More Turmoil to Come?

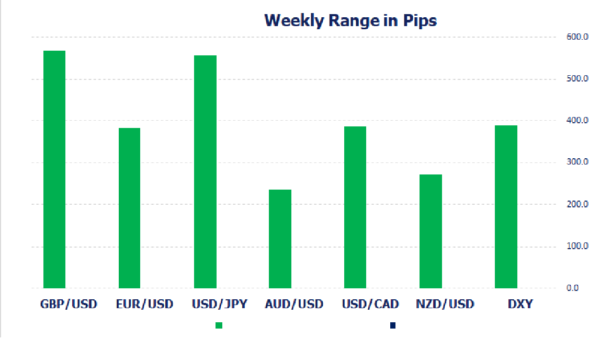

Stock markets have steadied in Asia and early European trade on Tuesday but that is not reflective of the mood in the markets at the moment so it may struggle to hold. The volatility in FX markets at the start...

EUR/USD Due for a Corrective Bounce?

With all the attention on the pound today, there was some sharp movements in the euro which you may have missed. The single currency dropped to a fresh low on the year against the greenback, reaching a low of 0.9551...

Brent Dropped to Its February Lows

The commodity market is now experiencing a huge stress due to concerns of the reduction in demand for energies. Early in the week, Brent dropped to $85.35 and no other negative factors have appeared since then. However, those that are...

Gold Extends its Decline to Fresh 29-Month Lows

Gold has been losing ground since early March, generating a profound structure of lower highs and lower lows within a descending channel. Furthermore, in the last few daily sessions, the technical picture has deteriorated, with the pair forming consecutive fresh...

Week Ahead: Central Bank Fallout, More Pain for the Pound, and Inflation Data

Last week, there were some major events that created quite a bit of volatility. The most important events were the FOMC interest rate hike of 75bps to bring the Fed Funds rate to 3.25%, the BOE rate hike of 50bps...

Week Ahead – Recession Fears Mounting

US Now that Wall Street has had some time to digest the FOMC decision, the focus shifts to how quickly the economy is weakening and a wave of Fed speak. A wide range of economic releases includes more Fed regional...

Weekly Economic & Financial Commentary: Shot Across the Bow, Japan Intervenes Against Surging Dollar

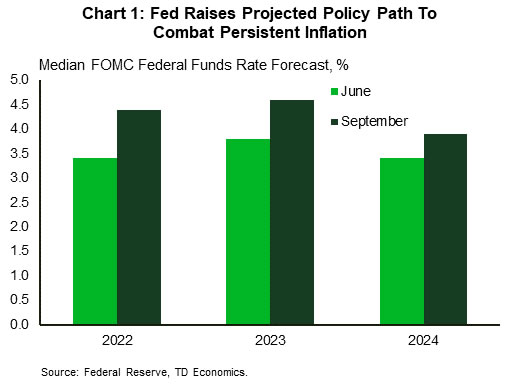

Summary United States: Whatever It Takes As widely expected, the FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage...

The Weekly Bottom Line: The FOMC Aims High

U.S. Highlights The Federal Reserve raised interest rates by 75bps for the third consecutive meeting, bringing the federal funds rate to its highest level in 14 years. FOMC Chair Powell reiterated his Jackson Hole speech, stating that the Fed is...

GBP/USD Freefall: Where Will It Stop?

Cable traders will remember today for a LONG time. The UK government’s announcement of a “mini” budget cutting taxes and capping energy bills has spooked international investors, leading to a surge in UK gilt yields and driving GBP/USD down to...

Gold Falls Below $1650 as US Dollar Soars

On the back of fresh data via the PMI flashes out of the EU and UK, which showed that both economies are in contractionary territory, the EUR/USD and GBP/USD are trading lower on the day. As a result, the strength...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals