GBPUSD Losing 2% after BoE with Next Big Stop as at Low as 1.2000

GBPUSD collapsed to 1.2380 by 2% or more than 230 pips from the start of the day on Thursday, with pressure intensifying after the Bank of England’s bank rate decision announcement. As analysts had expected, the Bank of England raised...

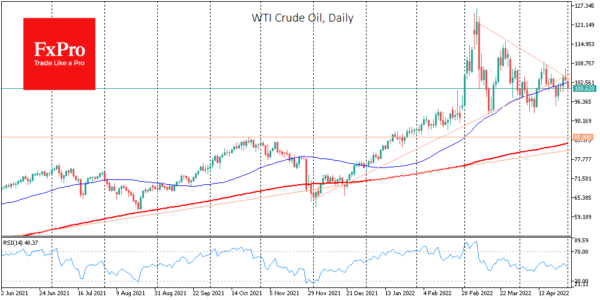

Oil Preparing for Sharp Moves

The price of crude is down more than 3% by the start of the New York trading session with a tug-of-war around $100 a barrel of WTI. And this is a rather remarkable market reaction, given reports that EU countries...

Emerging Risks Could Submerge Global Growth

Summary In our April International Economic Outlook, we highlighted how China’s commitment to its “Zero-COVID policy is a key theme as well as a major risk to the 2022 global economic outlook. Lockdowns, in our view, make China’s official GDP...

Weekly Economic & Financial Commentary: How Much Will the Fed Tighten Next Week?

Summary United States: GDP Head Fake Obscures Otherwise Intact Fundamentals In a jampacked week of economic data, Thursday’s negative GDP growth print took center stage. The U.S. economy contracted at a 1.4% annualized rate in Q1-2022. The weak headline figure...

Cliff Notes: A Singular Focus

Key insights from the week that was. In Australia this week, the market had a singular focus – inflation. The Q1 CPI report did not disappoint, with both headline and trimmed mean core inflation coming in ahead of our top-of-the-market...

EUR/JPY Faces Key Test ahead of BoJ and EZ CPI

This popular currency pair could be in for a sell-off amid ongoing risk-off trade and given the prospect for intervention from BoJ to deal with the rapidly weakening yen When you are left with the bad and the worse, you...

Why Current Level is the Most Important for EURUSD

The single currency has fallen under 1.0590, below pandemic lows and at its lowest level since April 2017. The 1.0600 area for EURUSD has repeatedly worked as a turning point since 2015. In 1997 and 1998 the selloffs also stopped...

The Week Ahead: Vive la France!

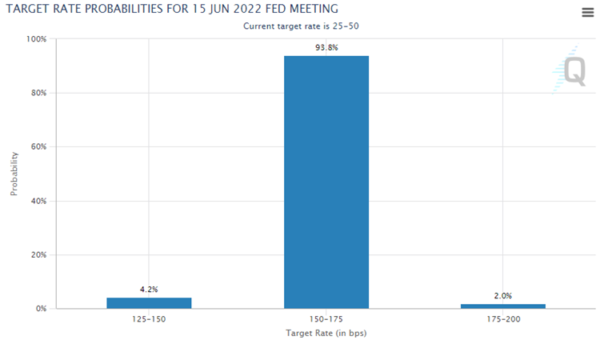

Traders are convinced that the Fed is going to raise interest rates aggressively “until something breaks.” The Week Ahead: Vive la France! For most traders, the focus last week was on the ramp up into peak Q1 earnings season. We...

The Weekly Bottom Line: Economic Outlook Dims

U.S. Highlights US yields continued to move higher this week, as Fed Chair Jerome Powell solidified the case for a 50-basis point rate hike at the Fed’s next meeting on May 4th. He also left the door open to additional...

Can the BoJ alter the one-way selling in the JPY?

As most FX traders would attest to – the JPY has been taken to the woodshed, where the flow has been one way; it’s been brutal, but it’s been thoroughly deserved. In a world where every G10 central bank is...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals