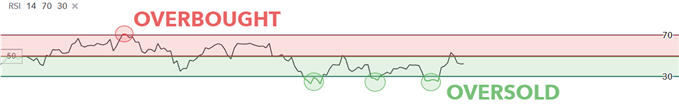

Relative Strength Index (RSI) Defined and Explained

Relative Strength Index – Talking Points: What is Relative Strength Index (RSI)? How do you calculate Relative Strength Index? What does the Relative Strength Index tell you? Relative Strength Index: A Summary Become a Better Trader with Our Trading Tips...

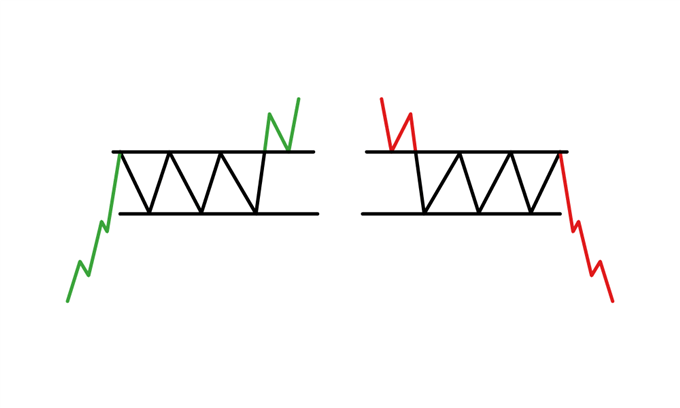

Using Rectangle Patterns to Trade Breakouts

Rectangle chart patterns and trading breakouts: Main talking points Breakouts can generally offer some of the higher potential risk/reward setups, allowing traders to keep stops tight relative to potential profit target. One very popular way of doing so is by...

How Many Pips Should Be Targeted Per Day?

How Many Pips Should Be Targeted Per Day? Trading with pips talking points: Targeting X amount of pips per day is unrealistic Forex traders should instead focus on diligently following a set strategy Trading using limited leverage should yield a...

Fed Rate Cuts & US Yield Curve Inversion | Wolf Richter | Podcast

Key points covered in this podcast – Expectations for Fed rate cuts and their impact on asset prices – Does the US yield curve inversion really mean imminent recession? – Asset price bubbles and what they mean for diversification Wolf...

The Basics of Technical Analysis

An Introduction to Technical Analysis Technical analysis is becoming an increasingly popular approach to trading, thanks in part to the advancement in charting packages and trading platforms. However, for a novice trader, understanding technical analysis – and how it can...

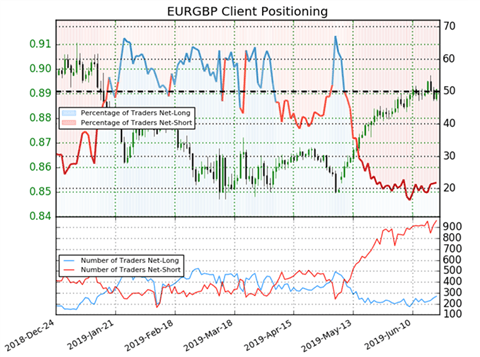

Sentiment Analysis for Forex Trading

Forex sentiment analysis can be a useful tool to help traders understand and act on price behavior. While applying sound technical and fundamental analyses is key, having an additional feel for the market consensus can add depth to a trader’s...

Trading the Bullish Harami Pattern

Learn to Trade the Bullish Harami The Bullish Harami consists of two candlesticks and hints at a bullish reversal in the market. The Bullish Harami candlestick should not be traded in isolation but instead, should be considered along with other...

Using the Rising Wedge Pattern in Forex Trading

The rising wedge is a popular reversal pattern that is predictive in nature and can give traders a clue to the direction and distance of the next price move. Rising wedges appear regularly in the financial markets and traders gravitate...

Double Top Pattern: A Forex Trader’s Guide

Double top patterns are noteworthy technical trading structures to learn and integrate into a trader’s arsenal. Double tops can enhance technical analysis when trading both forex or stocks, making the pattern highly versatile in nature. Double Top Pattern: Main Talking...

How Monetary and Fiscal Policy Can Amplify or Stave Off Crises

Why financial market traders must monitor both monetary and fiscal policy: When trading financial markets, especially when there are concerns about a global economic slowdown, it’s essential to monitor both government fiscal policy and central bank monetary policy. When they...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals