BoC Review: Woah, We’re Halfway There (But the Other Half May Take a While)

The Bank of Canada increased its key monetary policy interest rate to 1.50% this morning (from 1.25%). This was the fourth increase in a year. In its statement explaining the decision, the Bank struck a neutral to slightly hawkish tone....

Gold Struggles as Global Trade Tensions Escalate

Gold has posted considerable losses in the Wednesday session. In North American trade, the spot price for one ounce of gold is $1246.24, down 0.74% on the day. On the release front, inflation reports narrowly beat their estimates. Core PPI...

US CPI Preview: Onward and Upward

CPI likely rose a trend-like 0.2 percent in June amid steady gains in the core index. Consumers may have caught a little respite in travel costs last month, but solid demand and rising input costs point to inflation firming. Carrying...

When the Going Gets Tough, the Tough Get Going

US Poised to Publish $200 Billion Tariff List (Bloomberg) Investors confidence was rocked after the latest US administrations trade salvo which reminded us that not all is quiet on the western trade war front after the Trump administration released a...

CAD/JPY Could Stage Breakout on Hawkish BoC

Earlier I wrote on the USD/JPY, highlighting a potential breakout in that pair above a long-term bearish trend line. In fact, weakness in the yen is a dominant theme as the ongoing stock market rally continues to undermine the appeal...

Japanese Yen Dips to 7-Week Low, Inflation Reports Next

The Japanese yen has posted losses in the Tuesday session. In North American trade, USD/JPY is trading at 111.27, up 0.38% on the day. On the release front, Japanese Preliminary Machine Tool Orders dropped to 11.4%. This marked a fifth...

All is Quiet on the Western Trade War Front

For a change, all is quiet on the western trade war front as the drop in aggressive US tariff posturing and the nonfarm payroll after effects have propelled US equity market to the third consecutive day of substantial gains. While...

GBP/USD Blasted by BoJo Bowing Out, Bears Watching 1.3205 and 1.3050

“There are decades where nothing happens; and there are weeks where decades happen.” -Vladamir Lenin With respect to the early 20th century Soviet leader, pound traders no doubt feel like they’ve seen a decade’s worth of Brexit news crammed into...

Market Uncertainty Following Boris Johnson Resignation

Market uncertainty over Brexit has reached new heights after Boris Johnson resigned as Foreign Secretary this afternoon. This will be the second crushing blow to Theresa May, following the resignation of former Brexit Secretary David Davis over the weekend. With...

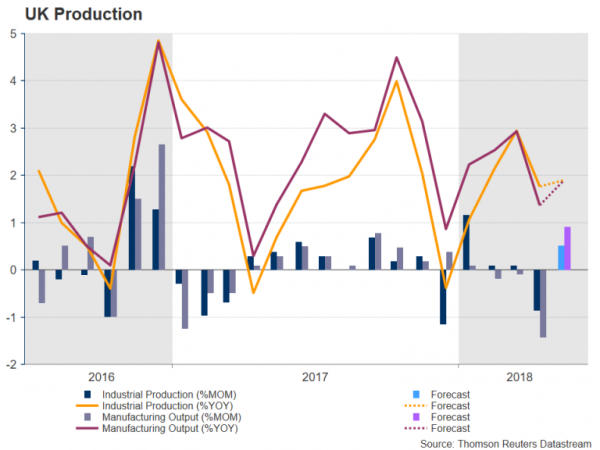

UK Data to Point to May Rebound in Output; Could Seal August Rate Hike

As the pound enjoys a bounce on hopes of a soft Brexit, a flurry of data out of the UK on Tuesday could provide the currency with more reason for cheer if they confirm a rebound in growth in May....

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals