Stocks making the biggest moves midday: Pfizer, Peloton, Carnival and more

Paxlovid, a Pfizer’s coronavirus disease (COVID-19) pill, is seen manufactured in Ascoli, Italy, in this undated handout photo obtained by Reuters on November 16, 2021. Pfizer | Handout | via Reuters Check out the companies making headlines in midday trading....

Stocks making the biggest moves premarket: Exxon Mobil, Pfizer, Peloton and others

Check out the companies making headlines before the bell: Exxon Mobil (XOM) – The energy giant signaled that it will report a fourth consecutive quarterly profit, thanks in large part to stronger oil and gas prices. The snapshot of fourth...

Market Morning Briefing: Dollar-Yen Has Paused Below 115

STOCKS Dow and Dax have risen sharply today and can test 37000 and 16200 on the upside respectively. Nikkei and Shanghai have come down, but have supports at current levels which if holds can produce a bounce towards 29500 &...

Euro Hovers At 1.13 Line

On the final day of 2021, the major pairs are stuck in tight ranges. The euro is trading quietly at 1.1310 in the European session. This holiday week was characterized by a dearth of economic releases and illiquid markets. That...

Hang Seng Outperforms, HK TECH Index Bounces After Tough Year

ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Contact...

Elliott Wave View: Natural Gas (NG) Near The End Of Correction

Elliott Wave View in Natural Gas (NG) suggests it is correcting cycle from June 22, 2020 low in larger degree 3, 7, or 11 swing. The decline is unfolding as a flat elliott wave structure. Down from October 6, 2021...

Unemployment claims end 2021 near pre-pandemic levels

A recruiter hands out information to a job seeker during a job fair in Miami, Florida, on Dec. 16, 2021. Eva Marie Uzcategui/Bloomberg via Getty Images Initial claims for unemployment benefits ended 2021 near pre-pandemic levels, after an improving labor...

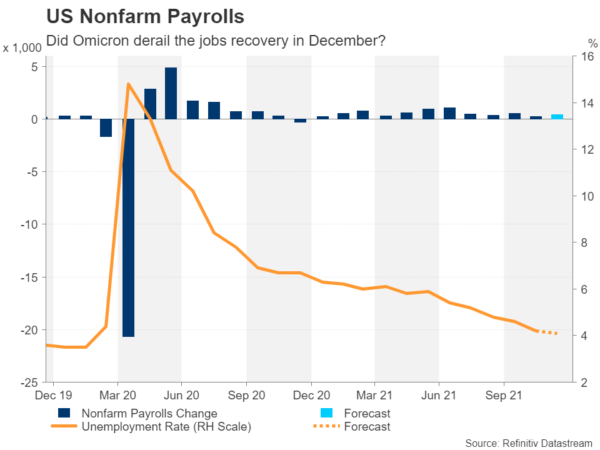

Week Ahead – NFP Report to Kick Off New Year, Inject Life into Muted FX Market

Markets have been dead quiet during the holiday period but the upcoming week is guaranteed to bring increased volatility. The nonfarm payrolls report along with the FOMC minutes and a host of other US data are bound to wake markets...

Euro Slips Below 1.13 But Recovers

The euro lost ground earlier on Thursday but has recovered most of these losses. EUR/USD is currently trading at 1.1337, down 0.08% on the day. Risk appetite boosts euro With a very light economic calendar this week, the markets are...

Stocks at Highs and Dollar Ticks Slightly Lower

Dollar heavy as sentiment remains positive; US jobless claims send positive messages Major US stock futures have managed to remain near record highs, while trading volumes have narrowed, and liquidity is drying up as the trading doors near closure for...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals