Introduction to Pitchfork Analysis & Median Line Trading

This piece focuses pitchfork analysis and median line trading, and reviews how parallels of these trendlines can be utilized to give structure to a market advance or decline. The objective of this methodology is to attempt to identify the gradient...

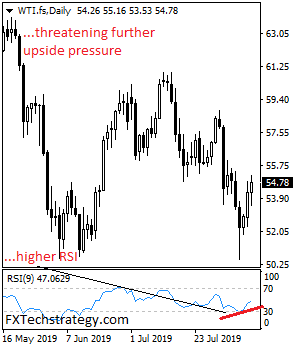

CRUDE OIL: Recovery Threat Eyes 56.01 Zone

CRUDE OIL recovery threats eyes 56.01 zone as the commodity looks to extend gain. Support lies at the 54.00 level where a break will expose the 53.50 level. A cut through here will set the stage for a run at...

GBP/USD’s Long-Overdue, but Likely Short-Lived, Bounce

Sometimes, a market becomes so oversold that it can rally even on unsubstantiated rumors or even outright bad news. That looks like it’s the case with GBP/USD today. Over the weekend, The Telegraph reported that Boris Johnson would meet with...

EURCHF’s Steady Decline Seems to Have One Thing in Focus: The Gap of April 2017

EURCHF bears continued registering lower lows over the last three-months, through levels not seen for around two-years. The move down fell 31 pips shy of the June 2017 low of 1.0831. The pair corrected slightly, and the bears are now...

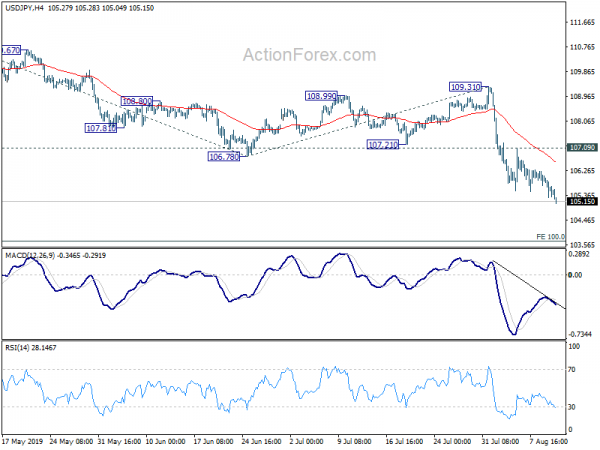

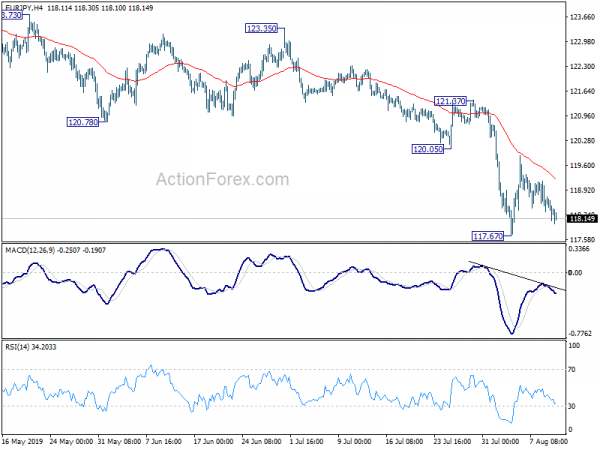

Markets Remain in Risk Aversion as Yen and Swiss Franc Maintain Momentum

Risk aversion is the main theme even though trading is generally subdued today. Yen is currently the strongest one, followed by Sterling and then Swiss Franc. The Pound is trying to recover upside is so far capped by no-deal Brexit...

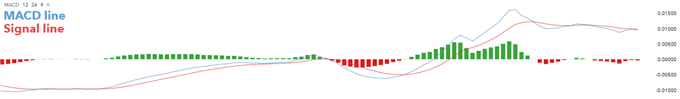

MACD: The Moving Average Convergence Divergence Explained

MACD Indicator – Talking Points: What is MACD? What does MACD measure? How is MACD calculated? Limitations of MACD What is MACD? The Moving Average Convergence Divergence (MACD) is a technical indicator which simply measures the relationship of exponential moving...

Week Ahead May Provide Volatility As More Uncertainty Prevails

Compared to last week’s somewhat muted action, analysts suggest that this week could have unexpected turns and traders could move in. In the previous days, the US accused China as a currency manipulator. The US accusations followed after the currency...

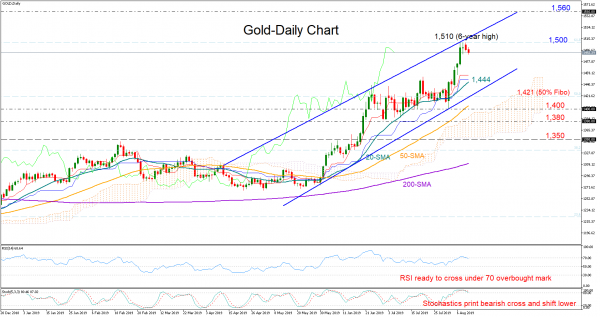

Gold Bulls Locked Below 1,500, Could Lose Momentum In Short-Term

Gold bulls got trapped around the 6-year high of 1,500 and the 61.8% Fibonacci of the long downleg from 1,796 to 1,046 after gaining more than 3.5% last week. Technically, the market could soften in the short-term as the RSI...

Yen and Franc Firm in Quiet Trading, More Upside Ahead

The financial markets are relatively quiet today with Japan and Singapore on holiday. Yen and Swiss franc generally firmer but there is no clear follow through buying to extend last week’s rally yet. On the other hand, Dollar is soft,...

Wall Street bull worries eroding confidence will push stocks lower

One of Wall Street’s biggest bulls is bracing for more wild market swings. With the S&P 500 and Dow off 4% from their all-time highs, Wells Fargo Securities’ Christopher Harvey is worried fear over ultra-low U.S. rates and negative rates...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals