Hot Inflation Surprise, Choppy Stock Session, Earnings JPM, GS, & Pepsi, Bitcoin Lower

US stocks initially shrugged off a strong start to earnings seasons and traded lower after a hot inflation report unnerved some investors as expectations grow that the Fed will have to acknowledge that higher inflation will stick around. Today’s earnings...

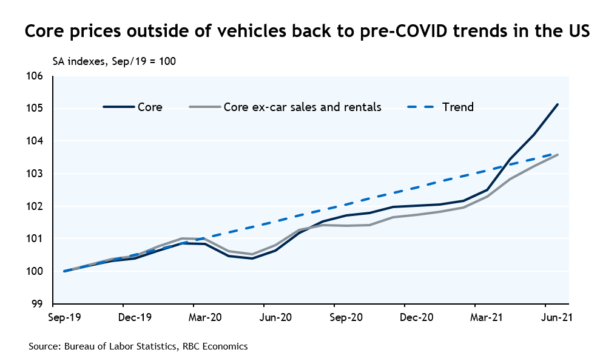

US Transportation Demand Recovery Pushed Prices Higher in June

Headline inflation up 5.4% in June from year-ago and core (ex-food and energy) up 4.5%Base effects continue to be at play; transportation related prices surged againPrice gain still relatively narrowly based; more guidance on tapering from Fed in August US...

Yen Takes Pause after Strong Weekly Gains

The Japanese yen is slightly lower in Monday trade. In the North American session, USD/JPY is trading at 110.28, up 0.16% on the day. The yen is coming off its best week since April, as USD/JPY declined 0.81% last week...

USD/CAD Rebounds, Punches Above 1.25

The Canadian dollar is trading quietly in the European session. Currently, USD/CAD is trading at 1.2505, up 0.51%. Canada job data sends lifts loonie The Canadian dollar ended the week on a high note, courtesy of excellent June employment data....

European Open: Asian Equities Extend Rally, GBP/AUD Hits 3-Month High

With traders their most bearish on AUD futures in a year and the UK still on track to ease lockdown restrictions, GBP/AUD may be able to extend gains from its 3-month high. Asian Indices: Australia’s ASX 200 index rose by...

Weekly Economic & Financial Commentary: June FOMC Minutes Raise as Many Questions as Answers

Summary United States: Growth Concerns Rattle Markets During Relatively Quiet Week for Economic Data Financial markets were jittery this week as uncertainty mounted around the new COVID variant hampering global activity and the growing idea that a lack of supply...

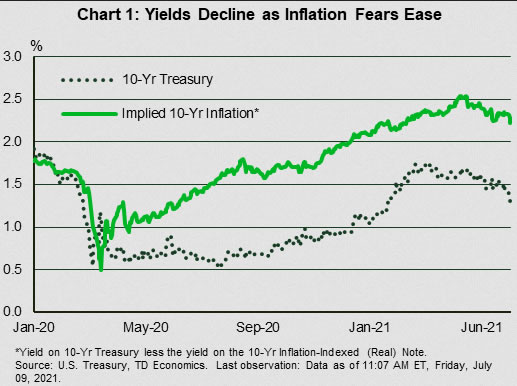

The Weekly Bottom Line: Bond Market Inflation Fears Ease

U.S. Highlights Economic news was relatively light in a holiday-shortened week. The move down in Treasury yields garnered headlines, as bond markets ratchet down inflation expectations. The FOMC Minutes were released this week and confirmed increased confidence among members that...

Week Ahead: US Banks Report Q2 Results, EUR/GBP in Focus ahead of Euro 2020 Final

Q2 US earnings season kicks off in earnest this week, and it will undoubtedly be one of the biggest storylines to watch over the next couple of weeks. The biggest market storyline of the past week was undoubtedly around the...

Week Ahead – Market Volatility to Remain Elevated

Global stocks are all over the place as some indexes fall into correction as others continue to extend higher into record territory. The bond market volatility surprised many investors as the growth outlook took a massive hit as the spread...

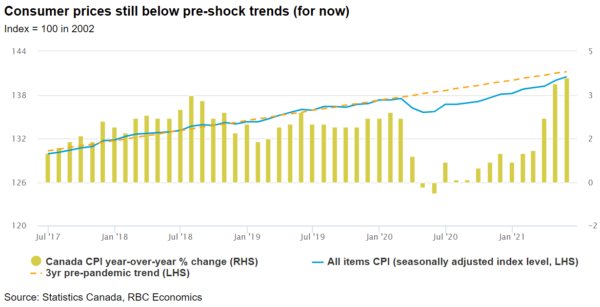

Forward Guidance: Bank of Canada Poised to Taper Stimulus as Recovery Progresses

We expect no major forecast changes in next week’s Bank of Canada rate decision and Monetary Policy Report. Indeed, the Canadian economic recovery is progressing largely in line with the central bank’s expectations, suggesting April GDP growth forecasts should be...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals