Gap trading strategies help traders capitalize on the gaps in charts caused by price fluctuations between sessions. Read on to discover more about the phenomenon of gaps, the four types to be aware of, and how to employ a gap trading system.

What is a gap?

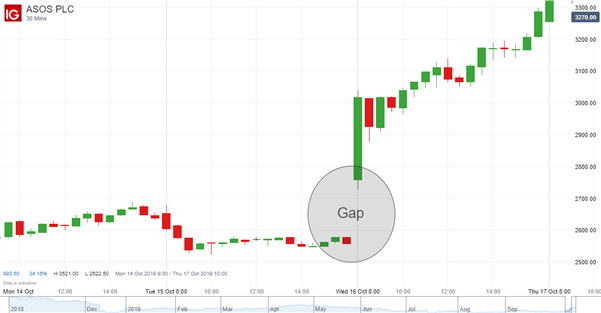

A gap refers to the area on a chart where no trading activity has taken place. This will appear as an asset’s price moves sharply up or down with nothing in between, meaning the market has opened at a different price to its prior close.

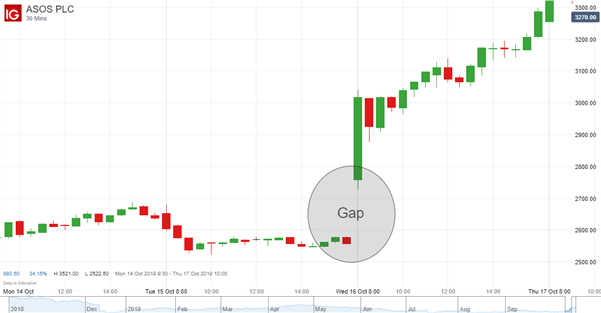

Why does the gap occur? The most frequent cause is fundamental factors. For example, in the chart above, ASOS stock rallied overnight as the company’s full year results showed it avoided another profit warning – along with traders showing confidence in the company’s ability to fix critical operational issues.

Other news such as product announcements, analyst upgrades and downgrades, and new senior appointments can lead to gaps. This is because they can move the market significantly between trading sessions in either direction.

Gap down stocks and gap up stocks refer to the direction of the price movement either side of the gap. A full gap down is when the opening price is lower than the prior low price, while a full gap up (as shown above) occurs when the opening price is greater than the prior high price.

The four types of gaps in trading

Aside from gap down and gap up, there are four main types of gap, dependent on where they show up on a chart: common gaps, breakway gaps, continuation or runaway gaps, and exhaustion gaps.

1. Common gaps simply show a gap in price action independent of price patterns and usually don’t provide exciting trading opportunities.

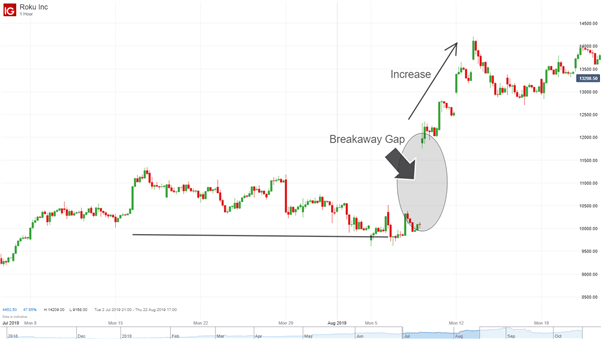

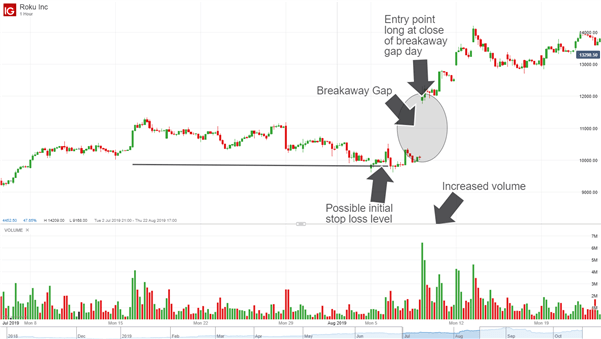

2. Breakway gaps signal a new trend where the asset ‘gaps away’ from the price pattern, as can be seen below where the gap triggers a breakout. If a breakaway gap is accompanied by higher trading volume, it may be worth taking a position long for a breakaway gap up, and short for a breakaway gap down, on the candle following the gap. (see our gap trading example below).

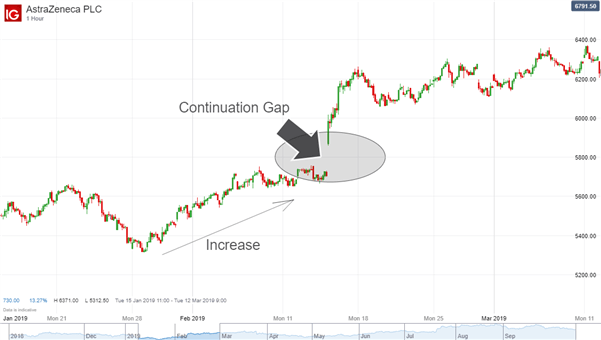

3. Continuation or runaway gaps show an acceleration of an already bullish or bearish pattern in the same direction. This can be caused by a news event that confirms the sentiment and furthers the trend. Traders might look to follow the trend and place a stop just below the gap for a bullish runaway gap and just above for a bearish runaway gap.

What does it mean when a gap has been ‘filled’?

A gap being ‘filled’ refers to the price returning to the original level before the gap happened. This usually means the price action, in the following days or weeks, retraces to the last day before a gap.

There are a range of factors that come into play with gap fill stocks:

- Price corrections: An overly optimistic or pessimistic initial spike may invite a correction.

- Support and resistance isn’t left behind when a price moves up or down sharply.

- Patterns: Price patterns dictate the likelihood of a gap being filled. For example, price reversals seen with exhaustion gaps are likely to be filled as this type of gap trade signals the end of a price trend.

Trading the gap: Gap trading strategies & tips

There are a range of gap trading techniques to explore, from fading and predicting gaps to using indicators to help you gauge price action. You can free download these best forex indicators.

Fading the gap

‘Fading the gap’ is when gaps are filled within the trading day they occur. Let’s say a stock gapped up at the open with a higher price than the previous close, on a positive earnings report. Now let’s say, as the day progresses, tradersdelve deeper into the company’s presentation deck, see things they don’t like, and start selling. Eventually, the price hits yesterday’s close, and the gap is filled.

Irrational exuberance from less experienced traders can be particularly advantageous for more seasoned market practitioners when it comes to fading the gap, as the volume that causes the gap is often caused by FOMO in trading.

Predicting a gap

If technical or fundamental factors point to the potential for a gap on the next trading day, it may be time to enter a position. For example, having detailed knowledge of a given company and its operations can help a trader predict a gap for that stock ahead of an earnings report.

Using trade indicators

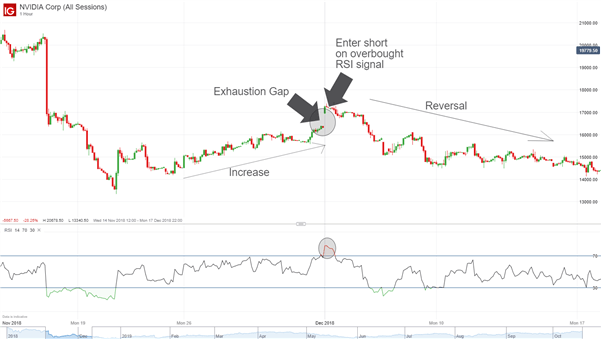

Traders can use tools such as the Exponential Moving Average and RSI to ascertain key price points and inform their decisions. For example, the below chart shows how an overbought RSI signal can be used to enter short after an exhaustion gap.

RECOMMENDATIONS

We have created innovative HIGH GAIN PROFIT robot,

We recommend our BEST ROBOT FOREXVPORTFOLIO v11, which is already being used by traders all over the world, successfully making unlimited profits over and over again.

For beginners and experienced traders!

You can WATCH LIVE STREAMING with our success forex trading here

The next chart shows an aggressive approach to the breakaway gap example. It reveals where a long position is entered in response to increased trading volume following the gap, and a possible initial stop loss level to protect against the higher risk.

A more conservative approach to this breakaway gap would be to enter on a pullback , which gives the opportunity to test the gap. While it may offer smaller upside, this approach means traders can get away with a much tighter initial stop loss order.

In order not to get into a gap and not lose your capital, many professional traders use special forex trading advisors for MT4 in trading or order professional forex account management service

Gap Trading Rules: Key things to consider

- Classify the gap you are going to play : It’s important to know which of the four types of gap you have identified. A continuation gap will prolong a trend while an exhaustion gap is set to reverse it – two very different outcomes.

- When a gap has started filling, it will rarely stop due to there often being no immediate support or resistance.

- Has a move been fueled by amateur or professional investors? Amateur investors may exhibit irrational exuberance that sets up an exhaustion gap, so waiting for the price to start to break before taking a position may be wise.

- Pay attention to volume. Breakaway gaps normally exhibit high volume (see trading example above) while low volume should occur in exhaustion gaps.

- Be careful. Trading the gap means trading stock market volatility with low liquidity so caution must be exercised. Read more how to trade Forex profitably.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals