Gold Eases Back to $1900, US Inflation Data Due

Gold slips to $1900 after $100 swing yesterday Gold prices are edging lower after some wild swings in the previous session which saw the precious metal rise to $1975 before falling $100 lower. Safe haven flows, as Russian invaded Ukraine...

AUDNZD Wave Analysis

AUDNZD reversed from support area Likely to rise to resistance level 1.0750 AUDNZD currency pair recently reversed up from the support area located between the pivotal support level 1.0670 (which has been reversing the price from January) and the lower...

Nikkei 225 Wave Analysis

Nikkei 225 reversed from support area Likely to rise to resistance level 26875.00 Nikkei 225 index recently reversed up from the support area located between the key support level 26000.00 (which stopped the previous impulse wave (i) in January) and...

Markets Stabilized from Ukraine Crisis, But Risks Remain

Overall, the markets seem to have stabilized from the shocking invasion of Ukraine by Russia, for now at least. US stock markets staged a late and strong turnaround overnight while Asian markets also recovered. Gold is back pressing 1900 handle...

U.S. is the ultimate safe haven for your money during Russia’s war on Ukraine, Blackstone’s Joe Zidle says

The world’s leading private equity firm suggests the U.S. the ultimate safe haven play. According to Blackstone’s Joseph Zidle, it’s largely insulated from the Russia-Ukraine war fallout. “The U.S. is an island of growth,” the firm’s chief investment strategist told...

Jobless claims total 232,000, slightly less than expected; Q4 GDP revised up to 7%

Weekly jobless claims came in slightly less than expected last week and economic growth to end 2021 was slightly better than originally reported.

Gold and Oil Surge on Russian Invasion, Stocks and Euro Dive

Russia invasion of Ukraine remains the dominant theme in the markets today. Safe haven flow pushes gold to highest level in more than a year, marching towards 2k handle. WTI crude oil also surges pass 100 level, rising as it...

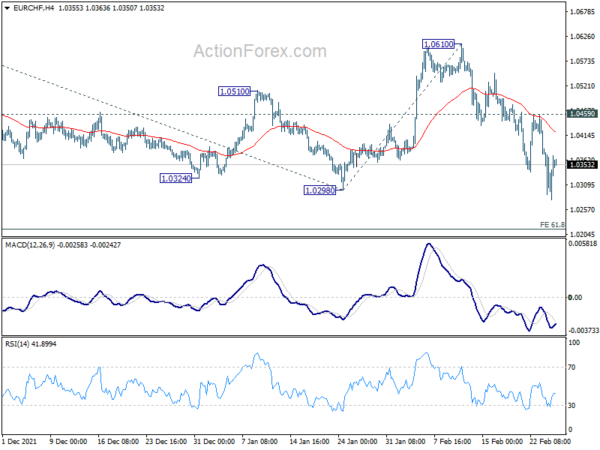

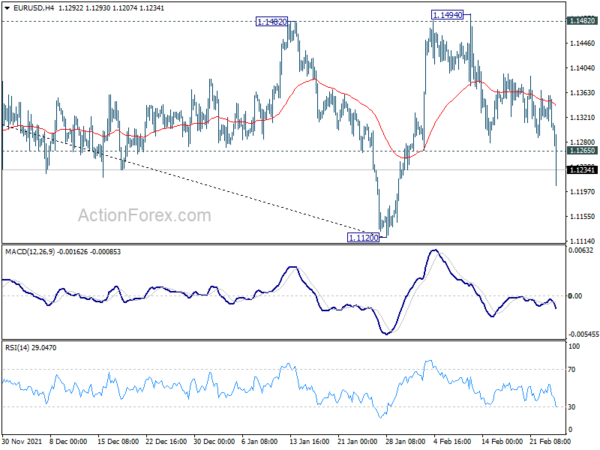

Global Markets Sink as Russia Invades Ukraine, Euro Under Heavy Selling

Global markets sink as Russia finally launches invasion of Ukraine. Risk averse sentiment dominates, pushing gold and oil higher, while stocks and cryptocurrencies tumble. In the currency markets, Yen and Swiss Franc surge sharply on safe-haven flows, together with Dollar....

The market has adjusted its views of how the Federal Reserve will raise interest rates

The Federal Reserve building is seen before the Federal Reserve board is expected to signal plans to raise interest rates in March as it focuses on fighting inflation in Washington, January 26, 2022. Joshua Roberts | Reuters The Federal Reserve...

Stock Markets Rebound But Uncertainty Remains

You get the feeling that investors are not quite sure what to do today. The markets managed to bounce back sharply from their lows on Tuesday and that momentum carried forward at the start of today’s session, before easing off...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals