Adapt and thrive: how FX algos are coping with volatility

COPYING AND DISTRIBUTING ARE PROHIBITED WITHOUT PERMISSION OF THE PUBLISHER: SContreras@Euromoney.com By: Paul Golden Published on: Monday, June 01, 2020 FX trading algorithms are getting smarter at dealing with crises – and getting more popular as a result. A few...

Potential Economic Implications of the Iranian Crisis

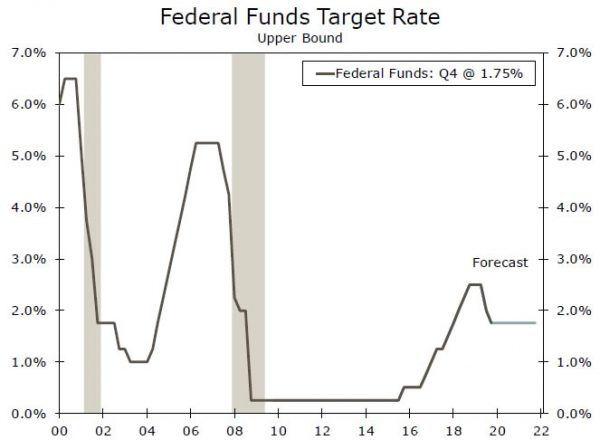

Higher oil prices do not have as much of a slowing effect on the U.S. economy as they did years ago. However, the uncertainty that the crisis could impart could potentially be more meaningful. Oil Prices Now Have Mixed Effect...

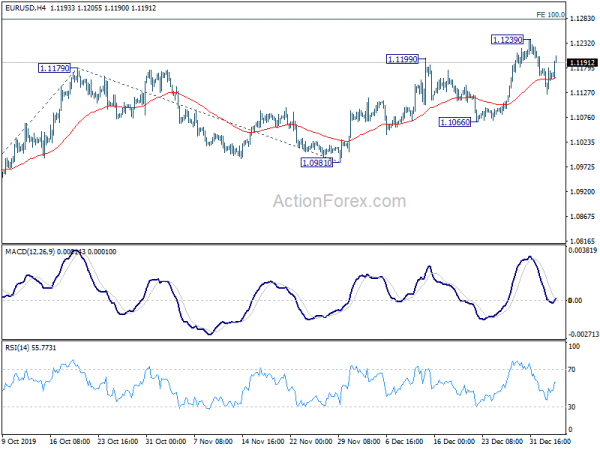

Euro and Sterling Rebound on Economic Data, Risk Aversions Continue

European majors stage a strong come back today as supported by positive data. Germany investor confidence recorded a strong rebound while UK PMI services was revised up. On the other hand, despite continuous risk aversion on Middle East tensions, Yen...

Stocks making the biggest moves premarket: Exxon, Axon, Boeing, Nordstrom & more

Check out the companies making headlines before the bell: Cal-Maine Foods (CALM) – The nation’s largest egg producer posted a quarterly loss of 21 cents per share, compared to consensus estimates of a 3 cents per share profit. Revenue also...

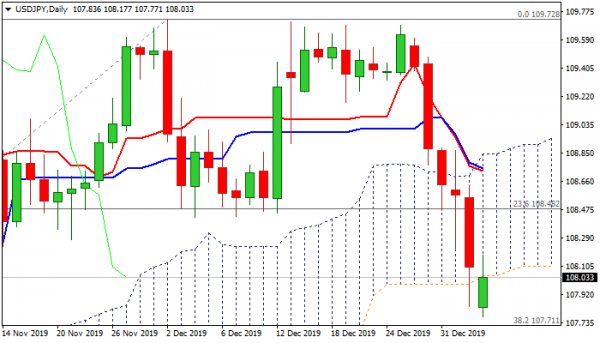

USD/JPY Outlook: Bears Are Taking A Breather But Outlook Remains Negative

The pair is consolidating around 108 handle on Monday, despite gap-lower opening at the beginning of the week, with larger bears taking breather above important Fibo support at 107.71 (38.2% of 104.44/109.72) after last week’s 1.2% fall. Safe-haven yen advanced...

USDJPY 107.50 Likely

The US dollar is trading under the 108.00 level against the Japanese yen currency as traders continue to sell any upside rallies in the pair. Market sentiment is extremely bearish due to geopolitical tensions, which indicates that further downside in...

UK finance still struggles with gender pay gap

Despite commitments by leaders of financial sector firms to improve gender balance, analysis of gender pay gap reports shows that little or no improvement has been made over the last three years in the UK. Research by gender diversity consultancy...

S&P 500 3212.00 Expected

Pivot (invalidation): 3246.00 Our preference Short positions below 3246.00 with targets at 3222.00 & 3212.00 in extension. Alternative scenario Above 3246.00 look for further upside with 3258.00 & 3269.00 as targets. – advertisement – Comment The RSI advocates for further...

Middle East Tensions Continue to Dominate as Gold and Oil Surge

Middle East tensions continued to drive risk aversion in the markets as another week started. Stocks in Asia are generally in red, except in being mixed in China. Gold and oil price surge sharply on safe haven flows. Movements in...

It’s Gap Galore Around Middle East Tensions | Gold, SPX, WTI

Middle East tensions continued to flare over the weekend, resulting in some impressive gaps to further underscore the risk-off start to 2020. In response to the US airstrike which killed two senior pro-Iranian officials, the Iraqi parliament voted to dispel...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals