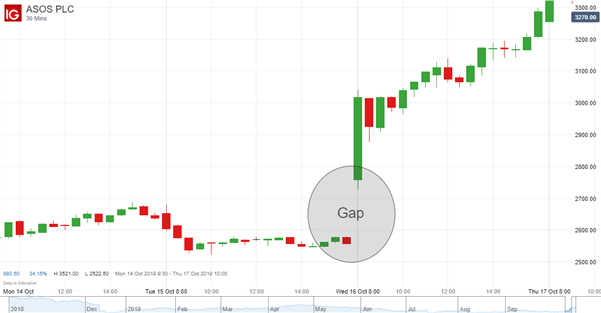

Trading the Gap: What are Gaps & How to Trade Them?

Gap trading strategies help traders capitalize on the gaps in charts caused by price fluctuations between sessions. Read on to discover more about the phenomenon of gaps, the four types to be aware of, and how to employ a gap...

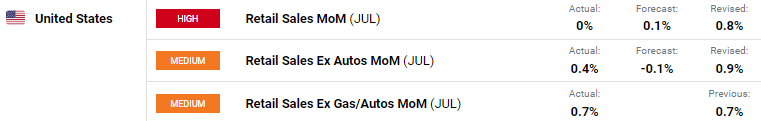

What are Retail Sales and Why is it Important to Traders? A Guide

Retail Sales: A Definition Retail sales or the Retail Sales Index (RSI) is an economic indicator that serves as a gauge of the overall health of an economy by outlining consumer spending information. The report delivers an aggregate measure of...

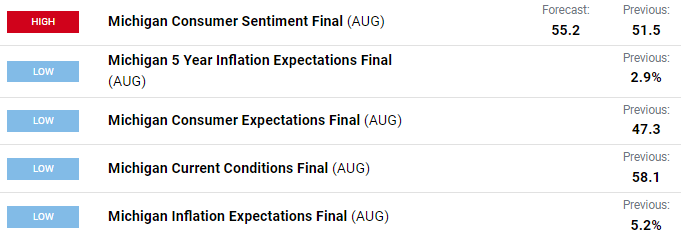

Consumer Sentiment Index: Basic Principles and Uses in Trading

What is Consumer Sentiment? Consumer sentiment, consumer confidence or the Index of Consumer Sentiment (ICS) is used as a barometer for overall economic health by market participants as determined by the consumer. The reading encompasses consumer and household opinion based...

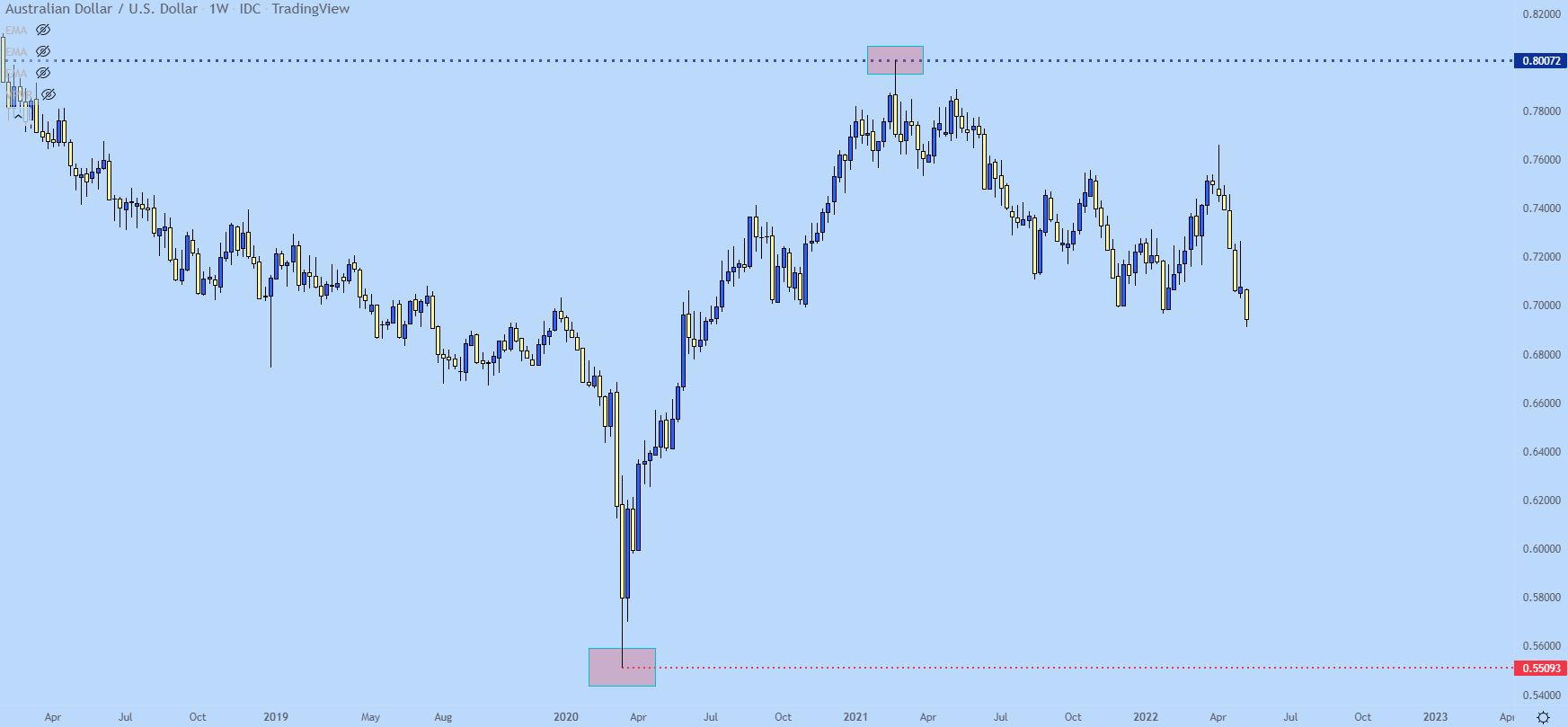

Price Action: The Power of the Wick

Probably one of the more compelling areas of price action is in its ability to show key levels or price zones that matter. And to be sure, there’s a lot of ways of finding potential support and resistance levels but...

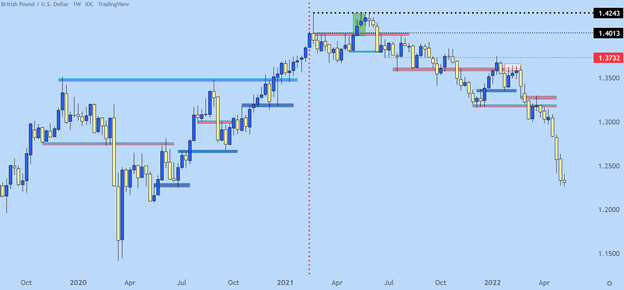

Price Action Support and Resistance

As we look at throughout our education section there’s a plethora of ways to find support and resistance levels. Fibonacci is a popular tool and psychological levels are a significant point of interest. But, if markets don’t acknowledge that support...

A Price Action Tell: Support at Prior Resistance, Resistance at Prior Support

As we talked about in our introduction to price action, markets are cyclical creatures. Prices go up, prices go down and as traders, the most we can hope to do is ride on the right side of the wave for...

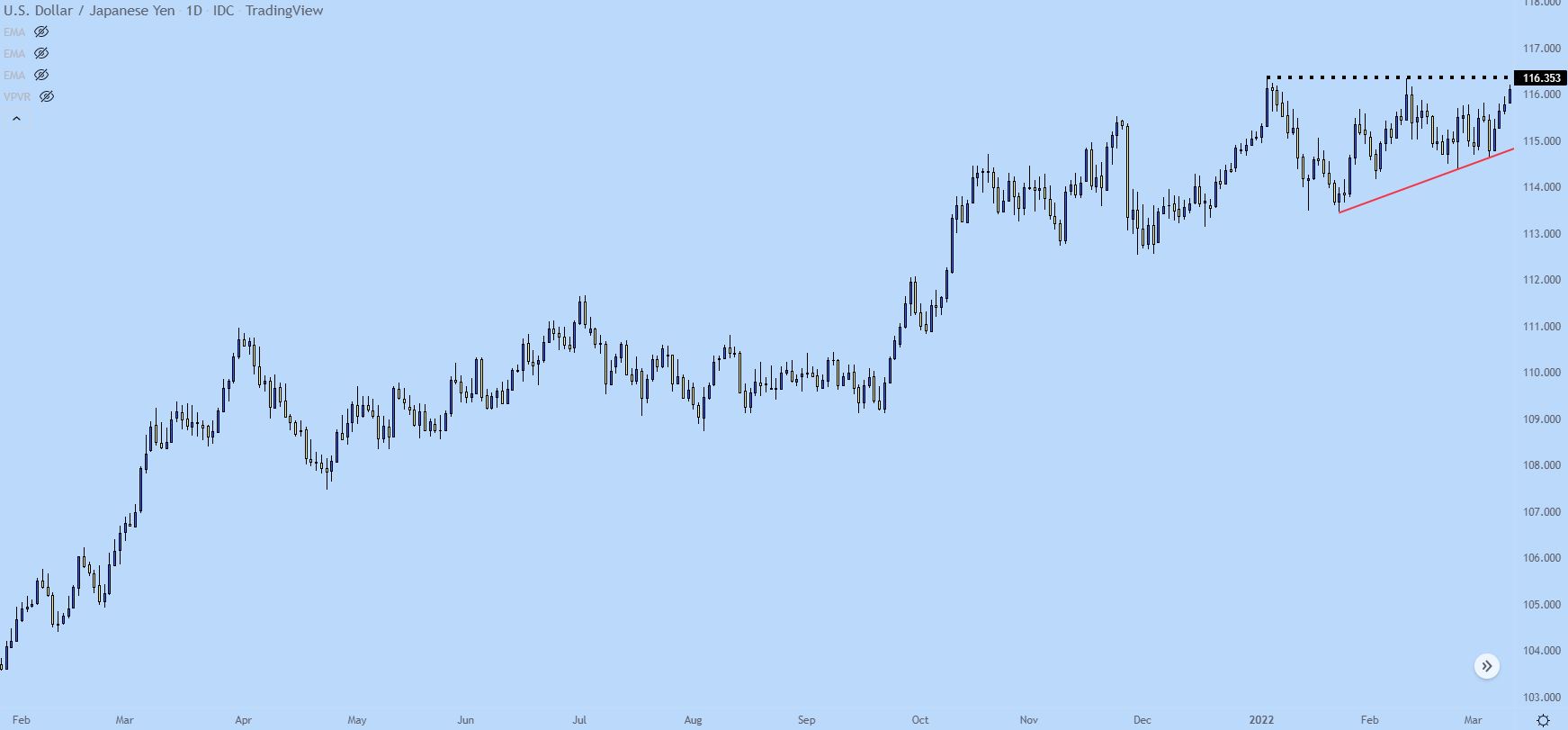

Trading Triangles in Price Action

Much of trading is waiting. I get it, that’s not what you want to hear. You want action, you want riveting, you want excitement. Heck, this topic is called price ‘action’ so, there surely must be something actionable about it,...

Engulfing Formations for Price Action Trading

There’s a litany of candlestick formations that traders can look for but few carry the potential of the engulfing candlestick. Introduction to Technical Analysis Candlestick Patterns Recommended by James Stanley Start Course Engulfing candlesticks are fairly simple to explain, it’s...

Price Action Pin Bars

We’ve looked at the importance of candlestick wicks in a few of our articles in the price action sub-module already. Wicks highlight reactions, and as traders, those reactions can be key because they may clue us into what might happen...

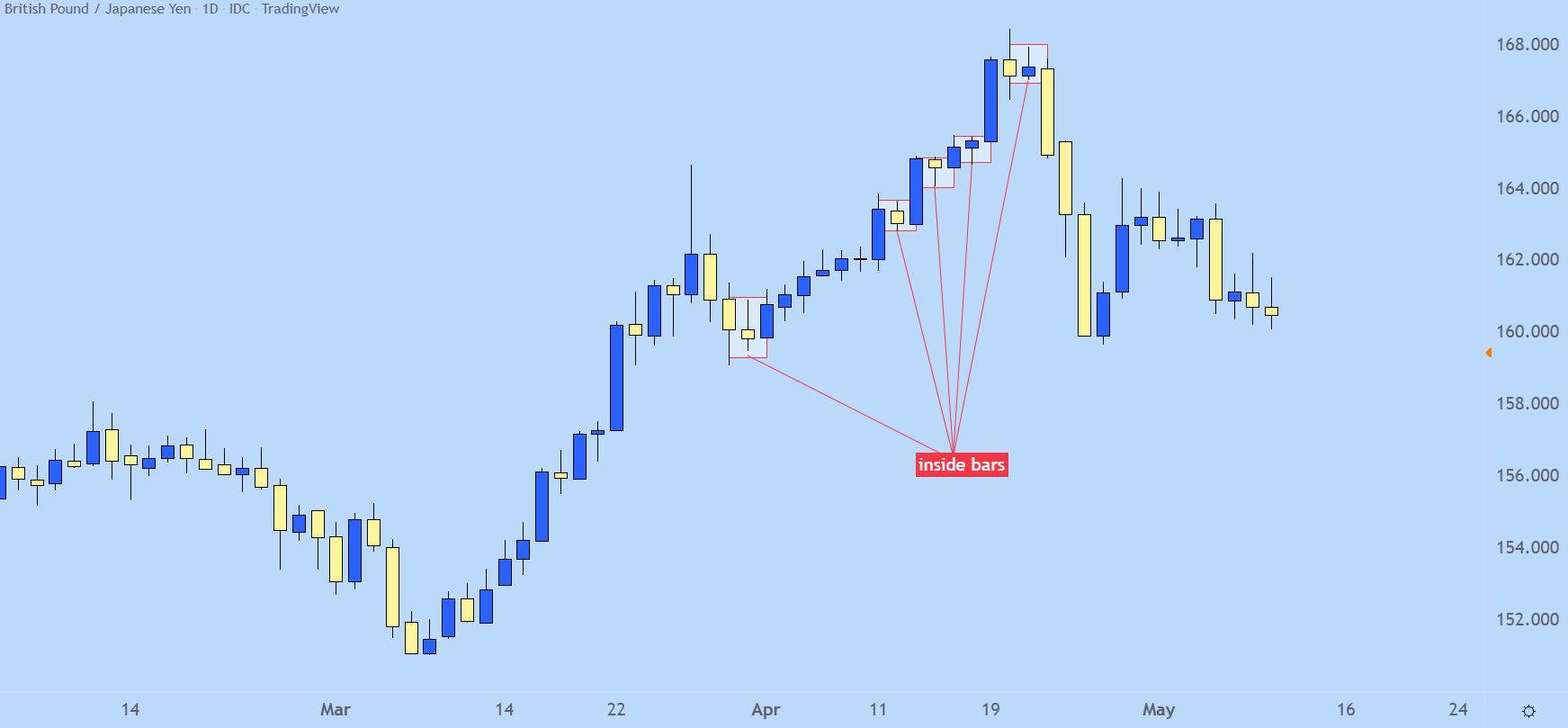

Inside Bars – The Hidden Price Action Driver

As odd as it is many aspects of trading analysis aren’t necessarily based on what’s happening as much as what isn’t happening. If you’ve heard of traders shorting VIX, that’s somewhat related. Traders will wait for a spike in volatility...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals