Australian Dollar Extends Losses

The Australian dollar can’t find its footing and continues to lose ground against the surging US dollar. AUD/USD was down considerably earlier today but has pared most of these losses. In the North American session, AUD/USD is trading at 0.6425,...

FX Intervention: Risks for Solos, Not Yet for Accords

The US dollar is under some pressure on Tuesday morning, which can be attributed to the dollar’s local profit-taking after substantial gains on previous days. European equities and US index futures are also getting some relief, pulling back from lows....

More Turmoil to Come?

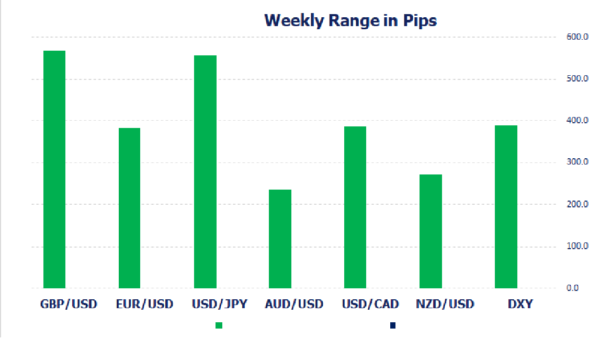

Stock markets have steadied in Asia and early European trade on Tuesday but that is not reflective of the mood in the markets at the moment so it may struggle to hold. The volatility in FX markets at the start...

EUR/USD Due for a Corrective Bounce?

With all the attention on the pound today, there was some sharp movements in the euro which you may have missed. The single currency dropped to a fresh low on the year against the greenback, reaching a low of 0.9551...

Week Ahead: Central Bank Fallout, More Pain for the Pound, and Inflation Data

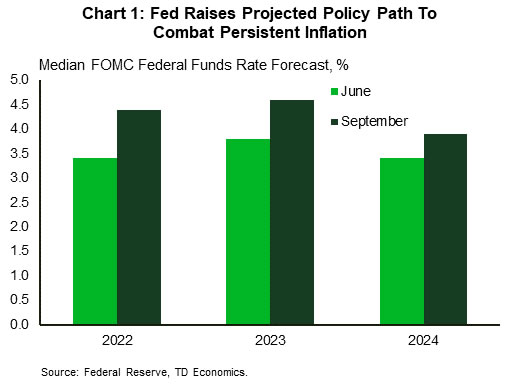

Last week, there were some major events that created quite a bit of volatility. The most important events were the FOMC interest rate hike of 75bps to bring the Fed Funds rate to 3.25%, the BOE rate hike of 50bps...

Week Ahead – Recession Fears Mounting

US Now that Wall Street has had some time to digest the FOMC decision, the focus shifts to how quickly the economy is weakening and a wave of Fed speak. A wide range of economic releases includes more Fed regional...

Weekly Economic & Financial Commentary: Shot Across the Bow, Japan Intervenes Against Surging Dollar

Summary United States: Whatever It Takes As widely expected, the FOMC raised the target range for the fed funds rate by 75 bps for the third consecutive time. The housing market continues to buckle under the pressure of higher mortgage...

The Weekly Bottom Line: The FOMC Aims High

U.S. Highlights The Federal Reserve raised interest rates by 75bps for the third consecutive meeting, bringing the federal funds rate to its highest level in 14 years. FOMC Chair Powell reiterated his Jackson Hole speech, stating that the Fed is...

Yen Settles Down after Wild Ride

It was certainly a day to remember for the Japanese yen on Thursday. USD/JPY traded in a stunning 550-point range, as the yen fell sharply before reversing directions and closing the day up over 1 per cent. Things have calmed...

Global September Preliminary PMIs and Economic Outlook

After a week in which a dozen central banks around the world either tightened policy or resorted to currency intervention, the focus is now on the economy. Just how much of the move was priced in, and how much will...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals