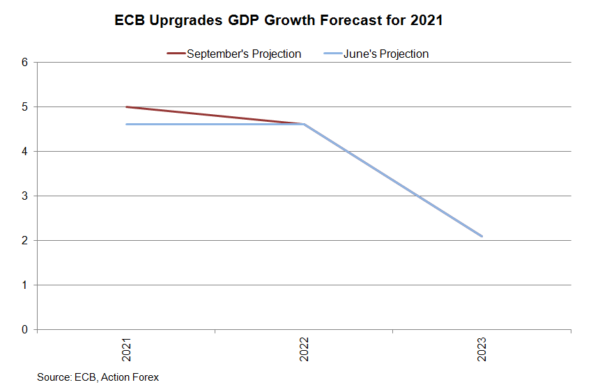

ECB to Slow Asset Purchases via PEPP. Growth and Inflation Outlook Upgraded

Two important messages delivered at the ECB meetings are: 1) the end of the front-loading of PEPP asset purchases and 2) acknowledgement of a more persistent inflation pressure. The policy rates were all kept unchanged with the main refi rate,...

Weekly jobless claims post sharp drop to 310,000, another new pandemic low

First-time filings for unemployment claims in the U.S. dropped to 310,000 last week, easily the lowest of the Covid era and a significant step toward the pre-pandemic normal, the Labor Department reported Thursday. Claims had been expected to total 335,000...

ECB Research – Saving the Battle for December

At today’s meeting, ECB decided to slow its PEPP bond purchases to a ‘moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters.’ This slowdown was widely expected and probably...

Stocks Little Changed, ECB Moderates Purchases, Another Pandemic Low for Jobless Claims

US stocks pared losses after weekly jobless claims hit a fresh pandemic low and as the ECB turns optimistic enough to moderate their PEPP buying. The S&P 500 index won’t make a major move unless inflation heats up or if...

Businesses are feeling stronger inflation and paying higher wages, Fed’s ‘Beige Book’ says

U.S. businesses are experiencing escalating inflation that is being aggravated by a shortage of goods and likely will be passed onto consumers in many areas, the Federal Reserve reported Wednesday. In its periodic “Beige Book” look at the nation’s economic...

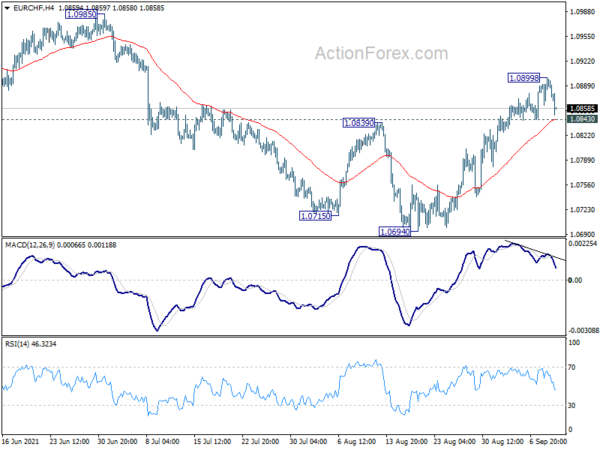

Euro Tumbles in Crosses, No Help from ECB Re-calibration

Euro tumbles notably against European majors and Yen today, and ECB’s re-calibration of PEPP purchases provide no support. But Dollar is seen as equally weak. Sterling is currently the star performer for today, followed by Swiss Franc and Yen. Commodity...

Watch Christine Lagarde speak after the ECB announces a slowing of its pandemic-era bond buying

© 2021 CNBC LLC. All Rights Reserved. A Division of NBCUniversal Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Market Data Terms of Use...

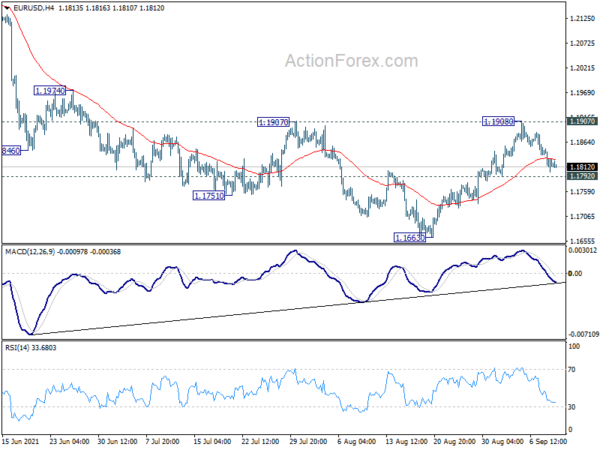

EUR/USD Declines Reaches Target

The decline of the EUR/USD continued on Wednesday, as the rate eventually reached the support of the weekly S1 simple pivot point at 1.1806. However, after touching the pivot point, the pair recovered to the 1.1830 level. Up to the...

GBP/USD Ignores Technical Levels

On Wednesday, the GBP/USD found support in the 1.3730 level and started a surge. The surge ignored most technical levels or broke their resistance with ease. By the middle of Thursday’s European trading hours, the rate had reached the 100-hour...

Euro Losing Momentum ahead of BoC, Dollar Recovering Further

Commodity currencies are trading generally lower in Asia today, with pull back in Japanese stocks in the background. Canadian Dollar is also soft after BoC’s rate decision overnight. Dollar, Yen and Swiss Franc are trading mildly firmer, extending this week’s...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals