Dollar Steady, Yields Impatient ahead of FOMC

The markets remain generally quiet today, awaiting FOMC rate decision. Sterling regains much of the ground lost earlier in the week. Canadian Dollar is also firm, in particular against other commodity currencies. On the other hand, Swiss Franc is paring...

Markets on Fed Watch, Vaccine Woes in Europe

After a mixed session in Asia, Europe is seeing a mildly lower start, with most sitting on the sidelines ahead of the much-anticipated FOMC meeting later today. Volumes are expected to be light across the session with few wanting to...

Gold Bulls Await A Fresh Impetus Above 1,740 To Resume Rally

Gold bounced off 1,699 to fight the tough wall around 1,740 on the four-hour chart, which has been a crucial obstacle to upside movements since the start of the month. The sideways trajectory in the RSI and the MACD and...

Mortgage refinance demand tanks 39% as rates continue to climb

A house’s real estate for sale sign shows the home as being “Under Contract” in Washington, DC, November 19, 2020. Saul Loeb | AFP | Getty Images Higher mortgage rates are cutting into demand for refinances, as fewer and fewer...

Dollar Holding in Range, FOMC Awaited

The markets continues to trade in non-committal way as traders await Fed’s comments on treasury yields. Swiss Franc is currently the strongest one for the week, thanks to yesterday’s rally. But there is no follow through buying so far. Canadian...

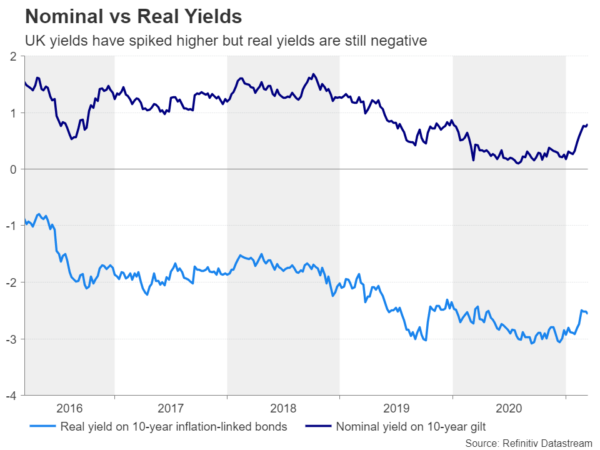

BOE Preview – Response to Rising Yields in Focus

We expect BOE to vote 9-0 to leave the Bank rate unchanged at 0.1%. Meanwhile, the QE program will also stay at 875B pound worth of government bonds, and 20B pound of corporate debt. Despite contraction in the first quarter,...

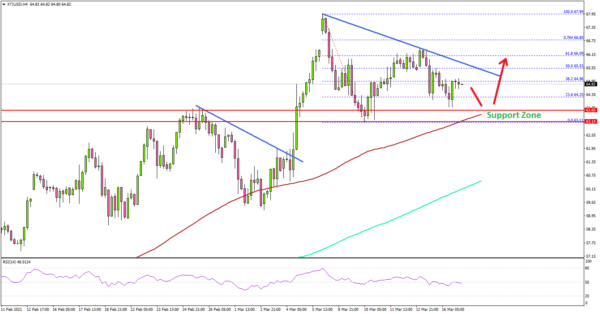

Crude Oil Price Correcting Gains, Key Supports Nearby

Key Highlights Crude oil price traded to a new multi-month high at $67.92 before correcting lower. A key bearish trend line is forming with resistance near $65.60 on the 4-hours chart of XTI/USD. Gold price is recovering, but it could...

As Fed gets ready to deliver its interest rate decision, Wells Fargo predicts the 10-year yield could reach 2.25% this year

Don’t rule out a 10-year Treasury Note yield as high as 2.25% this year. That’s the message from Wells Fargo Securities’ Michael Schumacher, ahead of Wednesday’s Federal Reserve interest rate decision. “The fiscal stimulus is enormous, and the vaccine rollout...

Bank of England to Stick to ‘Cautionary Realism’ as UK Yields Surge

The Bank of England will announce its latest decision on Thursday (12:00 GMT) just hours after the Fed’s, likely keeping its monetary policy settings unchanged also. There is no press conference or new economic projections to accompany the March meeting,...

Aussie Yawns after RBA Minutes

The Australian dollar is having a quiet Tuesday session. Currently, the pair is trading at 0.7744, down 0.14% on the day. Aussie dips lower The RBA minutes were a non-market mover on Tuesday, as there were no surprises from the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals