June Flashlight for the FOMC Blackout Period

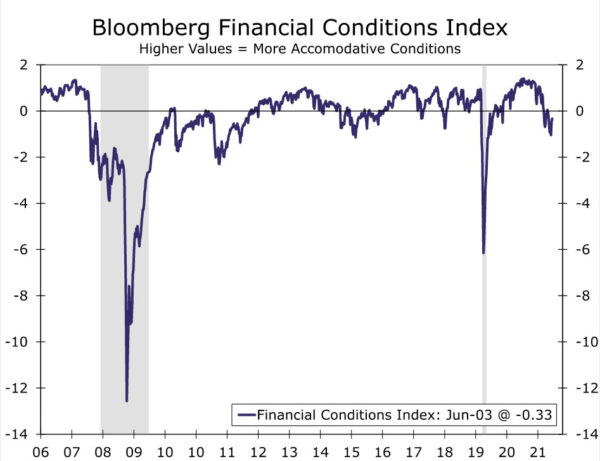

Summary We expect that the actual policy changes the FOMC announces on June 15 will be more or less inconsequential in terms of market reaction. That is, the Committee has clearly indicated that it plans to raise its target range...

A Bounce, But Hardly the Start of a Rise in the Crypto Market

Bitcoin rose 2.4% to $30.5K in the past 24 hours. Ethereum added 0.2% to $1820. Ether was unexpectedly among the laggards. Altcoins from the top 10 rose from 1.5% (BNB) to 4.1% (Solana). Total crypto market capitalisation, according to CoinMarketCap,...

US Dollar Turns to Jobs Report for More Fuel

The latest US employment report will hit the markets at 12:30 GMT Friday. Forecasts and business surveys point to another solid report, although there are some signs that the labor market might be running into trouble. As for the dollar,...

Euro Strength Accelerates ahead of EU Inflation Data

The euro continued rallying ahead of key economic data from the euro area. Eurostat will publish the flash consumer inflation data from the bloc. Analysts expect the data to show that the headline CPI rose from 7.4% to 7.7%, which...

NZ Dollar Shines as US Dollar Retreats

The New Zealand dollar continues to take advantage of US dollar weakness. NZD/USD posted sharp gains last week, climbing 2.01%. Will Business Confidence improve? The week kicks off with ANZ Business Confidence, which has been in deep-freeze for months. The...

Forex and Crytopcurrencies Forecasts

EUR/USD: Fed’s “Boring” FOMC Protocol The DXY dollar index hit a multi-year high of 105.05 on Friday, May 13, after a six-week rise. The last time it climbed this high was 20 years ago. However, a reversal followed, and it...

Weekly Economic & Financial Commentary: Signs of a Slowdown Begin to Emerge

Summary United States: Signs of a Slowdown Begin to Emerge April brought a steep 16.6% decline in new home sales and a 3.9% drop in pending home sales, the latest signs the housing market is cooling down amid sharply higher...

The Weekly Bottom Line: Bank of Canada Still on Track for Rate Hike

U.S. Highlights The second estimate of U.S. GDP growth confirmed that the economy contracted in the first quarter of the year, pulling back by 1.5% relative to the 1.4% reported previously. The housing market continued to show signs of buyer...

Week Ahead – Nonfarm Payrolls on Tap, Has the Dollar Topped?

The latest US employment report will be in the spotlight next week for any signs that recession worries have started to impact hiring. The dollar has lost some of its power lately and this dataset could determine whether we are...

Oil Possibly Locked in the $100-130 Range for Years

Crude oil has added for the fourth consecutive trading session. However, the rise in quotes has been tempered by comments from the German economy minister, claiming that the EU could agree on an embargo on Russian oil within days. However,...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals