Payments: PSD2 authentication delay means pain but long-term gain

The Central Bank of Ireland and the UK’s Financial Conduct Authority (FCA) have delayed the implementation of strong customer authentication (SCA) over concerns that banks, payment service providers and merchants were unprepared for the change. The original deadline for implementing...

Wall Street bull Ed Yardeni predicts stocks will fly 17% between now and 2021

With the S&P 500 about one percent from its all-time highs, Wall Street bull Edward Yardeni is predicts a record breakout is coming. The Yardeni Research president believes between now and the end of next year, the index will soar...

Yen Jumps as Trade Optimism Waned Suddenly after China Canceled Farm Trip

Yen and Swiss Franc ended as the strongest ones last week. They’re partly supported by lack of clear indication of imminent easing from respective central banks. There was additional buying on a pessimistic turn on US-China trade talks. Dollar ended...

MasterCard’s stock rallies nearly 50% this year, boosted by strong consumers

Andrew Harrer | Bloomberg | Getty Images The world’s second-largest payment processor is approaching a decade-long run for the company’s stock. Shares of MasterCard are getting a boost, as U.S. consumers embrace the secular shift from cash to card, and...

Dutch risk: Fiscal redux but no need to fret

Tariff wars are said to be driving the winds of change in the Netherlands The Netherlands has, unlike Germany, displayed remarkable strength, a peculiar aspect given the current global slowdown. According to Eurostat, real GDP grew by 0.5% in each...

Weekly Economic and Financial Commentary: Fed Cuts Again, But Dissent Rises

U.S. Review Fed Cuts Again, But Dissent Rises The Federal Reserve reduced the fed funds rate 25 bps this week, continuing to cite economic weakness overseas and “muted inflation pressures.” The higher pace of home sales and improving builder confidence...

The Weekly Bottom Line: Fed Cuts Rates, More to Come

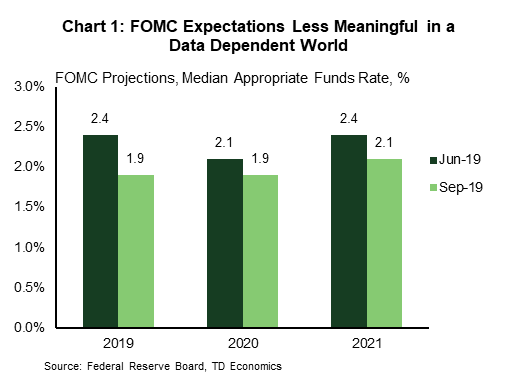

U.S. Highlights In the main financial event of the week, the Federal Reserve cut its key lending rate by 25 basis points, but was mum on the prospect for additional cuts. Our latest forecast sees slower economic growth leading to...

Forward Guidance: Geopolitical Uncertainty Matters – But Economic Data Still Looks a Little Better

A week that started off with worries about the stability of global oil supply in the wake of last weekend’s attack on a major oil production facility in Saudi Arabia ended up looking, if anything, a little better in terms...

Week Ahead – Markets Remain Focused on Geopolitical Risks

Iran, Trade Updates, Fed Speak, more rate decisions in focus We could see markets return to being fixated on trade updates, some corporate earnings (Nike, Micron, Conagra and Vail Resorts), yield curve inversions and stress on the money markets. On...

Week Ahead: US-China Trade and Brexit Back to Forefront

The week ahead features one major central bank decision and only a handful of market-moving data. So, it should be a quieter week. But following this week’s central bank bonanza, there will be some aftershocks to stir volatility. Meanwhile, with...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals