What Does Surprise BOE and Less Dovish ECB Mean for US Dollar Index (DXY)?

The Bank of England surprised markets AGAIN on Thursday with a hike in interest rates to 0.25%. (Recall at their last meeting they left rates unchanged when a hike was expected.) In addition, the ECB was slightly less dovish as...

Week Ahead – The Festive Season is Upon Us

Will markets coast into the new year? Last week was action-packed, dominated by major central bank announcements that in many cases represented a change of direction as we head into 2022. From supporting the economy through the pandemic to reining...

Lost work due to omicron? What to know about unemployment benefits

Pedestrians stand in line at a Covid-19 mobile testing site at Columbus Circle in New York, on Dec. 5, 2021. Jeenah Moon/Bloomberg via Getty Images Covid cases are spiking in some parts of the U.S., and the highly contagious omicron...

The Weekly Bottom Line: Slaying the Inflation Dragon

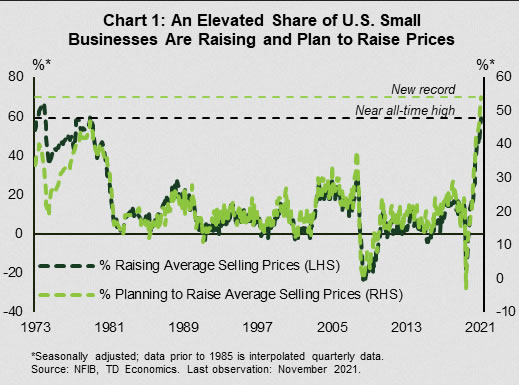

U.S. Highlights Evidence of accelerating price pressures continued to trickle in this week. Producer prices accelerated to 9.6% year-on-year in November. This was accompanied by an elevated share of small businesses raising prices (+6 points to 59%). After a strong...

Weekly Focus – Central Banks Choose the Hawkish Path

Central banks were in the spotlight this week, and the general outcome was on the hawkish side. The Federal Reserve brought its forward guidance more in line with what markets and analysts had already been expecting, signalling an end to...

Week Ahead – With the Central Bank Mayhem Out of the Day, the Festive Wind Down Begins

After a super exciting week, things will wind down significantly in the run up to the Christmas weekend, with the biggest risk for traders likely being suffering from post-central bank blues. Out of all the meetings, the Fed’s announcement undoubtedly...

Yen Rises as Investors Back in Risk Averse Mode

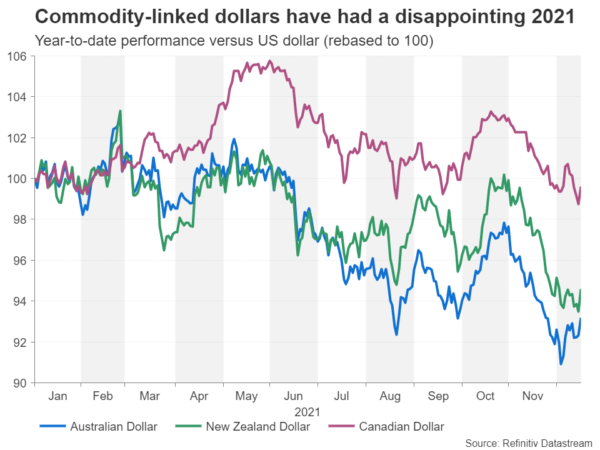

Investors are back in risk-off mode after a week of volatility. Yen is rising broadly, followed by Swiss Franc and Dollar. On the other hand, commodity currencies are back under some pressure. Euro and Sterling are both mixed. The question...

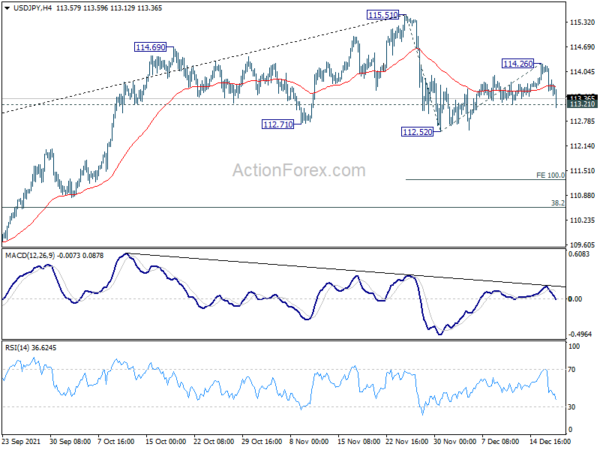

Japanese Yen Calm after BoJ Meeting

The Japanese yen is showing little movement on Friday. In the European session, USD/JPY is trading at 113.44, down 0.13% on the day. It was a dramatic week, with central banks in the spotlight. There were significant announcements on both...

NZDUSD Tiptoes Across 76.4% Fibonacci But Downside Risks Remain

NZDUSD has established a foothold consolidating around the 0.6734 level, which is the 76.4% Fibonacci retracement of the up leg from 0.6510 until 0.7464, after a five-week decline from the 0.7217 high. The simple moving averages (SMAs) are starting to...

USDCAD Halts Pullback, But Bearish Jitters Still In Play

USDCAD attempted to touch its nine-month high of 1.2947 from August earlier this week, but its efforts proved fruitless, with the price drifting lower to find support around the 1.2770 level and the red Tenkan-sen line. Signals from momentum indicators...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals