The New York Session: Forex Trading Tips

The New York forex session is one of the most liquid forex trading sessions. When the US session overlaps with the London forex market session it is considered to be the most liquid period of the day. What time does...

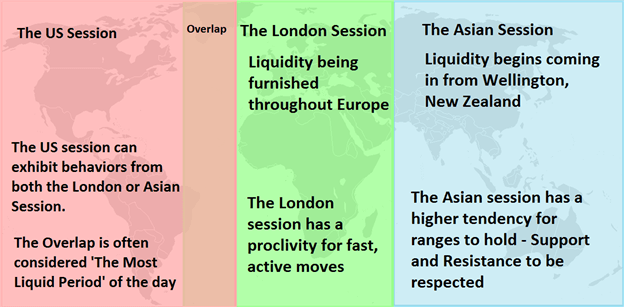

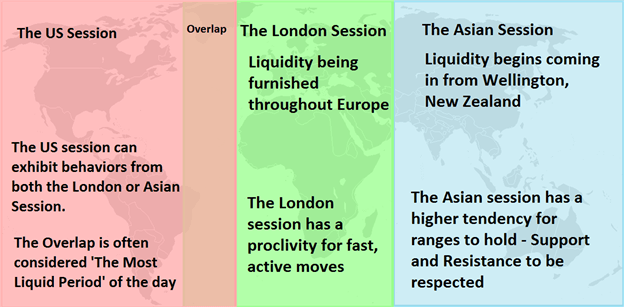

Major Forex Trading Sessions from Around the World

There are three major forex trading sessions which comprise the 24-hour market: the London session, the US session and the Asian session. Each major geographic market center can exhibit vastly unique traits and tendencies that can allow traders to effectively...

Technical vs Fundamental Analysis in Forex

Understanding the differences between fundamental and technical analysis in forex trading There is a great debate about which type of analysis is better for a trader. Is it better to be a fundamental trader or a technical trader? In this...

How Forex Traders Use ISM Data

The ISM manufacturing index plays an important role in forex trading, with ISM data influencing currency prices globally. As a result, the ISM manufacturing, construction and services indicators can provide unique opportunities for forex traders, which makes understanding this data...

The Importance of Liquidity in Forex Trading

As a trader gets started in forex trading, one of the first advantages they’re likely to come across is how much liquidity the forex market offers over other markets. The latest figures are roughly $5.1 trillion in daily traded volume...

Understanding Forex Rollover

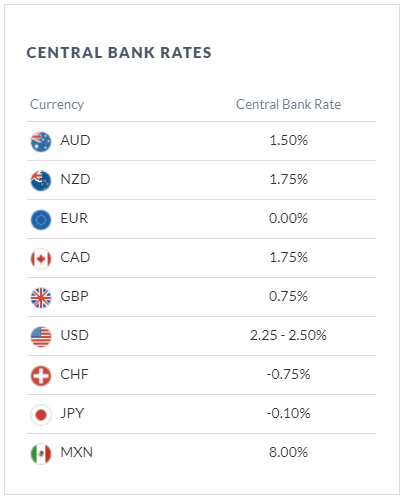

What is Rollover? Rollover is the interest paid or earned for holding a currency spot position overnight. Each currency has an overnight interbank interest rate associated with it, and because forex is traded in pairs, every trade involves not only...

3 Types of Forex Analysis

Forex analysis techniques talking points: There are three general types of forex analysis traders use to anticipate market movements and analyse trends. Traders tend to use one or a combination of FX analysis methods to fit their personality and/or trading...

Oil Trading Strategies with Futures Trader Tracy Shuchart| Podcast

KEY POINTS COVERED IN THIS PODCAST – How Tracy uses a macro approach to trading the oil market – The books to check out to improve your oil trading knowledge – Key oil benchmarks for 2019 Tracy Shuchart is a...

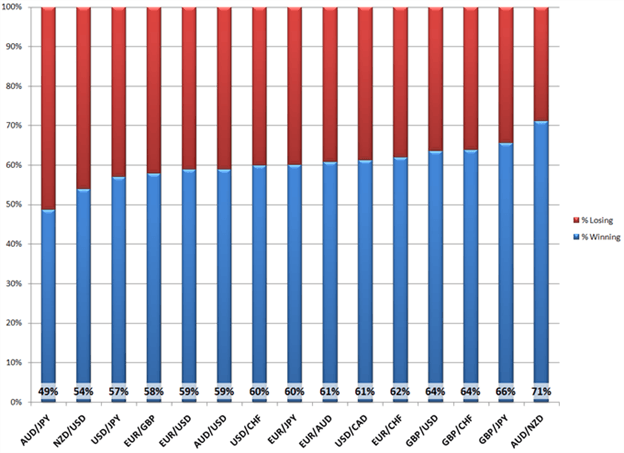

Currency Carry Trade: What is it and how does it work?

A currency carry trade involves borrowing a low-yielding currency in order to buy a higher yielding currency in an attempt to profit from the interest rate differential. This is also known as “rollover” and forms an integral part of a...

Using Stop Loss Orders in Forex Trading

Market movements can be unpredictable, and the stop loss is one of the few mechanisms that traders have to protect against excessive losses in the forex market. Stop losses in forex come in different forms and methods of application. This...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals