Paul Tudor Jones rips Fed on inflation, says credibility is at stake

The Federal Reserve is risking its credibility by keeping policy so loose and allowing inflation to grow in a way that may not be temporary, billionaire hedge fund manager Paul Tudor Jones told CNBC on Monday. This week could see...

Bank of America CEO Brian Moynihan says consumer spending is 20% higher this year than 2019

American consumers are spending more freely as the economy opens up further, Bank of America CEO Brian Moynihan said Monday. Transaction volumes on customers’ credit and debit cards and over the Zelle payment network have grown by 20% so far...

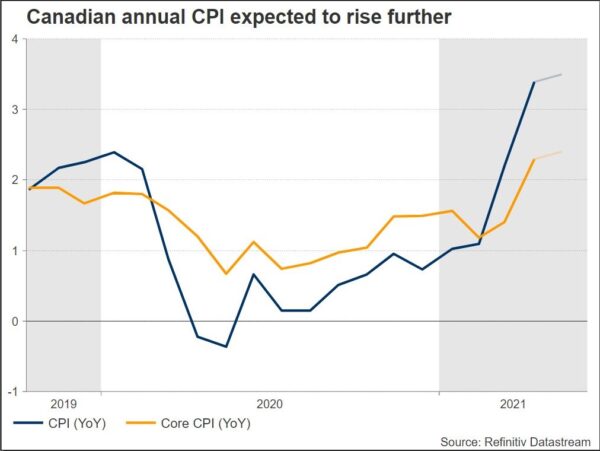

Loonie Needs Some Help to Return to Gains; Canada CPI on Cards

Canada will announce its inflation data for the month of May at 12:30 GMT on Wednesday. Global economic activity is picking up as COVID-19 incidences decline in many nations and vaccine coverage rises. However, growth is still uneven across the country. Will the loonie move higher...

FOMC Preview – Too Early to for Tapering while Surge in Inflation is More Imminent

We do not expect the Fed talk about tapering at this week’s meeting. Policymakers would likely hint more about it at the Jackson Hole symposium in August while a formal announcement would be made at the September FOMC meeting. Rather,...

Bank of America’s Moynihan says the Fed can pull back on policy help

Bank of America CEO Brian Moynihan encouraged the Federal Reserve to ease up on its ultra-easy monetary policy, saying Monday that the urgency for the pandemic-related response is abating. Speaking a day before the central bank begins its June policy...

US Open: Tech Rises, Bond Yields Fall as Investors Await Fed Decision

Tech stocks are set to outperform, bond yields continue to decline ahead of the FOMC. The Fed is expected to maintain its dovish stance. The rotation into value appears to be unwinding with tech once again back in favour. US...

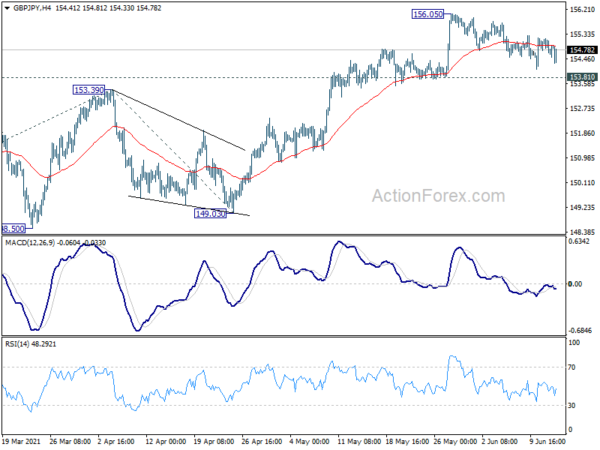

Sterling Softens on Possible Reopening Delay, Range Trading Continues

The forex markets continue to be generally quiet today, stuck inside Friday’s range. Sterling is mildly lower on talks that UK Prime Minister Boris Johnson is going to delay easing of restrictions due to rise in the Delta variant infections....

US 500 Index Bit By Bit Resumes Broader Bullish Bias

The US 500 stock index (Cash) is poised to move higher after having registered a fresh all-time high of 4,257. The 50- and 100-period simple moving averages (SMAs) are regaining their positive incline, sponsoring strengthening sentiment in the index. The...

GBP/USD Outlook: Sterling Remains In Red

Cable stands at the back foot on Monday and fell to one-month low (1.4069), in extension of Friday’s 0.45% drop that generated negative signal on formation of bearish engulfing pattern on daily chart. Stronger dollar keep pound under pressure, along...

Forex Quiet as FOMC Awaited; Gold, Oil and Bitcoin on Moves

Trading is generally subdued in Asian session today, with little reactions to the G7 summit. Also, China and Hong Kong are on a one-day holiday. Commodity currencies are mildly firmer while Swiss Franc and Yen are softer. But all major...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals