Stocks making the biggest moves midday: Ulta Beauty, Big Lots, Autodesk, Workday and more

Ulta Beauty store. Scott Mlyn | CNBC Check out the companies making headlines in midday trading Friday. Ulta Beauty — The beauty retailer surged 12.5% following better-than-expected quarterly earnings and revenue. Ulta Beauty also shared a better-than-expected outlook for the...

Week Ahead – Nonfarm Payrolls on Tap, Has the Dollar Topped?

The latest US employment report will be in the spotlight next week for any signs that recession worries have started to impact hiring. The dollar has lost some of its power lately and this dataset could determine whether we are...

WTI Futures Extend Advance as Positive Momentum Strengthens

WTI oil futures (July delivery) have been in a sustained uptrend since the 92.60 region rejected any further dip, generating a profound structure of higher highs and higher lows. Moreover, the ascending 50- and 200-day simple moving averages (SMAs) endorse...

GBPJPY Rangebound after Decline Halts

GBPJPY has experienced a sharp decline after peaking at the six-year high of 168.41 in early April. However, the pair has managed to find its feet and is currently trading sideways, while near-term risks seem to be tilted to the...

USDJPY’s Retracement Opposed by Soaring 50-day SMA

USDJPY is trading around the lower Bollinger band residing within a support zone which is linking the 127.34 barrier with the rising 50-day simple moving average (SMA) at 126.25, the former being the 23.6% Fibonacci retracement of the uptrend from...

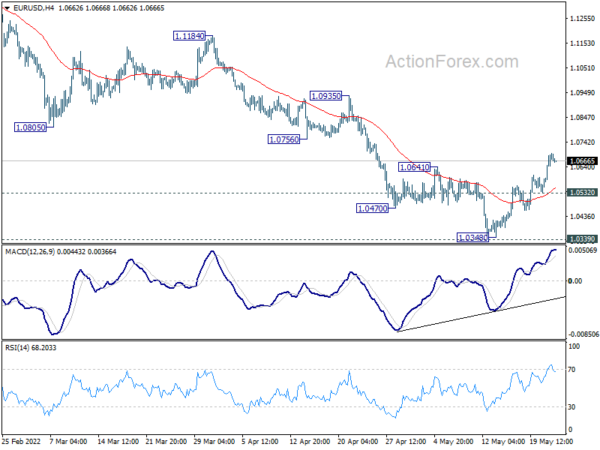

Elliott Wave Analysis: EUR/USD Has Room for Higher Prices

The USD is moving lower across the board as gap between FED and other CB is narrowing. We see more and more ECB members and speculation for a potential 50bp hike which is the main reason for stronger euro these...

NZDUSD Increases above 0.6500 in Short-term Bounce

NZDUSD is ticking higher above 0.6500 again after the bounce off the two-year low of 0.6214. The technical indicators are showing more positive signs, as the MACD is advancing above its trigger line in the negative region, while the RSI is...

Oil Possibly Locked in the $100-130 Range for Years

Crude oil has added for the fourth consecutive trading session. However, the rise in quotes has been tempered by comments from the German economy minister, claiming that the EU could agree on an embargo on Russian oil within days. However,...

Dollar and Yen Recovering Slightly in Indecisive Markets

The moves in the financial markets are so far rather indecisive. While US stocks rebounded overnight, Asian indexes turned softer. Dollar and Yen are recovering slightly after yesterday’s selloff. Commodity currencies are retreating. European majors are mixed. While Euro and...

US 500 Index’s Downside Bearing Curbed as Buyers Step In

The US 500 stock index (Cash) is trading near the red Tenkan-sen line at 3,952 following an increase in risk appetite around a recorded 14½-month low of 3,809. The rolling over of the 200-day simple moving average (SMA) is feeding...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals