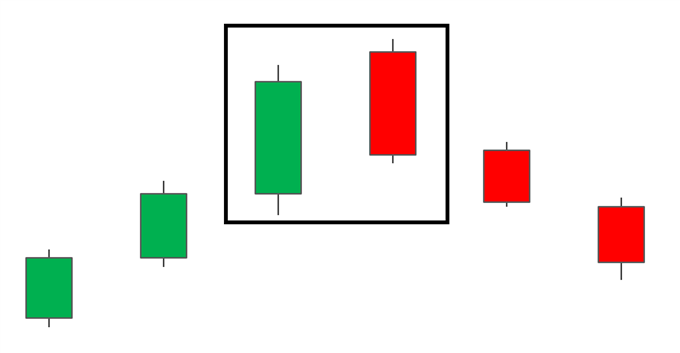

How to Trade the Dark Cloud Cover Candlestick

The Dark Cloud Cover pattern is used by many traders to spot reversals in the market and achieve favorable risk to reward ratios. It is fairly easy to spot, however, traders need to view the formation of the Dark Cloud...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals