US 500 Index’s Positive Tone Shaky Near 38.2% Fibonacci

The US 500 stock index (Cash) is consolidating slightly north of the 4,446 level, which is the upper part of a support border and coincidentally the 38.2% Fibonacci retracement level of the up wave from 4,137 until 4,638. The rolling...

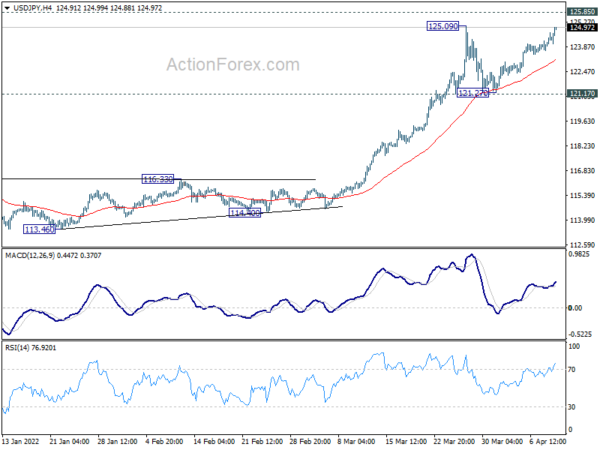

Yen Selling Steps Up a Gear on Rising Treasury Yields

Yen’s selloff intensifies today, following extended rally in major benchmark treasury yields. US 10-year yields breaks 2.75% handle for the first time since March2 019. Germany 10-year bund yield also breaches 0.8% handle. On the other hand, Japan 10-year JGB...

GBPUSD Wave Analysis

GBPUSD reversed from round support level 1.3000 Likely to rise to resistance level 1.3160 GBPUSD currency pair today reversed up with the daily Hammer from the round support level 1.3000 (which stopped the previous sharp impulse wave 1 in the...

Pound Tests 1.3000 Again, Risks Falling to 1.2600

The British pound returned to the $1.3000 area, a significant circular level from which the British currency bounced in the middle of last month. The bulls continue to hold for the second consecutive trading session. The intraday charts clearly show...

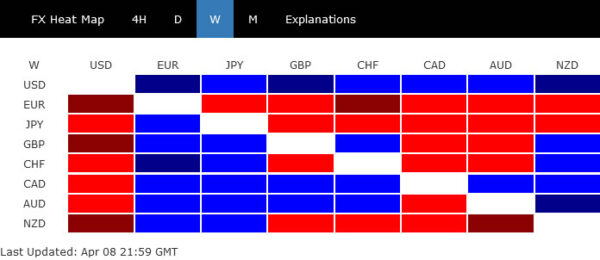

Yen Lower as a Busy Week Starts, RBNZ, BoC, ECB, UK GDP, US CPI Featured

Yen is trading broadly lower in Asian session today. But commodity currencies are also soft on mild risk-off sentiment. On the other hand, Euro and Dollar are the stronger ones, while Sterling and Swiss Franc follow. UK data will be...

Dollar Ended Broadly Higher as 10-Yr Yield Hit 2.7

Dollar was initially mixed last week but buyers jumped in after FOMC minutes revealed the quantitative tightening plan. US benchmark treasury yields also surged to highest level since 2019. Both Canadian and Australian Dollars followed as second and third strongest....

As inflation bites and America’s mood darkens, higher-income consumers are cutting back, too

The top income bracket spends the most among American consumers, but its strength amid inflation may be overstated, according to a new CNBC survey.

Here’s how the Fed raising interest rates can help get inflation lower, and why it could fail

A customer shops at at a grocery store on February 10, 2022 in Miami, Florida. The Labor Department announced that consumer prices jumped 7.5% last month compared with 12 months earlier, the steepest year-over-year increase since February 1982. Joe Raedle...

Weekly Economic & Financial Commentary: Minutes Put All Eyes on the Fed, but Economic Activity Remains Strong

Summary United States: Minutes Put All Eyes on the Fed, but Economic Activity Remains Strong In an otherwise calm week of data, Wednesday’s release of the FOMC minutes stirred things up as they showed committee members agreeing that elevated inflation...

Week Ahead: Central Banks, Inflation Data, and Earnings to Highlight the Week

After a somewhat quiet week due to the lack of economic highlights last week, things kick into high gear this week as central banks and inflation data take center stage. The RBNZ, BOC, and ECB all meet this week to...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals