Types of Forex Orders

There are many different types of forex orders, which traders use to manage their trades. While these may vary between different brokers, there tends to be several basic FX order types all brokers accept. Knowing what these are and having...

Hawkish vs Dovish meaning: How Monetary Policy Affects Fx Trading

You have probably heard a financial news presenter say something along the lines of “The central bank governor came out slightly hawkish today after bouts of strong economic data”. The terms Hawkish Dovish meaning whether central banks are more likely to tighten (hawkish) or...

What is Slippage? Slippage in Forex Explained

Slippage can be a common occurrence in forex trading but is often misunderstood. Understanding how forex slippage occurs can enable a trader to minimize negative slippage, while potentially maximizing positive slippage. These concepts will be explored in this article to...

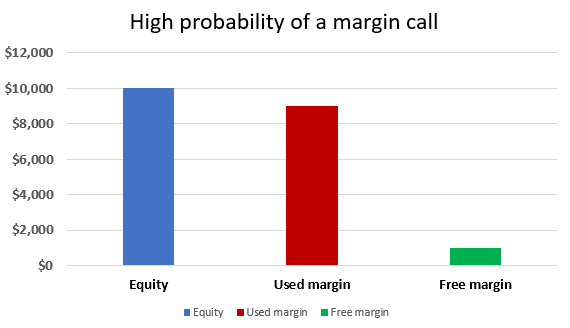

What is Margin Call in Forex and How to Avoid One?

Margin Calls in Forex Trading – Main Talking Points: A short introduction to margin and leverage Causes of margin call Margin call procedure How to avoid margin calls Traders go to great lengths to avoid margin call in forex. Therefore,...

Technical Analysis Tips from Wall Street pro Helene Meisler | Podcast

Key points covered in this podcast – How to go beyond ‘chart reading’ and enrich your analysis – Why stocks considered ‘down and out’ might be good picks – The advantages of posting charts by hand Helene Meisler is an...

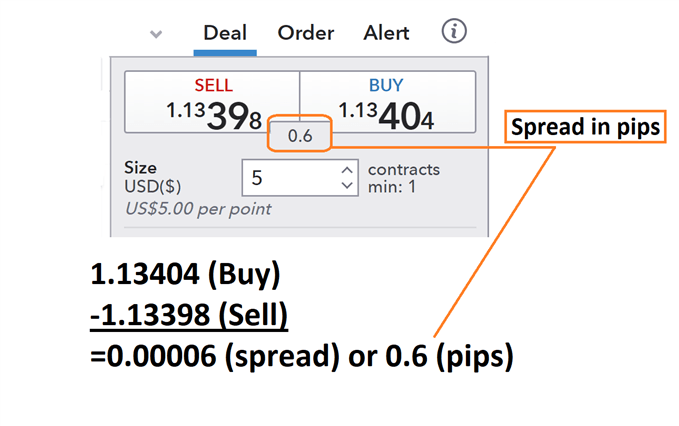

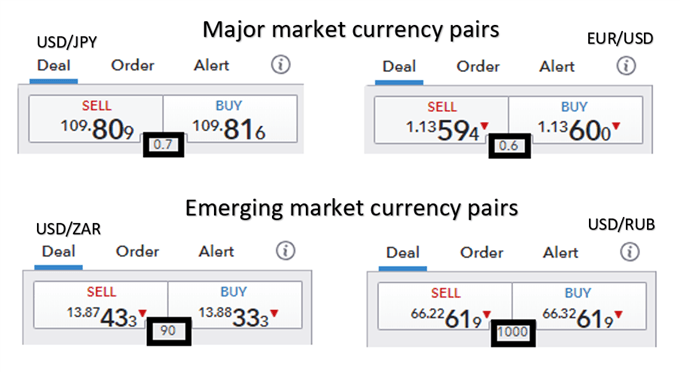

What Does a Forex Spread Tell Traders?

Forex spreads explained: Main talking points Spreads are based on the buy and sell price of a currency pair. Costs are based on forex spreads and lot sizes. Forex spreads are variable and should be referenced from your trading platform....

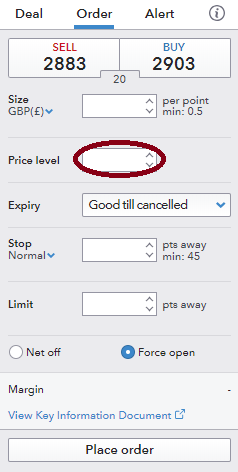

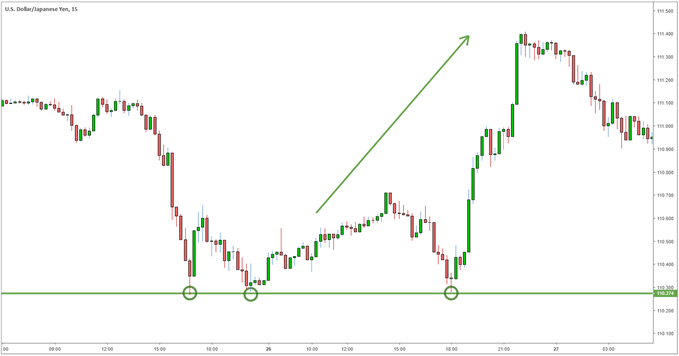

Top 5 Benefits of Using Entry Orders in Forex Trading

Entry orders are a valuable tool in forex trading. Traders can strategize to come up with a great trading plan, but if they can’t execute that plan effectively, all their hard work might as well be thrown out the window....

Long vs Short Positions in Forex Trading

Understanding the basics of going long or short in forex is fundamental for all beginner traders. Taking a long or short position comes down to whether a trader thinks a currency will appreciate (go up) or depreciate (go down), relative...

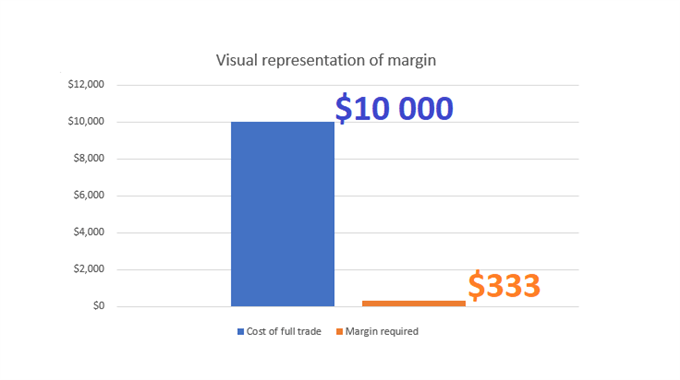

Using Margin in Forex Trading

Margin is the minimum amount of money required to place a leveraged trade. Closely linked to margin is the concept of margin call – which traders go to great lengths to avoid. Not knowing what margin is can turn out...

Forex Spreads Trading Strategies & Tips

This article will explore top forex spread trading techniques and key tips traders should follow to protect themselves against a widening spread. The forex spread is the difference in price between the bid (buy) and the ask (sell) price. The...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals