Weekly Economic & Financial Commentary: Some Economic Implications of the War Between Russia and Ukraine

Summary United States: Russia-Ukraine Conflict May Push Up Prices, but Inflation Has Yet to Slow Spending The Russian invasion of Ukraine dominated news headlines this week, and we cover the economic and financial implications of the conflict in a number...

The Weekly Bottom Line: Commodity Prices Rise Ahead of Key BoC Meeting

U.S. Highlights The Russian invasion of Ukraine shook markets this week with the S&P 500 entering correction territory before making gains Friday. Given Russia’s role as a key global energy producer, market concerns about supplies have driven prices for oil...

Bank of Canada Rate Hike Expected Despite Geopolitical Turbulence

Russia’s invasion of Ukraine is not expected to keep the Bank of Canada from hiking interest rates next Wednesday. Though added disruptions to global supply chains would eventually filter into Canadian trade flows, and higher commodity prices will boost costs...

US Core PCE Still Hot; Is 50 bps in the Cards?

The US released a host of data of Friday morning, the most important of which was the January reading of the core personal consumption expenditure price index (Core PCE). The headline PCE Price Index was 6.1% YoY vs 5.9% YoY...

Stock Markets Rebound But Uncertainty Remains

You get the feeling that investors are not quite sure what to do today. The markets managed to bounce back sharply from their lows on Tuesday and that momentum carried forward at the start of today’s session, before easing off...

Forex Forecast and Cryptocurrencies Forecast

EUR/USD: Waiting for War and Rate Hike The period from February 10 to 14 was unexpectedly stormy. Panic moods were diligently warmed up by the leading media, actively discussing the statements of world leaders, primarily the President of the United...

How the Coming Fed Hiking Cycle Will Differ – and Why it Matters

With a Fed hiking cycle starting soon, we look at what previous hiking cycles looked like and how the current situation compares. In a coming paper we will look at how markets have fared during previous hiking cycles and what...

Market Sentiment Remains Fragile as Investors eye Ukraine Escalation

Dollar stuck between opposing directional forces The ongoing tensions between Ukraine and Russia continue to be the main driving force behind market moves today as yesterday’s signs of de-escalation have completely evaporated. Specifically, the two sides are exchanging accusations over violations of ceasefire near the Eastern-Ukrainian borders,...

Digital Revolution: Will Cryptocurrencies Take Over the World? Part IV

Part IV: Conclusions Summary Monetary systems have evolved over centuries, and there is nothing inherently “permanent” about the current system, which is composed of “public” money (i.e., paper bills that are the liabilities of central banks) and “private” money (i.e.,...

Dollar Recovers ahead of Fed Minutes and Retail Sales

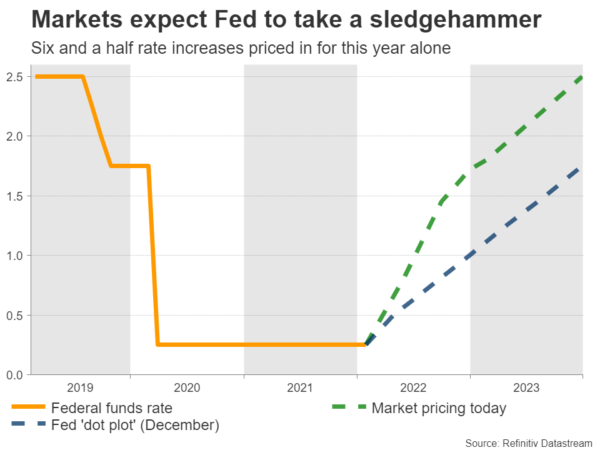

Traders are betting the Fed will take a sledgehammer to crush inflation, but that wasn’t enough to really boost the dollar until fears of armed conflict in Ukraine sent investors into the reserve currency’s safety. The latest retail sales data...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals