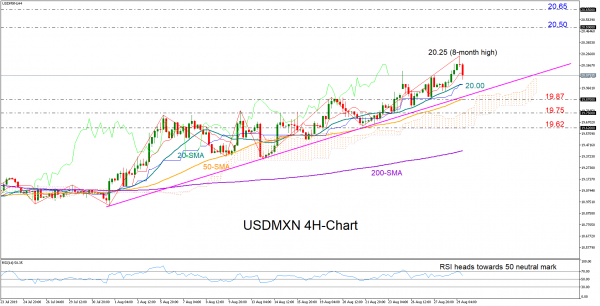

USDMXN Prints a Gravestone Doji and Pulls Back

USDMXN is printing a bearish candle in the four-hour chart after creating a gravestone doji, signaling the continuation of the negative correction. The RSI has also reversed south after peaking slightly below its 70 oversold level, providing additional discouraging signals...

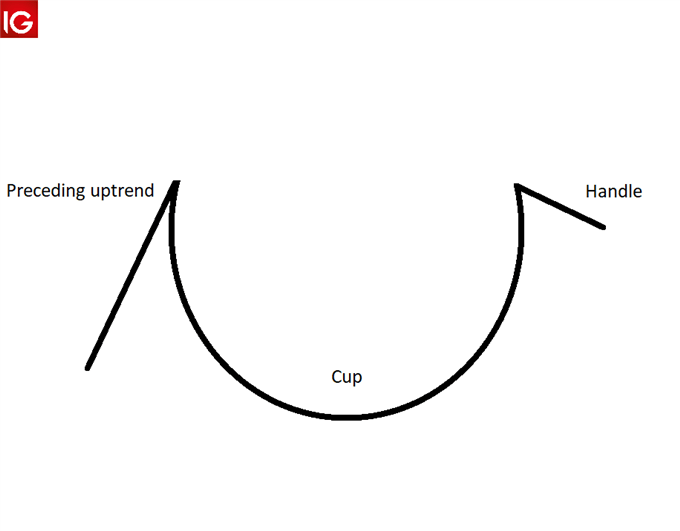

Trading with the Cup and Handle Pattern

The cup and handle pattern occurs regularly within the financial markets. Incorporating the cup and handle strategy within a trading system can enhance a trader’s market analysis technique. What is a cup and handle pattern and how does it work?...

Privacy fears slow spread of UK-style data-sharing to combat money laundering

European banks are ramping up spending on the fight against financial crime, after a wave of money-laundering scandals on the continent. However, industry insiders betray little optimism about the impact it will have on crime, let alone on banks’ reputations....

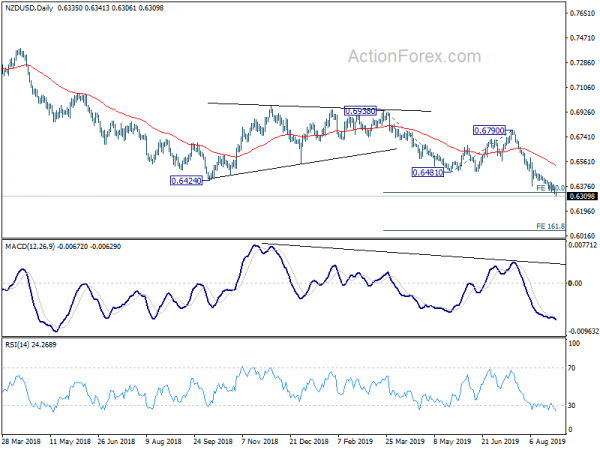

Kiwi Declines To 5-Year Low After Weak Business Confidence Data

Sterling declined in the Asian session in reaction to the decision by Boris Johnson to suspend the House of Commons. This suspension raised the likelihood that the country would leave the European Union without a deal on October 31. The...

New Zealand Dollar Leads Commodity Currencies Lower, Yen and Franc Firm

Commodity currencies remain generally pressured on risk aversion today. In particular, New Zealand Dollar is weighed down by poor business confidence data. Australian is not much better after contraction in private capital spending. On the other hand, Yen and Swiss...

BOC Prepares for Insurance Rate Cut

Global economic slowdown, escalations of US- China trade war and further Fed funds rate cut have heightened speculations that BOC would have to lower its policy rate in coming months. We agree on this assessment but expect that the insurance...

AUD/JPY Impulsive Downleg May Have Resumed

Short-term technical outlook on AUD/JPY Key Levels (1 to 3 days) – advertisement – Intermediate resistance: 71.55 Pivot (key resistance): 72.00 Supports: 70.70 & 69.90/70 Next resistance: 72.90 Directional Bias (1 to 3 days) Bearish bias below 72.00 key short-term...

Mexico adds to LatAm bank gloom

Mexican banks have become the latest in Latin America to face a structural weakening in their operating environment. With investors in the region’s financial institutions still reeling from the fallout from the collapse of Argentine bank stocks, those who were...

Stocks making the biggest moves after hours: Nutanix, Ollie’s and Guess

Nutanix IPO celebration at the Nasdaq market site in New York, September 30, 2016. Source: Nasdaq Check out the companies making headlines after the bell: Shares of Nutanix soared 18% in extended trading after the company announced a lower-than-expected loss...

GER30 Index Consolidates above the 11,338 Level; SMAs Converge

The GER30 index has consolidated in a sideways market in the last 20 sessions, as the 50-period simple moving average (SMA) has flattened and blended with the 100-period SMA. The index has currently moved into the Ichimoku cloud, trading around...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals