Yen Takes a Pause after Busy Week

The Japanese yen has started the week with slight gains, as USD/JPY is trading at 122.75 in the North American session. It was a rollercoaster week for the yen, which showed strong volatility throughout the week. USD/JPY posted considerable gains...

Natural Gas Without Hysteria

The energy sector has retreated markedly from its highs in the first days of March but remains a hot topic for markets. Europe’s gas market survived several bouts of fear that it would be without Russian gas. However, we only...

Weekly Economic & Financial Commentary: Soaring Price Gauges Turn Up the Pressure on the Fed

Summary United States: Soaring Price Gauges Turn Up the Pressure on the Fed The Fed’s difficult job got harder this week. Its preferred inflation gauge set another fresh 40-year record high, while the ISM prices paid measure shot up 11.5...

US: ISM Manufacturing Index Registers 22nd Consecutive Month of Expansion

The March ISM manufacturing index registered 57.1, missing expectations of a 59.0 print. The index fell 1.5 percentage points from the February reading of 58.6. New orders fell by 7.9 percentage points to 53.8, while new export orders fell by...

US Core PCE Continues to Rise; Puts More Pressure on Fed

It’s not a secret that inflation has been high in the US. US CPI and Core CPI has been on the rise for months. Today, the US released what is considered to be the Fed’s favorite measure of inflation for...

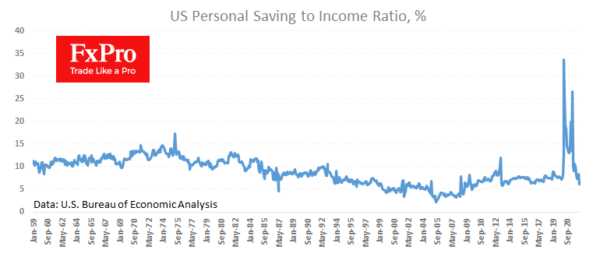

Healthy Jobs and Income US Data Helps USD, But Not S&P500

American households increased spending by 0.2% in February, compared with a 0.5% rise in income. But this data only looks optimistic at first glance. Americans saved 6.3% of disposable income compared to 6.1% in January. In other words, we are...

Will an Inverted Yield Curve Spell Impending Doom?

Much has been made of the fact we’ve seen 10yr US Treasury yields trade at a discount to 2yr yields. What’s commonly known as curve ‘inversion’? I’m not sure this is going surprise too many as most bond traders had...

Gold Tests $1900 as the “Peace Trade” Picks Up Steam

A close near current levels would shift the near-term technical bias in favor of the bears, with the next support level to watch coming in around $1870… “All we are saying is give peace a chance.” – John Lennon There’s...

Aussie Dips ahead of Retail Sales

Aussie slips below 0.75 line After a strong week, the Australian dollar has reversed directions and dropped below the 0.75 line on Monday. Investors will be keeping an eye on Australian retail sales, which will be released on Tuesday. The...

Week Ahead: Russia/Ukraine Battles Continue; Core PCE and NFP on Tap

Last week was about the US and NATO working to help Ukraine. However, the Russian invasion into Ukraine continues this week as the top Russian negotiator said that no progress is being made on main political issues. Can the two...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals