Hawkish Powell Roils Markets, Oil Rallies

Asian stocks traded higher this morning while European shares rose after Fed Chair Jerome Powell struck a more hawkish tone on monetary policy. In the currency arena, king dollar received fresh inspiration amid new rate hike bets as the selloff...

China Boeing 737 plane crash: No reports yet of bodies or survivors

BEIJING — No bodies or survivors have yet been found from the China Eastern Airlines crash as of Tuesday morning, Chinese state media said. The domestic flight on a Boeing 737-800, which was carrying 132 people, nosedived Monday afternoon in...

NZDUSD Under Pressure as NZ Consumer Confidence Slumps to the Lowest Level Since GFC

U.S. yields surged overnight by a jaw-dropping 10-18bp across the curve after Fed Chair Powell opened the door to a 50bp rate hike at the next FOMC meeting. “if we conclude that it is appropriate to move more aggressively by...

Powell says ‘inflation is much too high’ and the Fed will take ‘necessary steps’ to address

Federal Reserve Board Chairman Jerome Powell testifies during a hearing before Senate Banking, Housing and Urban Affairs Committee on Capitol Hill November 30, 2021 in Washington, DC. Alex Wong | Getty Images News | Getty Images Federal Reserve Chairman Jerome...

Goldman Sachs, Galaxy Digital announce milestone over-the-counter crypto trade

A Goldman Sachs Group Inc. logo hangs on the floor of the New York Stock Exchange in New York, U.S., on Wednesday, May 19, 2010. Daniel Acker | Bloomberg | Getty Images Goldman Sachs is pushing further into the nascent...

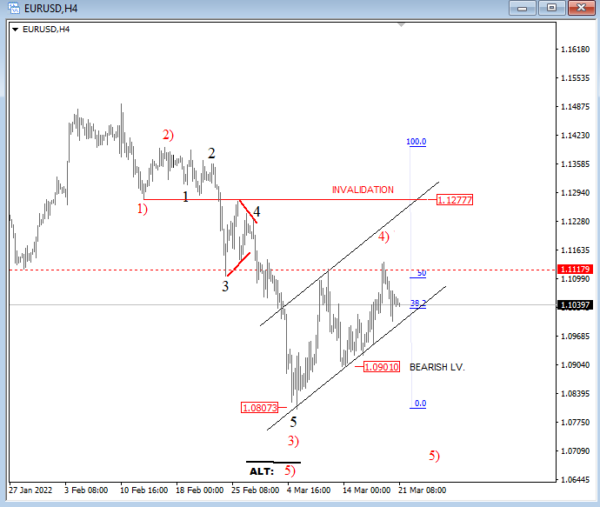

EUR/USD Elliott Wave Analysis: More Weakness Ahead

Stocks are higher since the FED decision last week, so buy the rumor sell the news is what caused a turn. We see commodity currencies doing well, with more upside in view in the very near term. If you favor...

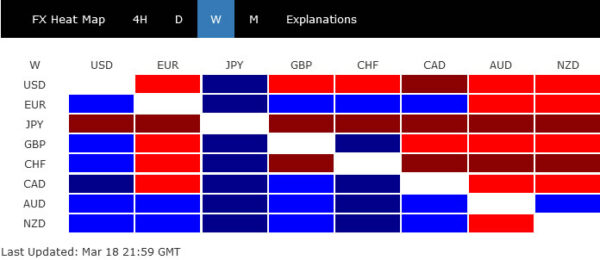

Yen Extended Down Trend on Rise in Yields and Rebound in Stocks

Yen’s down trend continued last week and even accelerated against commodity currencies. Persistent rally in benchmark yields, rebound in stocks, and diverging central bank expectations are expected to weigh on Yen further. Meanwhile, expected rate hike by Fed and BoE...

Weekly Economic & Financial Commentary: Significant Monetary Policy Tightening Ahead

Summary United States: Significant Monetary Policy Tightening Ahead In a full week of economic data, Wednesday’s FOMC meeting took center stage. FOMC officials lifted the target range for the federal funds rate by 25 bps. Meanwhile, data on retail sales,...

The Weekly Bottom Line: The Fed Amps Up its Fight Against Inflation

U.S. Highlights The U.S. Federal Reserve raised interest rates for the first time since 2018, and signalled it is prepared to raise rates substantially in order to contain inflation. Oil prices were down this week as renewed lockdowns in China...

Week Ahead: Follow Through from FOMC and BOE; Headline Watching from Russia/Ukraine War

With a lack of an obvious catalyst this week, markets will continue to trade off the rate hikes from the FOMC and the BOE. Last week, the FOMC hiked rates by 25bps and noted in its statement that there are...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals