Dollar Softer Slightly, European Majors Trying a Rebound

Dollar is turning softer entering into US session, as traders might start to lighten up position ahead tomorrow’s FOMC rate decision. Commodity currencies are also soft, except Aussie which is supported by RBA’s hawkish rate hike. Yet, there is no...

Fears of a Fed mistake grow as this week’s anticipated interest rate hike looms

Jerome Powell, Chairman of the U.S. Federal Reserve, attends the National Association of Business Economicseconomic policy conference in Washington, D.C, United States on March 21, 2022. Yasin Ozturk | Anadolu Agency | Getty Images The Federal Reserve is tasked with...

The Federal Reserve’s fight with inflation could cool the hot labor market, risking stagflation

The Federal Reserve is hiking interest rates in an effort to defuse an explosive year of price inflation. But global forces could neutralize the effects of that tightening of monetary policy, and keep inflation high. Some observers believe the U.S....

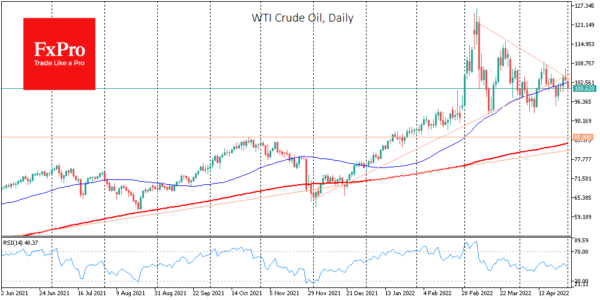

Oil Preparing for Sharp Moves

The price of crude is down more than 3% by the start of the New York trading session with a tug-of-war around $100 a barrel of WTI. And this is a rather remarkable market reaction, given reports that EU countries...

Dollar Staying Firm in Quiet Markets, Canadian Dollar Lower With Oil Price

Dollar remains the firmer one today, in quiet markets, as traders are awaiting Fed’s rate hike, and forward guidance later in the week. Yen’s trading tone is so far positive, as risk markets lack buyers. Commodity currencies are weak together...

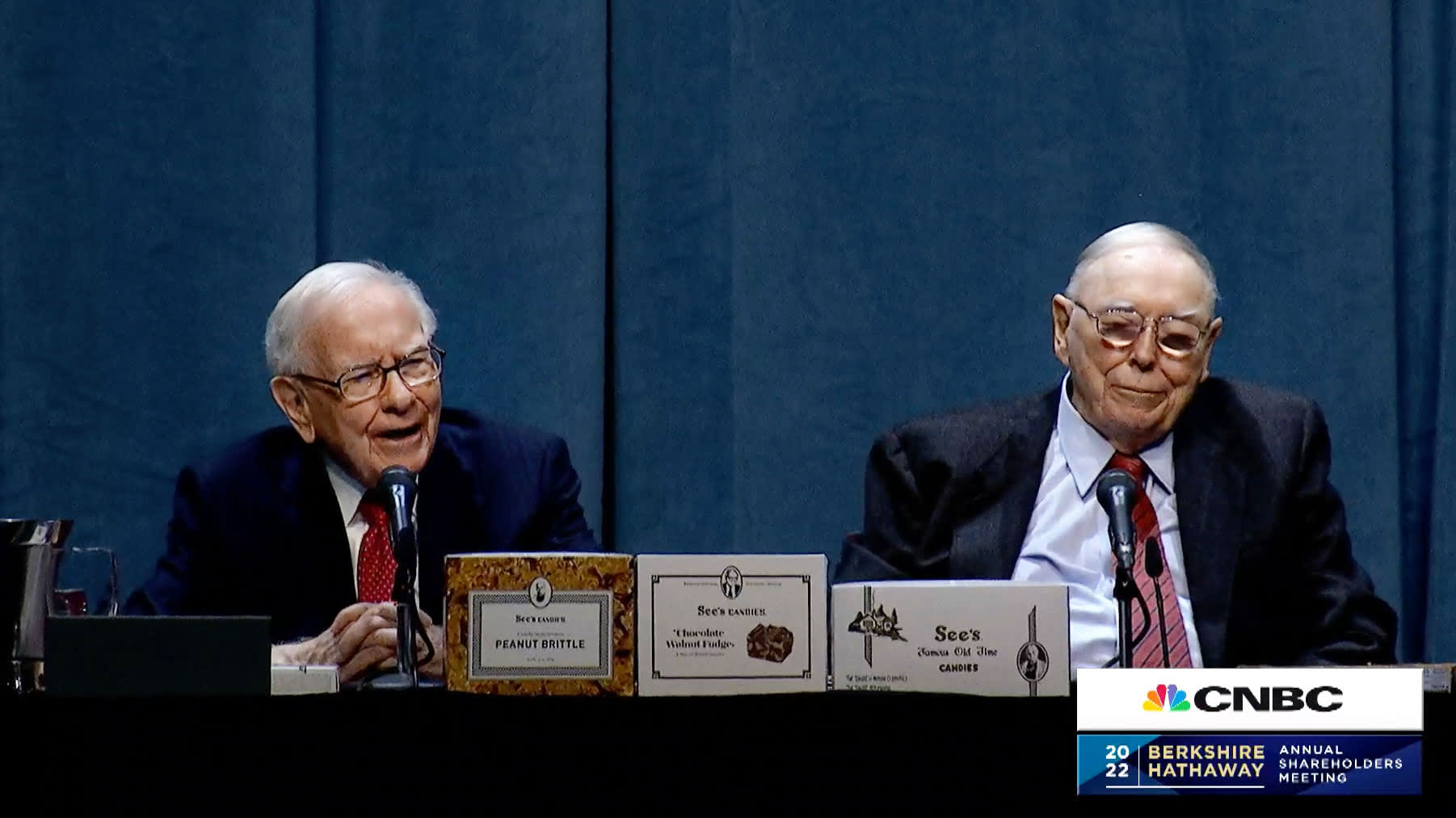

Warren Buffett rips Wall Street for turning the stock market into ‘a gambling parlor’

Berkshire Hathaway CEO Warren Buffett lambasted Wall Street for encouraging speculative behavior in the stock market, effectively turning it into a “gambling parlor.” Buffett, 91, spoke at length during his annual shareholder meeting Saturday about one of his favorite targets...

Dollar Index Hit Two-Decade High as Focus Turns to Fed Hike

Dollar ended up as the strongest one last week, having the best week since 2015 and with Dollar index hitting a two-decade high. Though, the rally somewhat slowed towards the end of the week. It could be a result of...

Emerging Risks Could Submerge Global Growth

Summary In our April International Economic Outlook, we highlighted how China’s commitment to its “Zero-COVID policy is a key theme as well as a major risk to the 2022 global economic outlook. Lockdowns, in our view, make China’s official GDP...

Weekly Economic & Financial Commentary: How Much Will the Fed Tighten Next Week?

Summary United States: GDP Head Fake Obscures Otherwise Intact Fundamentals In a jampacked week of economic data, Thursday’s negative GDP growth print took center stage. The U.S. economy contracted at a 1.4% annualized rate in Q1-2022. The weak headline figure...

Core PCE Levels Off, But the ECI May Have the Fed More Concerned

The US released what is considered to be the Fed’s favorite measure of inflation on Friday, the Core PCE Price Index. The March print was 5.2% YoY vs 5.3% YoY expected and 5.3% YoY in February. The headline PCE Price...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals