Euro Rebounds Against While Stock Traders Take Profit

The forex markets are reversing some of this week moves today, as stock investors are also taking some profits ahead of the weekend. Euro is the better performing so far, followed by Swiss Franc, Dollar and Yen. Meanwhile, Sterling and...

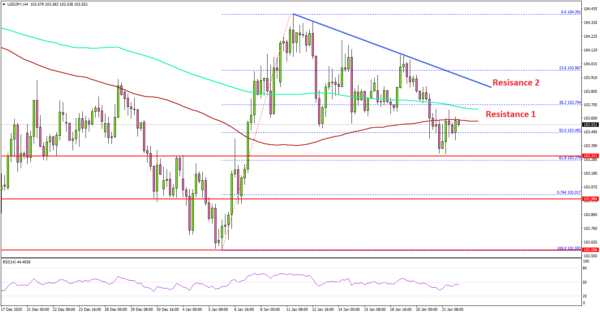

USD/JPY Extends Losses, Recovery Could Face Hurdles

Key Highlights USD/JPY extended its decline below the 103.50 support. A major bearish trend line is forming with resistance near 103.80 on the 4-hours chart. The US Initial Jobless Claims in the week ending Jan 16, 2021 declined from 926K...

Stock futures flat as markets look to end record-setting week

John Nacion | NurPhoto | Getty Images Contracts tied to the major U.S. stock indexes held around the flatline Thursday evening as Wall Street appeared headed to close out the record-setting week on a muted note. Dow futures lost 27...

The Most Volatile Currency Pairs and How to Trade Them

FX markets are susceptible to a range of factors which affect their volatility, and many traders look to tailor their strategies to capitalize on the most volatile currency pairs. Currency volatility, often measured by calculating the standard deviation or variance...

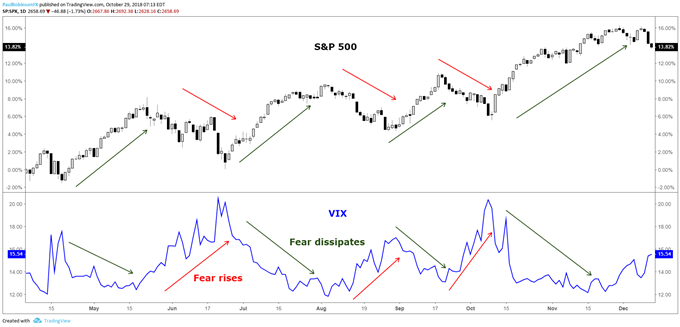

What is the VIX? A Guide to the S&P 500 Volatility Index

S&P 500 Volatility Index: An introduction Traders should keep a close eye on the ‘VIX’, or CBOE Volatility Index, when trading major indices like the S&P 500. The S&P 500 VIX correlation is a primary example of why the relationship...

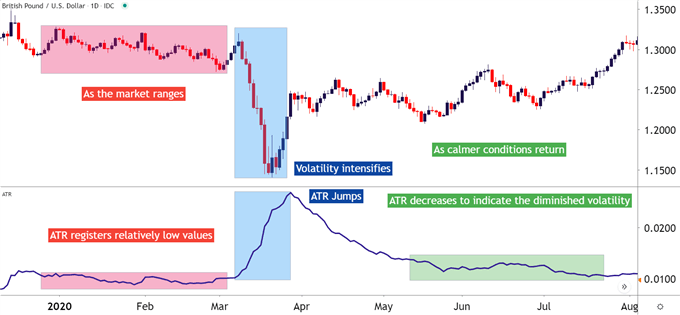

How to Measure Volatility with Average True Range (ATR)

MEASURING VOLATILITY: TALKING POINTS Volatility is the measurement of price variations over a specified period of time. We discuss the Average True Range indicator (ATR) as a measurement of volatility. Technical Analysis can bring a significant amount of value to...

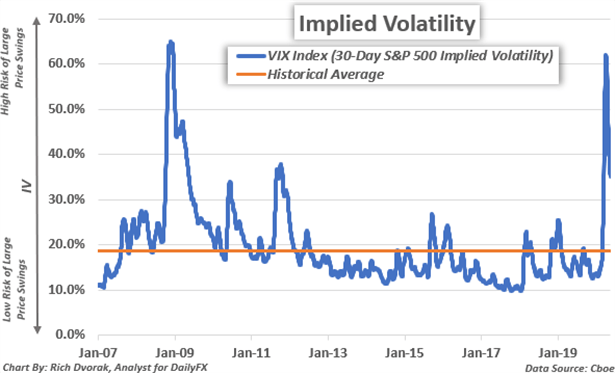

Implied Volatility: What it is & Why Traders Should Care

Implied volatility, synonymous with expected volatility, is a variable that shows the degree of movement expected for a given market or security. Often labeled as IV for short, implied volatility quantifies the anticipated magnitude, or size, of a move in...

Historical Volatility: A Timeline of the Biggest Volatility Cycles

Throughout history there have been a number of extremely meaningful volatility spikes across major financial markets. Each had defining characteristics that made them similar, despite occurring in very different markets and for different reasons. The continuity seen across these volatility...

US: Housing Starts End the Year on Strong Footing

TD Bank Financial Grouphttp://www.td.com/economics/ The information contained in this report has been prepared for the information of our customers by TD Bank Financial Group. The information has been drawn from sources believed to be reliable, but the accuracy or completeness...

ECB Gets Slightly More Hawkish, Revealing that it might Not Use All of PEPP Envelope

The ECB left its powder dry in January. While continuing to warn of the downside risks on the Eurozone and global economy, the central bank delivered a hawkish tweak about operation of the Pandemic Emergency Purchase Program (PEPP). On the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals