Key Highlights

- AUD/USD started a strong recovery from the 0.6754 low.

- There was a break above a crucial bearish trend line at 0.6775 on the 4-hours chart.

- The US ISM Manufacturing Index declined from 48.3 to 48.1 in Nov 2019.

- The Reserve Bank of Australia (RBA) kept rates at 0.75% and refrained from hinting any future rate cuts.

AUD/USD Technical Analysis

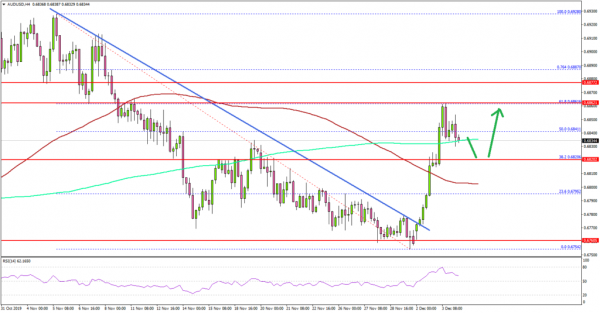

After a strong decline, the Aussie Dollar found support near the 0.6750 area against the US Dollar. As a result, AUD/USD started a decent recovery and broke many hurdles such as 0.6775 and 0.6800.

Looking at the 4-hours chart, the pair even broke the 0.6820 resistance area, the 100 simple moving average (red), and the 200 simple moving average (green).

Moreover, the pair surpassed the 50% Fib retracement level of the last major slide from the 0.6928 high to 0.6754 low. However, the pair faced selling interest near the 0.6860 resistance area.

The stated 0.6860 holds key since it was a support earlier and now coincides with the 61.8% Fib retracement level of the last major slide from the 0.6928 high to 0.6754 low.

Therefore, a clear break above the 0.6860 resistance might open the doors for more upsides above 0.6880 and 0.6900 in the near term.

Conversely, AUD/USD could decline and test the 0.6820 support area and the 100 SMA. Any further losses may perhaps push the pair back into a bearish zone towards 0.6750.

Fundamentally, the US ISM Manufacturing Index for Nov 2019 was released by the Institute for Supply Management (ISM). The market was looking for a minor increase in the index from 48.3 to 49.2.

The actual result was below the market forecast, as the US ISM Manufacturing Index declined from 48.3 to 48.1 in Nov 2019. Besides, the New Orders Index declined 1.9 percentage points from the October reading and came in at 47.2.

The report added:

The Production Index registered 49.1 percent, up 2.9 percentage points compared to the October reading of 46.2 percent. The Employment Index registered 46.6 percent, a 1.1-percentage point decrease from the October reading of 47.7 percent.

Overall, AUD/USD is likely to continue its upside above 0.6860 as long as it is above the 0.6820 support. More importantly, there was a strong upside recently in EUR/USD and GBP/USD.

Upcoming Economic Releases

- Germany’s Services PMI for Nov 2019 – Forecast 51.3, versus 51.3 previous.

- Euro Zone Services PMI for Nov 2019 – Forecast 51.5, versus 51.5 previous.

- UK Services PMI for Nov 2019 – Forecast 48.6, versus 48.6 previous.

- US Services PMI for Nov 2019 – Forecast 51.6, versus 51.6 previous.

- US ADP Employment Change Nov 2019 – Forecast 140K, versus 125K previous.

- US ISM Non-Manufacturing Index for Nov 2019 – Forecast 54.5, versus 54.7 previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals