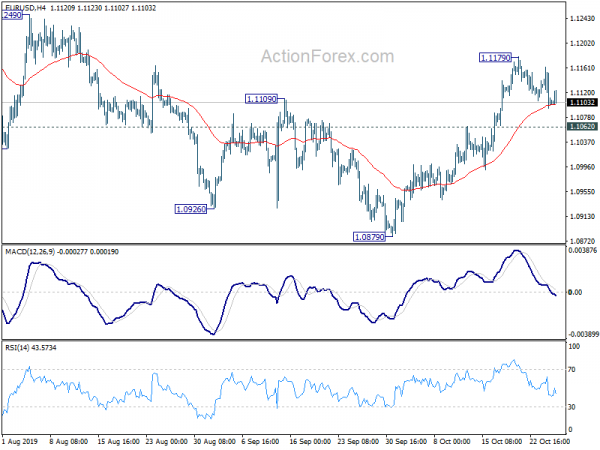

Euro Soft on Weak Business and Consumer Sentiments

Trading in the forex markets remain subdued ahead of weekly close. Euro is generally softer as data showed German business and consumer sentiments remained weak. Also, professional forecasters downgraded Eurozone inflation and growth projections in latest survey. For the week,...

EUR/USD Squeezed By 100– And 200-Hour SMAS

Yesterday, the EUR/USD currency pair declined to the support provided by the 200-hour SMA at 1.1109. During Friday morning, the pair was trying to surpass the 55-hour SMA at 1.1120. Given that the exchange rate is pressured by the 100-hour...

GBP/USD Tests Weekly PP

On Thursday, the GBP/USD exchange rate tried to surpass the support level formed by the weekly PP at 1.2832. During today’s morning, the rate continued to test the given support. Note that the currency pair is pressured by the 55-,...

USD/JPY Tests Falling Wedge Pattern

Yesterday, the USD/JPY currency pair consolidated at the 108.65 level. During Friday morning, the pair continued to trade at the given level. Note that the exchange rate is supported by the 55-, 100– and 200-hour moving averages, currently located circa...

XAU/USD Skyrocketed To 1,505.00

On Thursday, the XAU/USD exchange rate skyrocketed to the psychological level at 1,500.00. During today’s morning, the rate reached the 1,505.00 mark. On the one hand, yellow metal could continue to extend gains against the US Dollar within the following...

Can Google/Alphabet Break New High On The Third Attempt?

Alphabet Inc, the holding company of Google will report its Q3 2019 earnings on Mon, 28 Oct after the close of the U.S. session. Consensus adjusted EPS and revenue forecasts are pegged at $14.59 and $23.72bn respectively. My colleague, Ken...

The impact of Hong Kong unrest on finance: not fear but inconvenience

Extra security: a police patrol at MTR station on the lookout for protesters A finance conference was canned in Hong Kong last week. It will be pushed back three months, and held in Macau instead. It wasn’t that anyone feared...

WTI OIL Outlook: Oil Price On Track For Strong Bullish Weekly Close Following Rally On Unexpected Fall In US Crude Stocks

WTI oil maintains firm tone and consolidating under new one-month high at $56.49, posted on Thursday after three-day rally, which resulted in 4.7% rise. Oil prices were boosted by surprise decline in US oil inventories, as well as optimism about...

USD/JPY The Bias Remains Bullish

Pivot (invalidation): 108.50 Our preference Long positions above 108.50 with targets at 108.75 & 108.85 in extension. Alternative scenario Below 108.50 look for further downside with 108.40 & 108.30 as targets. – advertisement – Comment Technically the RSI is above...

Currencies: Euro Eases (Albeit Modestly) On Soft EMU PMI

Rates: PMI’s and ECB left no significant traces on bondsYesterday’s PMI’s didn’t really convince, notably in Germany, but were quickly categorized by markets. Draghi’s last (pro forma) meeting didn’t really impact bond trading in a lasting way either. Core bonds...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals