Price Action Support and Resistance

As we look at throughout our education section there’s a plethora of ways to find support and resistance levels. Fibonacci is a popular tool and psychological levels are a significant point of interest. But, if markets don’t acknowledge that support...

Yellen says the administration is fighting inflation, admits she was wrong that it was ‘transitory’

Treasury Secretary Janet Yellen emphasized that the White House has several strategies that will reduce inflation she conceded is too high for Americans.

Trend Trading

An Introduction to Trend Trading Of the three market conditions, trends are often the most sought after. This is an attractive market condition for traders for a number of reasons, key of which is one of biasing. The future is...

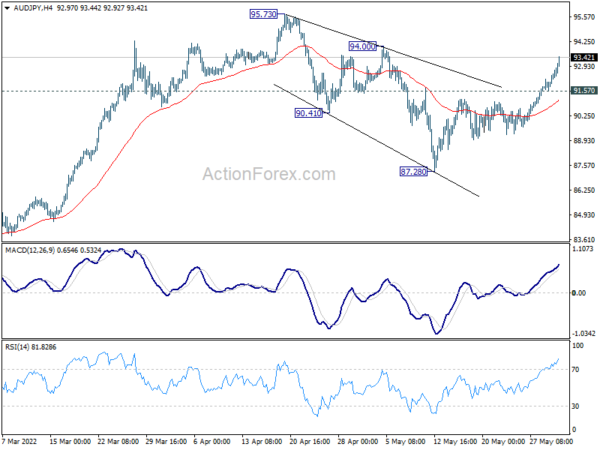

Yen Accelerating Down, Aussie Rising With Loonie

Australian Dollar is leading commodity currencies higher again, on the back of positive market sentiment. The Aussie is additionally support by better than expected GDP data, which affirms the case for more RBA rate hike. Canadian Dollar is also firm,...

Range Trading

How many different types of market environments are there? To be sure, we can line out a litany of different backdrops that traders might find. But, if we reduce price movements to their lowest common denominator, there’s really only two...

Breakouts: Risks, Downsides and Pitfalls

In our last article we looked at the breakout market condition while talking about the parameters around that. The breakout is the transitory state between a range or mean reversion and a fresh trend; but there’s a plethora of risk...

Breakout Ballistics in Trading and Analysis

An Introduction to Breakout Trading In our last section we looked into range-bound market conditions and mean-reversion strategies. As we shared, markets will either be trending or they won’t, and that pretty much denominates most of a market’s state. But,...

How to Trade Ranges

As we looked at in our previous article, the range market condition is often one of the more ignored conditions by new retail traders, and that’s generally due to the perception of capped potential. After all, if I’m trading a...

US Dollar Turns to Jobs Report for More Fuel

The latest US employment report will hit the markets at 12:30 GMT Friday. Forecasts and business surveys point to another solid report, although there are some signs that the labor market might be running into trouble. As for the dollar,...

USDJPY Wave Analysis

USDJPY reversed from support level 127.00 Likely to rise to resistance level 129.65 USDJPY recently reversed up from the key support level 127.00 (which stopped wave (ii) in April), intersecting with lower daily Bollinger Band and by the 50% Fibonacci...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals