Dollar Mildly Higher as Traders Turn Cautious, CAD Dips

Dollar and Sterling firm up mildly in overall quiet markets today. Commodity currencies are, on the other hand, trading lower. Investors are turning cautious ahead of the wave of central bank meetings later this week, in particular on Fed’s decision...

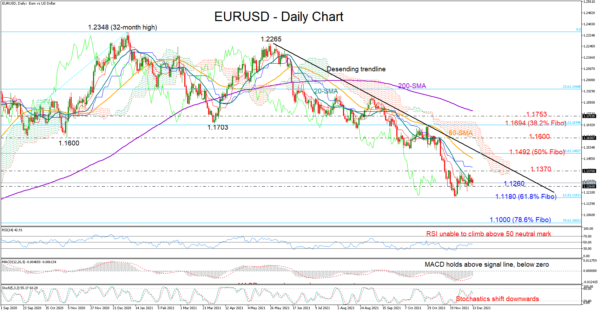

EURUSD Fragile but Bullish Hopes Still Exist

EURUSD could not sustain last week’s bullish breakout above the restrictive 20-day simple moving average (SMA), pulling back into the 1.1200 area on Monday. Downside risks are now on the table again as the RSI is drifting lower in the...

El-Erian says ‘transitory’ was the ‘worst inflation call in the history’ of the Fed

Mohamed El-Erian Olivia Michael | CNBC Calling inflation “transitory” was a historically bad move for the Federal Reserve, according to Allianz Chief Economic Advisor Mohamed El-Erian. “The characterization of inflation as transitory is probably the worst inflation call in the...

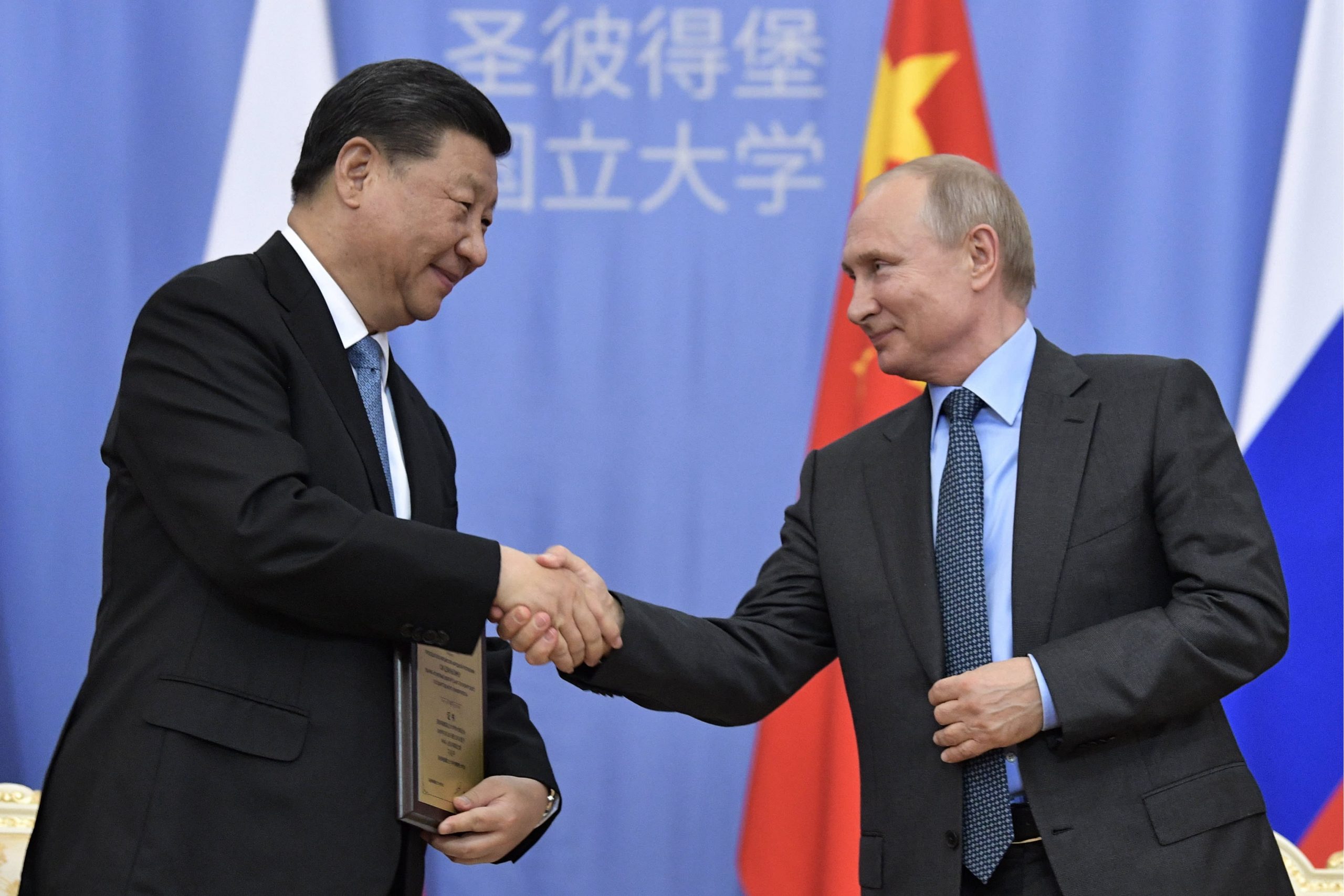

China’s Xi is set to meet Russia’s Putin virtually on Wednesday

ST PETERSBURG, RUSSIA – JUNE 6, 2019: China’s Persident Xi Jinping (L) and Russia’s President Vladimir Putin shake hands at a ceremony at St Petersburg University in which Xi Jinping was awarded St Petersburg University honorary doctoral degree. Alexei Nikolsky...

Markets Quiet Ahead of Fed, ECB, BoE, SNB, BoJ, and Lots of Data

The markets are rather quiet in Asian session. Stock indexes are trading higher but no follow through buying is seen. In the forex markets, major pairs and crosses are stuck inside Friday’s range, with commodity currencies a touch firmer. Activity...

Market Morning Briefing: Pound Has Bounced From Support Near 1.3150

STOCKS Dow, Nikkei, Shanghai and Indian indices are looking strong for the near term while the movement is indecisive in Dax which can move either ways towards 15400 or 15900 from current levels. We may look for an overall upward...

FOMC Preview – Fed to Double Size of QE Tapering

The Fed this week will announce acceleration of QE tapering. With inflation approaching 7%, policymakers would likely revise its view on inflation outlook and “retire” the word “transitory”. The updated economic projections and median dot plots showing members’ interest rate...

Markets Back in Risk-on Mode, But Forex Mixed Awaiting Central Bank Meetings

Investors seemed to have already put Omicron risks behind last week, with markets turned back into risk-on mode. But the forex markets were indeed quite mixed. Commodity currencies were the strongest ones, but the rebounds are looking more like corrective....

Weekly Economic & Financial Commentary: Restoring Balance in the Post-Pandemic Economy

Summary United States: Consumer Prices Continue to Climb, Little Reprieve to Supply Issues In Sight This week’s data continued to demonstrate severe supply problems. The number of unemployed workers per job opening reached a fresh record low of 0.67 in...

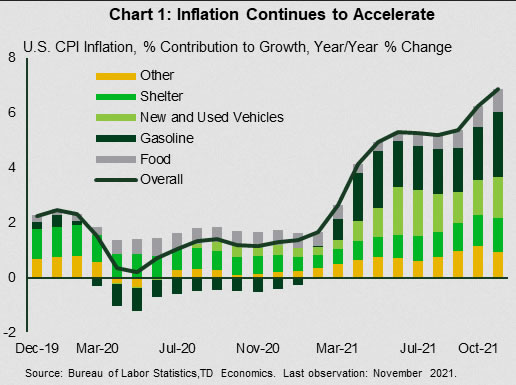

The Weekly Bottom Line: All About Inflation

U.S. Highlights Consumer prices continued to accelerate in November. On year-on-year basis, headline CPI was up 6.8% (from 6.2% previously), the highest in nearly forty years. Core inflation (ex. food and energy) also accelerated, hitting 4.9% (from 4.6% in October)....

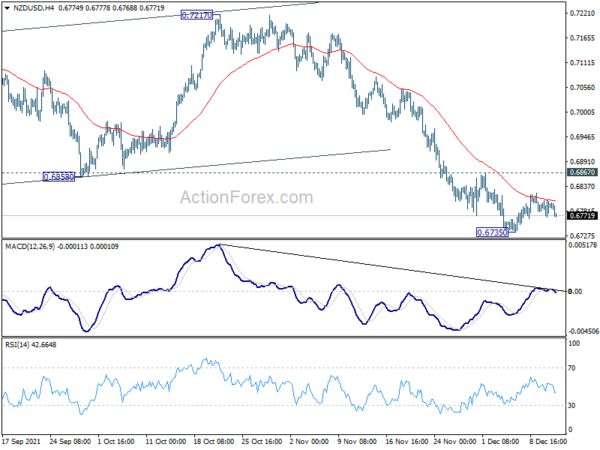

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals