Bond Rates Moving Towards Realistic Levels

Prospects for the unwinding of QE in the US and Australia in 2022 are finally lifting bond rates. The FOMC looks likely to have unwound its current QE program by mid 2022 along with the RBA. These forces along with...

US Open Note – Stocks Static and Yields Fail to Aid Dollar

OPEC and global energy risks; Central Banks and NFP report are drivers of the week Market uncertainty lingers but the greenback’s haven appeal remains muted, as a global energy crisis threatens recoveries across the globe. Stocks are slightly on the...

USD Seems To Recover After Friday’s Drop

The USD seemed to recover somewhat against some of its counterparts during todays’ Asian session, after Friday’s wide retreat as uncertainty seems to be on the rise once again. It should be noted that shares in China’s giant developer Evergrande...

Weekly Economic & Financial Commentary: With Eyes on Washington, the Expansion Continues to Roll Along

Summary United States: With Eyes on Washington, the Expansion Continues to Roll Along Data released this week showed the production and housing sectors continued to hum, despite ongoing supply constraints, while consumers kept spending, despite some trepidation about the economic...

The Weekly Bottom Line: Global Energy Supply Squeeze Taking the Spotlight

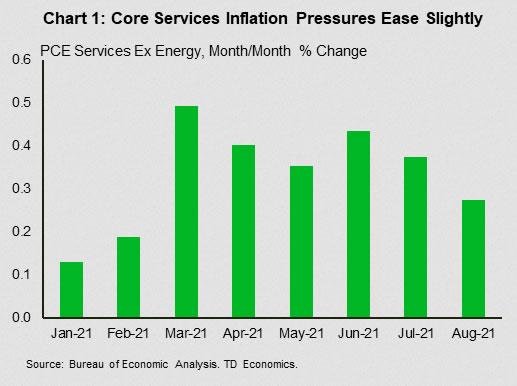

U.S. Highlights Equity markets fell this week as various concerns weighed on sentiment, including central banks signaling an end to pandemic era stimulus. Fortunately, Congress agreed to a last-minute spending deal to avert a shutdown, but it will still need...

Forward Guidance: September Jobs Reports to Show More Gains

Jobs will be on the radar next week as labour market reports for Canada and the US are released. We expect a 50,000 increase in headline employment in Canada and a 425,000 increase in the US. The spread of the...

Week Ahead: Central Banks, US Politics, and An Impending Energy Crisis?

With end of month and end of quarter behind us, we may see some money put to work after the Dow Jones sold off -1,516.81 points in September, the most points (not percentage) since the March 2020 selloff of -3,492.20...

Week Ahead – Central Banks Face Inflation Dilemma

A challenging period for the markets Nerves are starting to creep into the markets which will make the final months of the year very interesting. The list of downside risks for the economy and markets is growing all the time,...

A Choppy End to the Week

A rocky start to trading on the final day of the week and first of the new quarter, but things have taken a more positive turn with Europe erasing most of its losses and Wall Street opening a little higher....

US Averts Shutdown, But Market Mood Remains Sour

The US government won’t be shut today, as Joe Biden signed a funding bill that should keep the US government agencies running until December 3rd. But that doesn’t resolve the whole debt ceiling issue, nor avert the risk of an...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals