Weekly Economic & Financial Commentary: The Hawks in Full Control at the Fed

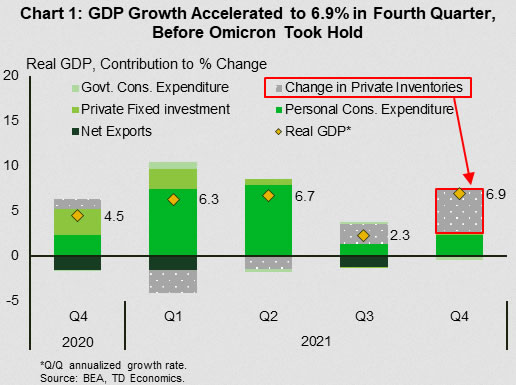

Summary United States: Moderating Growth and a More Aggressive Fed The economy had the wind at its back in 2021 with generous fiscal policy and an accommodative Fed. Inflation and supply chains were the key obstacles. In light of a...

The Weekly Bottom Line: Fed Sets the Stage for Rates to Liftoff Soon

U.S. Highlights The Fed left the policy rate unchanged at this week’s FOMC meeting but signaled that a rate hike was imminent come March. Uncertainty on the pace of hikes post March remains elevated, contributing to stock market volatility this...

Week Ahead: Central Banks, Geopolitics, Earnings and NFP

Last week, the FOMC met and Powell delivered a hawkish press conference which turned up the fire under already volatile markets. Not to be overlooked, the Bank of Canada set the table for a rate hike in March as well. ...

Week Ahead: 31 January 2022

Central Banks: RBA, BoE and ECB Earnings: GOOGL, AMZN and FB Data: Eurozone GDP and CPI, and US NFP Following the previous week’s big drop in US stock markets, we saw some very volatile price action as dip buyers initially...

Week Ahead – Three Central Banks Meet ahead of US Jobs Report

A busy week lies ahead. The Bank of England is widely expected to raise rates, the European Central Bank is unlikely to signal anything new, but the Reserve Bank of Australia could try to dampen rate hike bets. Over in...

RBA Meeting: Managing Rate Hike Expectations

The Reserve Bank of Australia announces its first policy decision of the year on Tuesday at 3:30 GMT. The last time the Bank’s governor, Philip Lowe, spoke in mid-December, he told investors he didn’t think conditions for a rate hike...

BoC Policy Meeting: It’s Time for a Rate Hike

The Bank of Canada (BoC) is widely expected to kick off the new year with a rate hike on Wednesday despite its muted communication over the past weeks. With inflation well above the central bank’s target and the labor market...

Aust Q4 CPI – Core Inflation Already Exceeds Peak in RBA’s Forecasts

Headline CPI 1.3%qtr/3.5%yr; trimmed mean 0.97%qtr/2.6%yr, weighted median 0.95%qtr/2.7%yr. Core inflation is now above the mid-point of the RBA’s inflation target, not something the RBA was expecting in its forecast profile this early nor of this magnitude. Headline inflation came...

Asian Open: Flash PMI’s in Focus, AUD Probes Trend Support

Flash PMI data is released across Asia, Europe and the US. And on the back of last week’s risk-off week then markets may be more sensitive to soft data should it disappoint. US equities suffered one of their worst weeks...

Eurozone PMIs: Another Dose of Bad News?

The latest PMI business surveys for the euro area will hit the markets early on Monday, starting with the French numbers at 08:15 GMT. Forecasts suggest the Eurozone economy lost further steam thanks to Omicron restrictions. Overall, economic growth remains...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals